Louisiana Collateral Mortgage Form

What is the Louisiana Collateral Mortgage

The Louisiana collateral mortgage is a unique financial instrument used primarily in real estate transactions within the state of Louisiana. This type of mortgage allows borrowers to secure a loan with their property while providing lenders with a flexible means of managing the loan. Unlike traditional mortgages, the collateral mortgage can be used for multiple loans over time, as it allows for the reuse of the same mortgage without the need to execute a new mortgage document each time. This can be particularly beneficial for borrowers who may require additional financing in the future.

How to use the Louisiana Collateral Mortgage

Using the Louisiana collateral mortgage involves several key steps. First, a borrower must apply for a loan with a lender that offers this type of mortgage. Once approved, the borrower signs the collateral mortgage agreement, which outlines the terms of the loan and the property being used as collateral. The borrower can then access funds as needed, up to the amount secured by the mortgage. It is essential for borrowers to understand their obligations under the agreement, including repayment terms and any fees associated with drawing on the collateral.

Steps to complete the Louisiana Collateral Mortgage

Completing a Louisiana collateral mortgage involves a series of steps to ensure that both the borrower and lender are protected. The process typically includes:

- Consulting with a financial advisor or mortgage professional to understand the implications of a collateral mortgage.

- Gathering necessary documentation, such as proof of income, credit history, and property details.

- Submitting a loan application to a lender that offers collateral mortgages.

- Reviewing and signing the collateral mortgage agreement, ensuring all terms are clearly understood.

- Recording the mortgage with the appropriate local government office to establish legal rights.

Legal use of the Louisiana Collateral Mortgage

The legal use of the Louisiana collateral mortgage is governed by state laws that outline the rights and responsibilities of both borrowers and lenders. It is crucial for all parties involved to comply with these regulations to ensure the enforceability of the mortgage. This includes adhering to proper documentation practices, ensuring that all agreements are signed and notarized as required, and maintaining accurate records of any transactions related to the mortgage. Legal counsel may be advisable to navigate any complexities associated with the collateral mortgage.

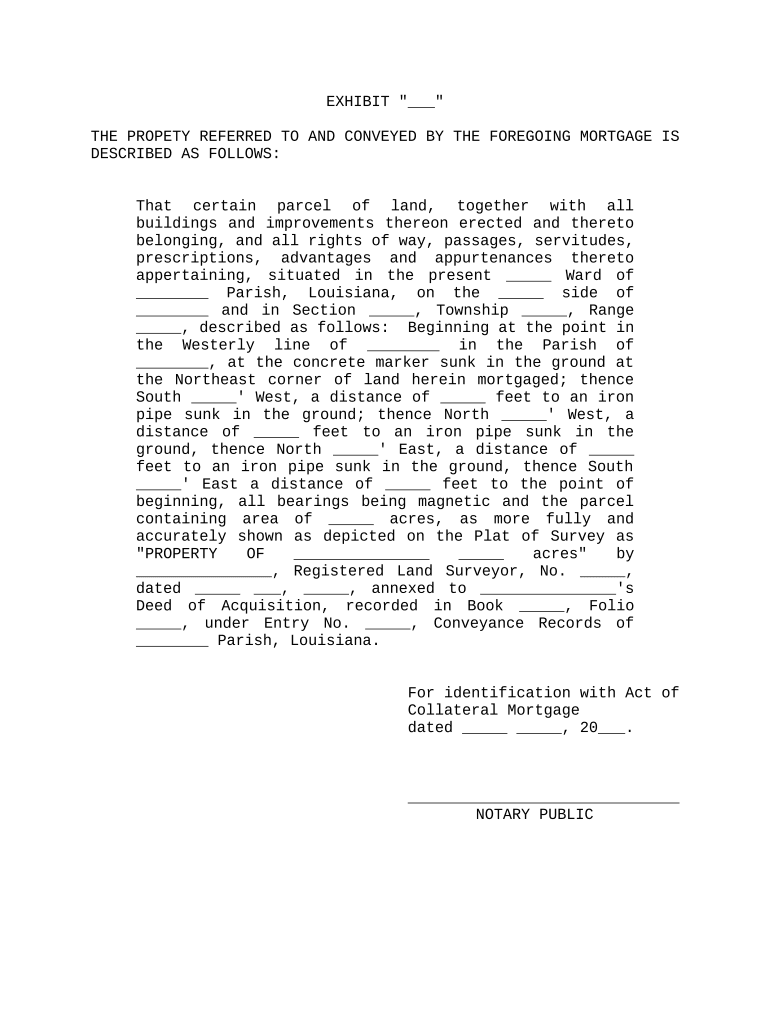

Key elements of the Louisiana Collateral Mortgage

Several key elements define the Louisiana collateral mortgage, making it distinct from other mortgage types. These include:

- Flexibility: Borrowers can access multiple loans secured by the same mortgage.

- Reusable collateral: The mortgage can be reused for future borrowing without additional paperwork.

- Legal framework: Governed by Louisiana state law, ensuring compliance and protection for both parties.

- Interest rates: Typically competitive, as lenders may view these mortgages as lower risk due to the secured nature.

Required Documents

To successfully complete a Louisiana collateral mortgage, borrowers must prepare several essential documents. These typically include:

- Proof of identity, such as a driver's license or passport.

- Income verification documents, including pay stubs or tax returns.

- Property title and appraisal documents to establish value.

- Credit report to assess borrowing eligibility.

- Any existing mortgage documents if the property is already encumbered.

Quick guide on how to complete louisiana collateral mortgage

Complete Louisiana Collateral Mortgage effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a seamless, eco-friendly alternative to conventional printed and signed papers, allowing you to find the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage Louisiana Collateral Mortgage on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to edit and eSign Louisiana Collateral Mortgage with ease

- Find Louisiana Collateral Mortgage and click Get Form to begin.

- Use the tools we provide to fill in your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries exactly the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious searching for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign Louisiana Collateral Mortgage to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Louisiana collateral mortgage?

A Louisiana collateral mortgage is a type of mortgage that allows the borrower to use their property as collateral for a loan. This mortgage structure can facilitate access to various types of loans while minimizing transaction costs. Understanding this can help you make informed decisions about the best financial options available.

-

How does airSlate SignNow support Louisiana collateral mortgage transactions?

airSlate SignNow streamlines the process of managing Louisiana collateral mortgage documents by allowing users to securely eSign and send documents. This user-friendly platform simplifies document handling, making it easy for lenders and borrowers to complete transactions efficiently. By leveraging airSlate SignNow, you can enhance your mortgage documentation process.

-

What are the costs associated with a Louisiana collateral mortgage?

The costs of a Louisiana collateral mortgage can vary based on factors such as loan amount and lender fees. It's important to consider interest rates and potential closing costs when calculating your overall expenses. Using airSlate SignNow can help manage and document all transactions, ensuring transparency in your expenses.

-

What features does airSlate SignNow offer for Louisiana collateral mortgage management?

airSlate SignNow offers features like eSigning, template management, and secure document storage, which are essential for effective Louisiana collateral mortgage management. These features help streamline the documentation process, reduce errors, and save time. Leveraging these tools enables better organization and efficiency during your mortgage dealings.

-

What benefits does eSigning provide for Louisiana collateral mortgages?

eSigning through airSlate SignNow provides signNow benefits for Louisiana collateral mortgages, including faster processing times and reduced paperwork. With electronic signatures, documents can be signed remotely, eliminating the need for physical meetings. This convenience can enhance customer satisfaction and accelerate the overall mortgage process.

-

Are there any integrations available with airSlate SignNow for Louisiana collateral mortgage services?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems, which can enhance your Louisiana collateral mortgage services. These integrations enable better data management and workflow efficiency, allowing you to focus on providing excellent service to your clients. You can automate many tasks related to documentation using these integrations.

-

How can I ensure compliance with Louisiana regulations when using airSlate SignNow for mortgages?

airSlate SignNow is designed to adhere to industry standards and regulations, providing tools that ensure compliance when handling Louisiana collateral mortgages. Utilizing features such as audit trails and secure storage can help maintain compliance with state laws. Staying informed about local regulations is still crucial to avoid any legal pitfalls.

Get more for Louisiana Collateral Mortgage

Find out other Louisiana Collateral Mortgage

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT