Secured Promissory Note with Monthly Installment Payments Kansas Form

Understanding the Secured Promissory Note

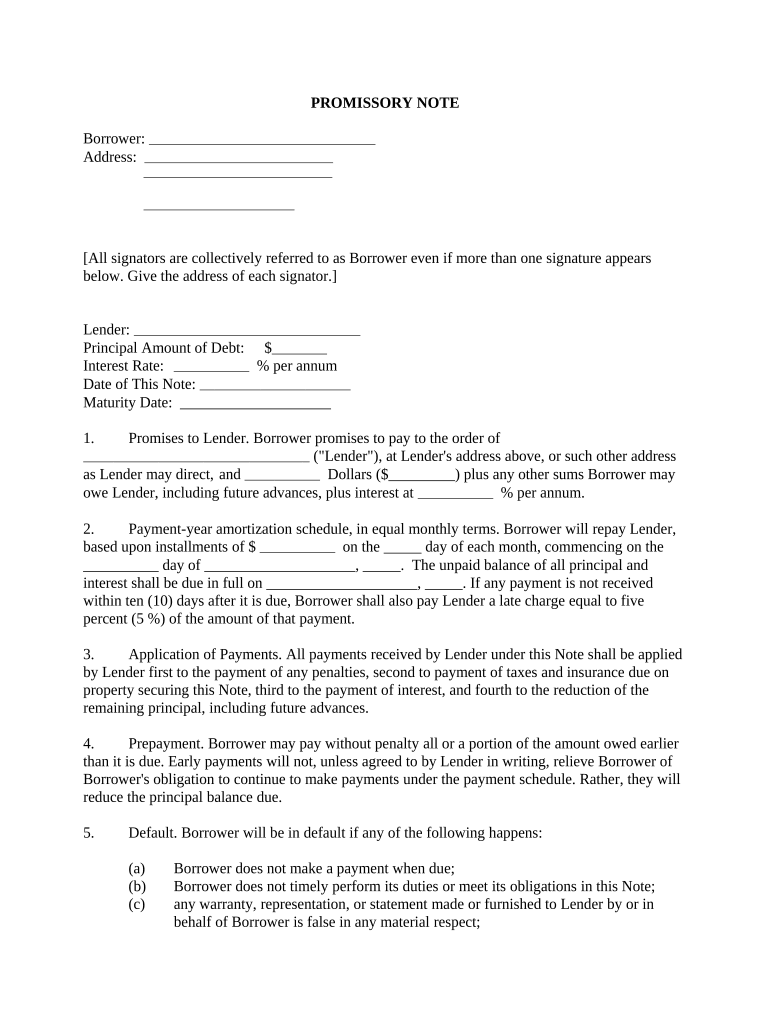

A secured promissory note is a financial document that outlines a borrower's promise to repay a loan, with the obligation backed by collateral. This type of note is particularly useful in transactions where the lender seeks assurance that the loan will be repaid. The collateral can be any asset of value, such as real estate or vehicles, which the lender can claim if the borrower defaults on the loan. The secured promissory note with monthly installment payments is structured to allow borrowers to repay the loan in manageable monthly amounts, making it a practical choice for many individuals and businesses.

Key Elements of the Secured Promissory Note

When creating a secured promissory note, several key elements must be included to ensure its legality and effectiveness:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the unpaid balance.

- Payment Schedule: Details on monthly installment amounts and due dates.

- Collateral Description: A clear description of the asset securing the loan.

- Default Terms: Conditions under which the borrower would be considered in default.

Steps to Complete the Secured Promissory Note

Completing a secured promissory note involves several important steps:

- Gather Information: Collect all necessary details about the borrower, lender, and the loan.

- Draft the Document: Use a template or create a document that includes all required elements.

- Review Terms: Ensure that all terms, including interest rates and payment schedules, are clear and agreed upon.

- Sign the Document: Both parties should sign the note in the presence of a witness or notary, if required.

- Distribute Copies: Provide copies of the signed document to both the borrower and lender for their records.

Legal Use of the Secured Promissory Note

The legal validity of a secured promissory note is contingent upon compliance with specific laws and regulations. In the United States, the note must meet the requirements set forth by the Uniform Commercial Code (UCC) and any state-specific laws governing secured transactions. It is advisable for both parties to understand their rights and obligations under the note, as well as the implications of defaulting on payments. Proper execution and adherence to legal standards ensure that the note can be enforced in a court of law if necessary.

Obtaining the Secured Promissory Note Form

To obtain a secured promissory note form, individuals can access templates through various legal resources or financial institutions. Many online platforms provide customizable templates that can be tailored to meet specific needs. It is essential to ensure that the form complies with state laws and includes all necessary elements. Consulting with a legal professional can also help ensure that the document is appropriately drafted and executed.

Examples of Using the Secured Promissory Note

Secured promissory notes are commonly used in various scenarios, including:

- Personal Loans: Individuals borrowing money from friends or family may use a secured promissory note to formalize the agreement.

- Real Estate Transactions: Buyers may secure loans against property to finance their purchases.

- Business Financing: Companies often use secured notes to obtain capital for expansion, backed by company assets.

Quick guide on how to complete secured promissory note with monthly installment payments kansas

Complete Secured Promissory Note With Monthly Installment Payments Kansas effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and eSign your documents swiftly without any delays. Manage Secured Promissory Note With Monthly Installment Payments Kansas on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Secured Promissory Note With Monthly Installment Payments Kansas with ease

- Obtain Secured Promissory Note With Monthly Installment Payments Kansas and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Secured Promissory Note With Monthly Installment Payments Kansas to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a secured promissory note form?

A secured promissory note form is a legal document that outlines a borrower's promise to repay a loan secured by collateral. This form ensures that lenders have a claim on the collateral if the borrower defaults on the loan. Using airSlate SignNow, you can create and eSign this form quickly, ensuring secure transactions.

-

How does airSlate SignNow simplify the creation of a secured promissory note form?

With airSlate SignNow, you can easily create a secured promissory note form using customizable templates. The user-friendly interface allows you to input necessary details and generate a professional document swiftly. This simplifies the process and saves you valuable time.

-

What are the benefits of using the secured promissory note form from airSlate SignNow?

The secured promissory note form from airSlate SignNow provides multiple benefits, including legal protection, clarity in transaction terms, and enhanced credibility for your agreements. Additionally, signing electronically reduces paperwork and speeds up the entire lending process. This makes it an ideal choice for both lenders and borrowers.

-

Is the secured promissory note form legally binding?

Yes, the secured promissory note form created with airSlate SignNow is legally binding as long as it meets all the required criteria for promissory notes in your jurisdiction. The electronic signatures used through our platform are compliant with e-signature laws, giving you peace of mind regarding the enforceability of your document.

-

Can I customize my secured promissory note form?

Absolutely! airSlate SignNow allows you to customize your secured promissory note form to meet your specific needs. You can modify terms, add details regarding the collateral, and personalize other sections to ensure it meets your legal and business requirements effectively.

-

What pricing plans does airSlate SignNow offer for the secured promissory note form?

airSlate SignNow offers various pricing plans to fit different business needs, including plans that allow unlimited use of the secured promissory note form. You can choose a plan that best suits your budget and requirements, ensuring you get cost-effective solutions for document management.

-

Are there any integrations available with airSlate SignNow for managing secured promissory note forms?

Yes, airSlate SignNow offers several integrations with popular business tools and platforms, enhancing the management of your secured promissory note forms. You can connect with CRM, accounting, or document storage systems, streamlining your workflow and improving efficiency in document transactions.

Get more for Secured Promissory Note With Monthly Installment Payments Kansas

- Woodbury pickleball form

- Pregnancy risk assessment template form

- Parentsibling signature form

- Entity maintenance bank details form

- Notice of informal conference sample

- Services hospital lahore logo form

- Georgia marriage certificate blank form

- Probus travel insurance plan a only re fit to travel form

Find out other Secured Promissory Note With Monthly Installment Payments Kansas

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast