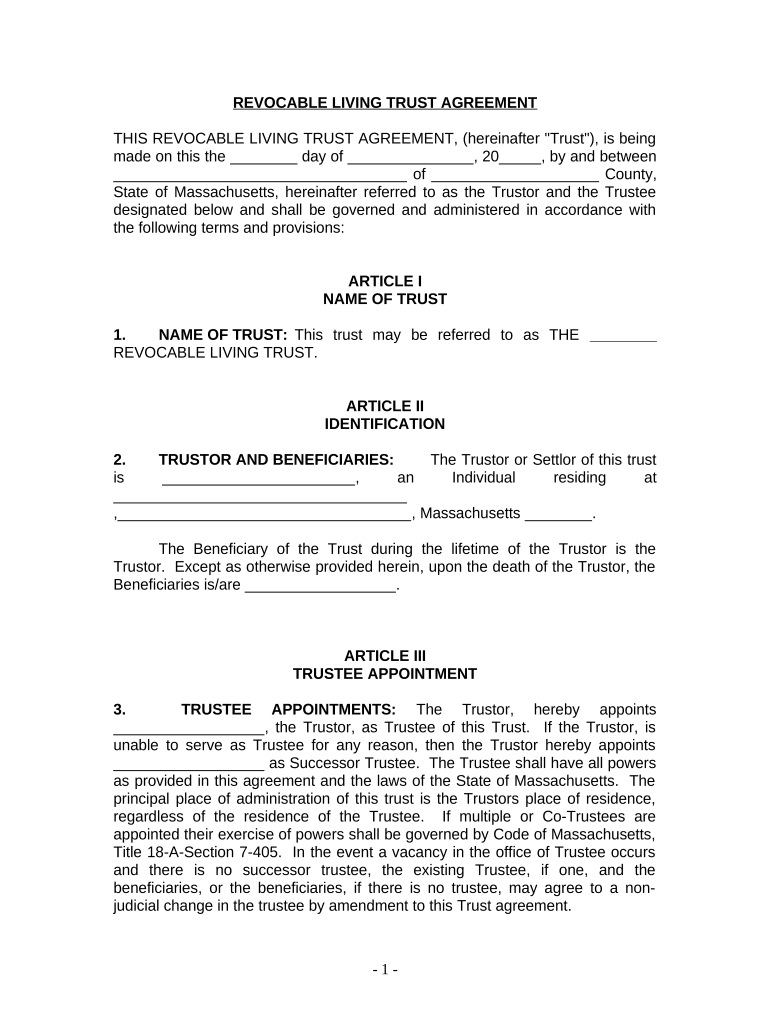

Massachusetts Trust Form

What is the Massachusetts Trust Form

The Massachusetts trust form is a legal document used to establish a trust in the state of Massachusetts. A trust is a fiduciary arrangement that allows a third party, known as a trustee, to hold assets on behalf of beneficiaries. This form outlines the terms of the trust, including the responsibilities of the trustee and the rights of the beneficiaries. It is essential for individuals looking to manage their assets effectively while ensuring proper distribution according to their wishes.

How to use the Massachusetts Trust Form

Using the Massachusetts trust form involves several steps to ensure it meets legal requirements and accurately reflects the grantor's intentions. First, individuals must gather necessary information, including details about the trust's assets, beneficiaries, and trustee. Next, the form should be completed with precise information, ensuring clarity in each section. Once filled out, the form must be signed by the grantor and, in some cases, witnessed or notarized to enhance its legal standing.

Steps to complete the Massachusetts Trust Form

Completing the Massachusetts trust form requires careful attention to detail. Here are the key steps:

- Begin by clearly identifying the grantor, trustee, and beneficiaries.

- Detail the assets that will be placed into the trust, including real estate, bank accounts, or investments.

- Specify the terms of the trust, including how and when assets will be distributed to beneficiaries.

- Review the completed form for accuracy and completeness.

- Sign the form in the presence of a notary public or witnesses as required by Massachusetts law.

Legal use of the Massachusetts Trust Form

The legal use of the Massachusetts trust form hinges on compliance with state laws governing trusts. To be legally binding, the form must be executed according to Massachusetts statutes, which may include specific requirements for signatures and notarization. Additionally, it is crucial to ensure that the trust's terms align with state regulations to avoid potential disputes among beneficiaries or challenges to the trust's validity.

Key elements of the Massachusetts Trust Form

Several key elements must be included in the Massachusetts trust form to ensure its effectiveness:

- Grantor Information: The individual creating the trust must be clearly identified.

- Trustee Designation: The person or entity responsible for managing the trust must be named.

- Beneficiary Details: All beneficiaries entitled to receive assets from the trust should be listed.

- Asset Description: A detailed account of the assets included in the trust is necessary.

- Distribution Terms: Clear instructions on how and when assets will be distributed to beneficiaries must be provided.

Who Issues the Form

The Massachusetts trust form is typically created by the grantor or their legal representative. While there is no central authority that issues this form, legal professionals often provide templates or guidance to ensure compliance with state laws. It is advisable to consult with an attorney specializing in estate planning to ensure that the form is correctly drafted and executed.

Quick guide on how to complete massachusetts trust form

Effortlessly Complete Massachusetts Trust Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents quickly and without hassle. Handle Massachusetts Trust Form on any device through the airSlate SignNow applications for Android or iOS and streamline any document-related workflow today.

How to Edit and Electronically Sign Massachusetts Trust Form with Ease

- Locate Massachusetts Trust Form and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and is legally equivalent to a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements with just a few clicks from your chosen device. Edit and electronically sign Massachusetts Trust Form to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Massachusetts trust form?

A Massachusetts trust form is a legal document used to establish a trust in the state of Massachusetts. It outlines the terms and conditions under which the assets in the trust will be managed and distributed. Using the right form is crucial for ensuring compliance with state laws.

-

How can airSlate SignNow help with my Massachusetts trust form?

airSlate SignNow makes it easy to complete and eSign your Massachusetts trust form securely online. With our user-friendly interface, you can upload your document, send it for signature, and store it safely in the cloud. This streamlines the process, saving you time and reducing paperwork.

-

What are the benefits of using airSlate SignNow for trust forms?

Using airSlate SignNow for your Massachusetts trust form offers numerous benefits, including enhanced security, time savings, and easy collaboration. Our platform ensures that your documents are signed and stored securely, while also providing real-time tracking and notifications. This helps you manage your trust documents more effectively.

-

Is there a cost associated with using airSlate SignNow for my Massachusetts trust form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different needs. You can choose a plan that best suits your requirements, whether for personal use or business needs. Explore our options to find an affordable solution for managing your Massachusetts trust form.

-

Can I integrate airSlate SignNow with other software for trust forms?

Absolutely! airSlate SignNow supports integrations with various applications to enhance your workflow. This means you can connect your other tools directly to streamline the management of your Massachusetts trust form without needing to switch between platforms.

-

How do I ensure my Massachusetts trust form is legally binding?

To ensure your Massachusetts trust form is legally binding, it must be properly completed and signed by all involved parties. airSlate SignNow complies with state eSignature laws, ensuring that your digitally signed forms hold up in court. You can rest assured that our solution meets legal standards.

-

Can I access my Massachusetts trust form on mobile devices?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to access and manage your Massachusetts trust form on the go. Our mobile app provides the same functionality as our web platform, ensuring you can send, sign, and store documents anytime, anywhere.

Get more for Massachusetts Trust Form

- Canyon county sild form

- Area and perimeter of triangles parallelograms and trapezoids worksheets form

- Ogmoil form

- Permiso de caza individual form

- Constitution vocabulary review fill in the blank form

- Saas partnership agreement template form

- Shareholder partnership agreement template form

- Silent partnership agreement template form

Find out other Massachusetts Trust Form

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document