Arizona Form A1 Wp

What is the Arizona Form A1 WP

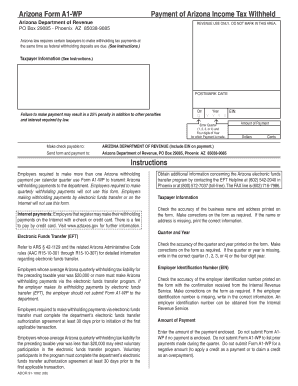

The Arizona Form A1 WP is a specific tax form used by employers in Arizona to report and pay withholding tax for employees. This form is essential for businesses to comply with state tax regulations, ensuring that the correct amount of income tax is withheld from employee wages. Understanding the purpose and requirements of the Arizona Form A1 WP is crucial for maintaining compliance with state laws and avoiding penalties.

How to use the Arizona Form A1 WP

Using the Arizona Form A1 WP involves several steps to ensure accurate completion and submission. Employers must first gather necessary information about their employees, including Social Security numbers and wage details. Once the form is filled out, it can be submitted either electronically or via mail. It is important to follow the specific guidelines provided by the Arizona Department of Revenue to ensure proper processing.

Steps to complete the Arizona Form A1 WP

Completing the Arizona Form A1 WP requires careful attention to detail. Here are the basic steps:

- Gather employee information, including names, addresses, and Social Security numbers.

- Calculate the total wages paid to employees during the reporting period.

- Determine the amount of state income tax to withhold based on the wages and applicable tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

Legal use of the Arizona Form A1 WP

The legal use of the Arizona Form A1 WP is governed by state tax laws. This form must be completed accurately and submitted on time to avoid penalties. Employers are responsible for ensuring that the information provided is correct and that they comply with all relevant tax regulations. Failure to do so can result in fines and other legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form A1 WP are crucial for compliance. Employers should be aware of the following important dates:

- Quarterly filing deadlines, typically due on the last day of the month following the end of each quarter.

- Annual reconciliation deadlines for submitting the final summary of withholding for the year.

Staying informed about these deadlines helps prevent late fees and ensures timely compliance with state tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form A1 WP can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission: Employers can file electronically through the Arizona Department of Revenue’s online portal.

- Mail: The completed form can be printed and sent to the appropriate address provided by the state.

- In-person: Employers may also choose to deliver the form directly to a local tax office.

Choosing the right submission method can streamline the filing process and ensure timely compliance.

Quick guide on how to complete arizona form a1 wp

Complete Arizona Form A1 Wp effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the proper form and safely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Arizona Form A1 Wp on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to edit and eSign Arizona Form A1 Wp with ease

- Locate Arizona Form A1 Wp and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow accommodates your needs in document management with just a few clicks from your preferred device. Edit and eSign Arizona Form A1 Wp and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form a1 wp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form A1 WP?

The Arizona Form A1 WP is a key document required for specific business registrations and compliance in Arizona. It serves as an essential part of the administrative process, ensuring businesses meet state requirements. Understanding how to properly fill out the Arizona Form A1 WP can save time and prevent penalties.

-

How does airSlate SignNow simplify the signing process for Arizona Form A1 WP?

AirSlate SignNow streamlines the signing process for the Arizona Form A1 WP by providing a user-friendly interface that allows for quick electronic signatures. This digital solution eliminates the need for printing and scanning, making it easier to obtain signatures swiftly. With airSlate SignNow, managing your Arizona Form A1 WP is more efficient and effective.

-

What are the pricing options for using airSlate SignNow with Arizona Form A1 WP?

AirSlate SignNow offers competitive pricing plans tailored for different business needs, making it accessible for those handling the Arizona Form A1 WP. The pricing models are designed to suit various budgets, ensuring that businesses of all sizes can benefit from this essential tool. Regular promotions may further enhance affordability.

-

What features does airSlate SignNow offer for managing the Arizona Form A1 WP?

AirSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking to enhance management of the Arizona Form A1 WP. These tools facilitate a smoother submission process and ensure that all documents are correctly completed and filed. The platform also provides audit trails for added compliance assurance.

-

Can I integrate airSlate SignNow with other applications while handling Arizona Form A1 WP?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing users to manage the Arizona Form A1 WP alongside other essential business tools. This integration enhances workflow efficiency by centralizing document management. You can connect it with popular apps like Google Workspace, Salesforce, and more.

-

What are the benefits of using airSlate SignNow for the Arizona Form A1 WP?

Using airSlate SignNow for the Arizona Form A1 WP offers numerous benefits, including increased efficiency, reduced processing time, and enhanced compliance. The ability to electronically sign and send documents means faster turnaround and less hassle. Additionally, the platform's security features ensure that your documents remain safe and confidential.

-

Is there customer support available for users of airSlate SignNow working with Arizona Form A1 WP?

Absolutely! AirSlate SignNow provides robust customer support for users managing the Arizona Form A1 WP. Whether you need help with technical issues or have questions about features, the support team is readily available to assist you efficiently and effectively.

Get more for Arizona Form A1 Wp

- Or126 horseshoe creek siuslaw river section oregon gov oregon form

- Name and address of the new employer date employment commences and the reason for the change in employment health ri form

- Form it 135 sales and use tax report for purchases of

- Form it 640 start up ny telecommunication services excise tax credit tax year

- Average time to complete 10 minutesidentity theft form

- Software e development agency contract template form

- Software development outsourc contract template form

- Software implementation contract template form

Find out other Arizona Form A1 Wp

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure