Kentucky Cancellation Form

What is the Kentucky Cancellation

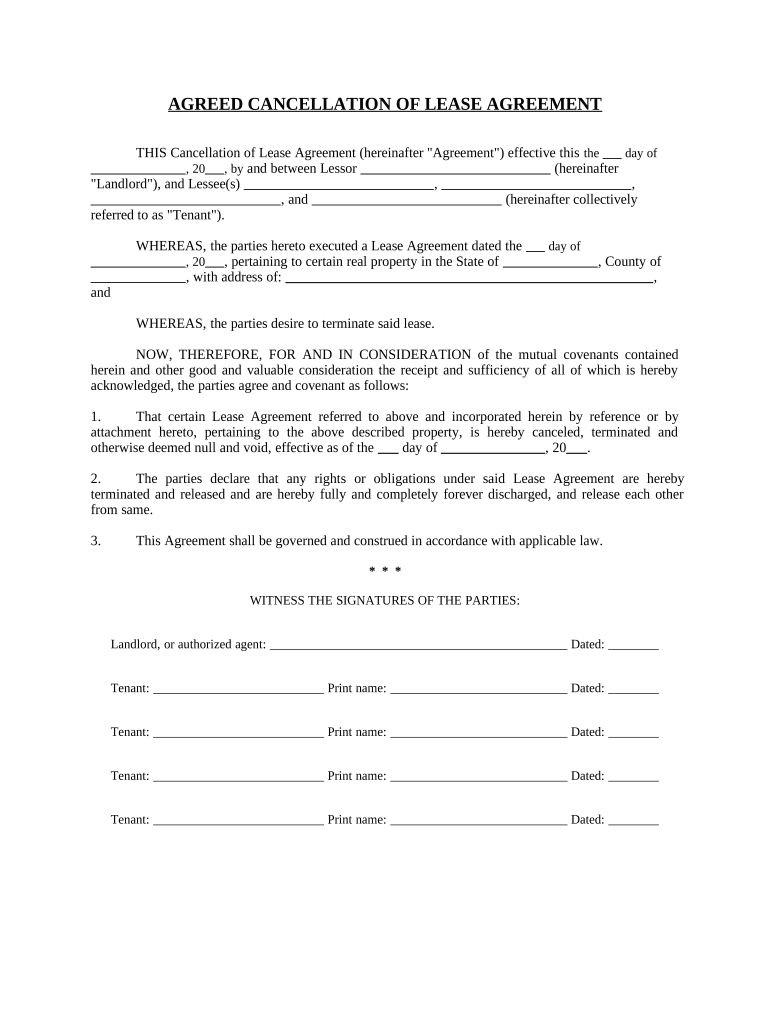

The Kentucky Cancellation form is a specific document used to officially cancel a previously filed application or registration within the state of Kentucky. This form is essential for individuals or businesses looking to terminate their obligations or registrations with state authorities. It can pertain to various types of applications, including business licenses, permits, and other regulatory filings.

How to use the Kentucky Cancellation

Using the Kentucky Cancellation form involves a straightforward process. First, ensure that you have the correct version of the form, which can typically be obtained from the relevant state department's website. Next, fill out the required fields, providing accurate information about the original application or registration you wish to cancel. After completing the form, submit it according to the instructions provided, either online, by mail, or in person, depending on the specific requirements of the issuing authority.

Steps to complete the Kentucky Cancellation

Completing the Kentucky Cancellation form requires several key steps:

- Obtain the form from the appropriate state agency.

- Fill in your personal or business information accurately.

- Provide details about the original application or registration, including dates and reference numbers.

- Sign and date the form to validate your request.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal use of the Kentucky Cancellation

The Kentucky Cancellation form is legally binding when completed and submitted correctly. It serves as an official notice to the state that you wish to terminate your registration or application. To ensure compliance, it is crucial to follow all state regulations regarding the cancellation process. This includes meeting any deadlines and providing necessary documentation that may be required to support your cancellation request.

Key elements of the Kentucky Cancellation

When filling out the Kentucky Cancellation form, several key elements must be included to ensure its validity:

- Your full name or business name.

- Contact information, including address and phone number.

- Details of the application or registration being canceled, including reference numbers.

- The reason for cancellation, if required.

- Your signature and the date of submission.

Required Documents

To successfully process the Kentucky Cancellation form, certain documents may be required. These can include:

- A copy of the original application or registration.

- Any correspondence related to the application that may support your cancellation.

- Identification documents if required by the state agency.

Form Submission Methods

The Kentucky Cancellation form can typically be submitted through various methods, depending on the agency's requirements:

- Online submission through the state agency's official website.

- Mailing the completed form to the appropriate office.

- In-person delivery at designated state offices.

Quick guide on how to complete kentucky cancellation

Prepare Kentucky Cancellation effortlessly on any device

Web-based document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Kentucky Cancellation on any platform using airSlate SignNow's Android or iOS applications and streamline your document-centric tasks today.

The easiest way to modify and eSign Kentucky Cancellation without hassle

- Locate Kentucky Cancellation and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Kentucky Cancellation and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow process for kentucky cancellation of documents?

The airSlate SignNow process for kentucky cancellation of documents is simple and efficient. Users can easily upload the necessary documents and designate cancellation within the platform. With electronic signatures, you can quickly finalize the cancellation, saving time and ensuring compliance.

-

How does airSlate SignNow help with kentucky cancellation for businesses?

airSlate SignNow provides businesses with an easy-to-use platform for handling kentucky cancellation. This solution enhances workflow efficiency, allowing users to prepare, send, and manage cancellation documents seamlessly. Moreover, it offers reliable tracking features to monitor the status of cancellations.

-

Are there any costs associated with kentucky cancellation using airSlate SignNow?

Yes, there are costs associated with using airSlate SignNow for kentucky cancellation, but they are designed to be cost-effective. Pricing plans vary depending on the features you need. You can select a plan that best fits your business size and cancellation document needs.

-

What features does airSlate SignNow offer for kentucky cancellation?

airSlate SignNow offers several features for kentucky cancellation, including customizable templates, secure eSignatures, and document tracking. The platform allows users to collaborate in real-time, ensuring that all necessary parties are involved in the cancellation process. Additionally, it supports various file formats for ease of use.

-

How secure is the kentucky cancellation process with airSlate SignNow?

The kentucky cancellation process with airSlate SignNow is highly secure, employing advanced encryption and security measures to protect your documents. Compliance with industry standards for data security ensures that your sensitive information remains confidential during cancellations. You can trust the platform for secure eSignatures.

-

Can airSlate SignNow integrate with other software for kentucky cancellation management?

Yes, airSlate SignNow can easily integrate with various software solutions for effective kentucky cancellation management. This feature enhances productivity by allowing users to connect their existing systems with the SignNow platform. Popular integrations include CRM systems, cloud storage, and project management tools.

-

What benefits does airSlate SignNow provide for kentucky cancellation processes?

airSlate SignNow offers numerous benefits for kentucky cancellation processes, including time savings, reduced paper usage, and improved compliance. With instant access to cancellation documents and electronic signatures, businesses can streamline their operations. This efficiency leads to faster turnaround times and enhanced productivity.

Get more for Kentucky Cancellation

- Form 300a colorado state judicial branch courts state co

- Peptic ulcer questionnaire form

- British army issue kit list form

- Ages and stages 36 months form

- Form 3cc

- Form 1120 ric u s income tax return for regulated

- Uspsps3602 r template txt form

- Mental health careva boise health careveterans affairs form

Find out other Kentucky Cancellation

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe