Living Trust for Husband and Wife with One Child Kansas Form

What is the Living Trust For Husband And Wife With One Child Kansas

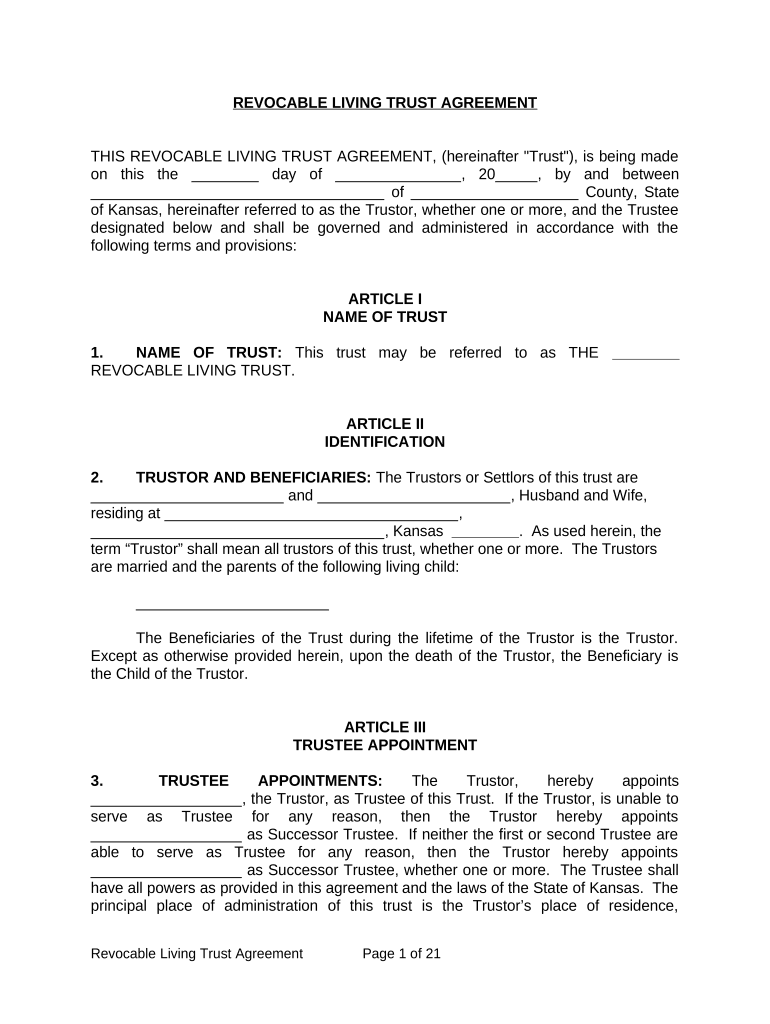

A living trust for husband and wife with one child in Kansas is a legal document that allows couples to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust provides a way to avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It can include various assets such as real estate, bank accounts, and investments. Establishing this trust can help couples maintain control over their assets while providing for their child’s future needs.

How to use the Living Trust For Husband And Wife With One Child Kansas

Using a living trust involves several steps. First, the couple must identify and list all assets they wish to include in the trust. Next, they need to create the trust document, which outlines the terms and conditions of the trust, including the roles of the trustees and beneficiaries. Once the document is prepared, it should be signed and notarized to ensure its legal validity. Finally, the couple must transfer ownership of their assets into the trust, which may involve changing titles or account names to reflect the trust's ownership.

Steps to complete the Living Trust For Husband And Wife With One Child Kansas

Completing a living trust involves the following steps:

- Gather all relevant financial documents and asset information.

- Consult with an attorney or use a trusted online service to draft the trust document.

- Review the document carefully to ensure it meets your wishes and complies with Kansas law.

- Sign the document in the presence of a notary public.

- Transfer assets into the trust by changing titles and account names as necessary.

Key elements of the Living Trust For Husband And Wife With One Child Kansas

Key elements of a living trust for husband and wife with one child in Kansas include:

- Trustees: Typically, both spouses act as co-trustees, managing the trust assets.

- Beneficiaries: The couple’s child is usually the primary beneficiary, receiving the assets upon the death of both parents.

- Asset management: The trust document outlines how assets are to be managed and distributed.

- Revocability: The trust can be altered or revoked by the couple during their lifetime.

State-specific rules for the Living Trust For Husband And Wife With One Child Kansas

Kansas has specific rules regarding living trusts. For instance, the trust must be created in writing and signed by the grantors. It is advisable to have the trust document notarized to enhance its legal standing. Additionally, Kansas law allows for the revocation of a living trust at any time while the grantors are alive. Couples should also be aware of any tax implications that may arise from transferring assets into the trust.

Legal use of the Living Trust For Husband And Wife With One Child Kansas

The legal use of a living trust in Kansas is primarily to facilitate the management and distribution of assets without the need for probate. This trust is recognized under Kansas law, provided it is properly established and maintained. It can also serve to protect assets from creditors and ensure that the couple's wishes are carried out after their passing. It is important to follow all legal requirements to ensure the trust remains valid and enforceable.

Quick guide on how to complete living trust for husband and wife with one child kansas

Complete Living Trust For Husband And Wife With One Child Kansas effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents promptly without delays. Manage Living Trust For Husband And Wife With One Child Kansas on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and eSign Living Trust For Husband And Wife With One Child Kansas with ease

- Obtain Living Trust For Husband And Wife With One Child Kansas and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from your preferred device. Modify and eSign Living Trust For Husband And Wife With One Child Kansas to ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in Kansas?

A Living Trust for Husband and Wife with One Child in Kansas is a legal document that allows couples to manage their assets during their lifetime and specify how those assets should be distributed after death. This type of trust can help avoid probate, providing a more streamlined and cost-effective solution for estate planning.

-

How much does a Living Trust for Husband and Wife with One Child in Kansas cost?

The cost of creating a Living Trust for Husband and Wife with One Child in Kansas can vary depending on complexity and whether you choose to hire an attorney or use an online service. Typically, the total expenses may range from a few hundred to several thousand dollars, but using an efficient platform like airSlate SignNow can signNowly reduce your costs.

-

What are the benefits of a Living Trust for Husband and Wife with One Child in Kansas?

A Living Trust for Husband and Wife with One Child in Kansas offers several benefits including avoiding probate, maintaining privacy, and the ability to manage your assets during your lifetime. Additionally, it allows for easier asset transfer to your child, ensuring that your wishes are respected after your passing.

-

Can I include additional assets in my Living Trust for Husband and Wife with One Child in Kansas later on?

Yes, you can add additional assets to your Living Trust for Husband and Wife with One Child in Kansas at any time. As your financial situation changes or you acquire new assets, you have the flexibility to update your trust to include those items, ensuring comprehensive management of your estate.

-

How does airSlate SignNow help with creating a Living Trust for Husband and Wife with One Child in Kansas?

airSlate SignNow provides an easy-to-use platform that simplifies the process of drafting a Living Trust for Husband and Wife with One Child in Kansas. With customizable templates and e-signature capabilities, it allows couples to efficiently create and manage their living trust documents without the complexities of traditional methods.

-

Are there any tax implications with a Living Trust for Husband and Wife with One Child in Kansas?

Generally, a Living Trust for Husband and Wife with One Child in Kansas does not carry immediate tax implications, as the assets remain under the control of the trustors during their lifetime. However, it is advisable to consult with a tax professional to understand any potential implications depending on your specific situation.

-

What happens to the Living Trust for Husband and Wife with One Child in Kansas if one spouse passes away?

When one spouse passes away, the Living Trust for Husband and Wife with One Child in Kansas typically continues to operate with the surviving spouse as the trustee. This allows for the seamless management of assets and ensures that the surviving spouse and child can access resources without disruption.

Get more for Living Trust For Husband And Wife With One Child Kansas

Find out other Living Trust For Husband And Wife With One Child Kansas

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT