Jersey Form 2018

What is the Jersey Form

The Jersey Form refers to the official income tax forms used by residents of New Jersey to report their income and calculate their state tax liability. These forms are essential for ensuring compliance with state tax regulations and include various types, such as the NJ-1040 for individuals and NJ-1065 for partnerships. Each form is designed to capture specific financial information relevant to the taxpayer's situation, making it crucial to select the correct form based on individual circumstances.

How to obtain the Jersey Form

To obtain the Jersey Form, taxpayers can visit the New Jersey Division of Taxation's official website, where they can download the necessary forms in PDF format. Additionally, forms can be requested through local tax offices or by calling the Division of Taxation directly. It is advisable to ensure that the most current version of the form is used, as outdated forms may not be accepted by the state.

Steps to complete the Jersey Form

Completing the Jersey Form involves several key steps:

- Gather all necessary financial documents, such as W-2s, 1099s, and any other income statements.

- Carefully read the instructions accompanying the form to understand the requirements and any specific calculations needed.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the form for any errors or omissions before signing.

- Submit the completed form by the specified deadline, either electronically or by mail.

Legal use of the Jersey Form

The Jersey Form must be completed and submitted in accordance with New Jersey state laws and regulations. This includes adhering to filing deadlines and ensuring that all information provided is truthful and accurate. Failure to comply with these legal requirements can result in penalties, including fines or additional tax assessments. It is important for taxpayers to familiarize themselves with the legal implications of filing their income tax forms to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in New Jersey have several options for submitting their income tax forms. These methods include:

- Online Submission: Taxpayers can file their forms electronically through the New Jersey Division of Taxation's online portal, which is a secure and efficient way to submit tax information.

- Mail: Completed forms can be mailed to the appropriate tax office address specified in the form instructions. It is recommended to use certified mail for tracking purposes.

- In-Person: Taxpayers may also choose to submit their forms in person at designated tax offices, where assistance may be available if needed.

Eligibility Criteria

Eligibility to file the Jersey Form varies based on several factors, including residency status, income level, and specific tax situations. Generally, all residents of New Jersey who earn income above a certain threshold are required to file. Additionally, non-residents who earn income from New Jersey sources must also file the appropriate forms. It is important to review the eligibility criteria outlined by the New Jersey Division of Taxation to determine the necessity of filing.

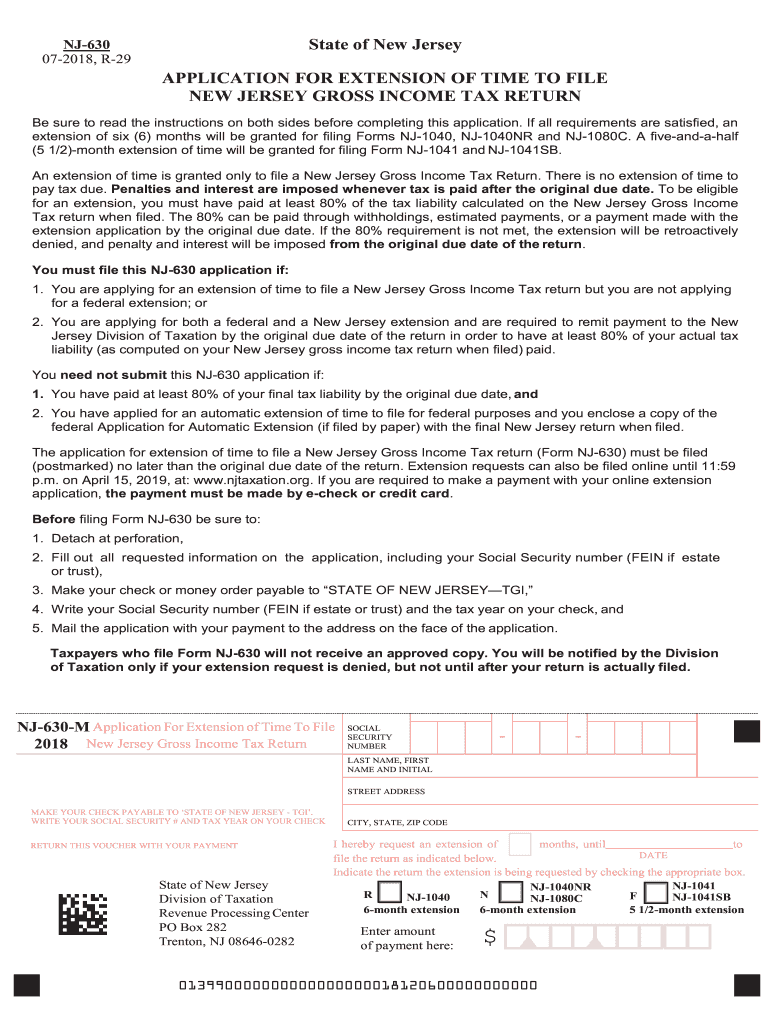

Quick guide on how to complete nj form630 application for extension of time to file nj gross income tax return

Your assistance manual on how to prepare your Jersey Form

If you’re uncertain about how to finalize and submit your Jersey Form, here are some brief guidelines on how to simplify the tax declaration process.

To begin, you simply need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, draft, and complete your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures while revisiting any responses that require modifications. Optimize your tax handling with advanced PDF editing, eSigning, and easy sharing capabilities.

Adhere to the following steps to finish your Jersey Form in just minutes:

- Set up your account and start processing PDFs in no time.

- Utilize our directory to find any IRS tax document; peruse available versions and schedules.

- Select Get form to access your Jersey Form in our editor.

- Complete the necessary fillable sections with your details (text entries, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any inaccuracies.

- Save the changes, print your copy, forward it to your recipient, and download it to your device.

Refer to this guide to electronically submit your taxes with airSlate SignNow. Keep in mind that filing on paper may lead to increased mistakes in returns and prolonged reimbursements. It is essential to visit the IRS website for your state's filing regulations before submitting your taxes electronically.

Create this form in 5 minutes or less

Find and fill out the correct nj form630 application for extension of time to file nj gross income tax return

FAQs

-

I need more time to file my income tax return, how long is a tax extension?

If you need more time definitely file Extension Form 4868. It only takes minutes to file and you will be given an additional 6 months time to file! Here’s the easiest way to file: The Secret To Overcoming The Big Tax Return Deadline

-

How do you file for an Automatic Extension of Time To File a Tax Return?

Use form 4868, and you can either e-file it, or just mail it in.A little warning. An extension to file is not an extension to pay. So, if you have a balance due, penalties and interest will be calculated on that balance due starting April 15th. So, you’ll want to estimate your taxes and pay that.The other thing is that if you have a refund coming, there technically is no need to file an extension. The failure-to-file penalty is based upon the amount you have due for your taxes. If you do not have a balance due, but have a refund, that failure-to-file penalty will be $0. You’ll just need to file eventually to get your refund.

-

What is to be done for a time-barred income tax return file of 2016-17?

If you miss in filing of return for the FY 2016–17,you may wait for a notice u/s142 issued by income tax department in compliance of which you may file you income tax return. It may be the department started proceedings for escape assessment for which a notice u/s 148 will be issued by the department. Again in compliance of this notice you may file your return. Now voluantary you may not file the your return. If some refund is due you may approach the commissioner of income tax and applied for vondonation of delay. If the CIT consisted that there is a genuine difficulty in filing of return, he may be allowed. However all these pptocefures are not easy. You should file your return in time regularly.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How beneficial will it be for me to file an income tax return if my income is hardly Rs 15000 annually from a part-time job?

You will feel proud of being an income tax assessee.At a later date, when you become rich, you have not to prove that from where you gathered so much wealth as it will be in black and white from day one.You will not be questioned about your integrity towards payment of taxes, if due any

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How do I file an income tax return in India for a loss towards the repayment of a retention bonus to an ex-employer?

There is no such option of set off and carry forward in case of income form salary. So you can’t claim retention bonus recovery as loss under Income tax act.The above does not purport to be legal advice and is meant to only clarify certain regulatory and practical aspects as elaborated above. For specific clarifications / legal advice feel free to write to dsssvtax@gmail or call/whatsapp : 9052535440.

-

I am a NRE and I stayed out of India for more than 6 months in a financial year. Do I have to file an income tax return each year?

Yes being a NRI you have to file income tax return. The following persons shall submit return of income on compulsory basis:a company/firm has to submit return whether there is any income/lossa person(other than firm/company) has to submit return of income if taxable income exceeds the exemption limit.a person in receipt of income derived from property held under a trust for charitable/religious purpose if income exceeds amount not chargeable to tax.chief executive officer of every political party if income exceeds amount not chargeable to tax.scientific research association, news agency, association/institute for control or supervision of a profession, institution for development of khadi and village industries, fund/institution referred to in section 10(23C)(iv)/(v), educational/medical institution, trade union- if income exceeds maximum amount not chargeable to tax.any university/college/other institution referred to in section 35(1)(ii)/(iii) have to submit return whether there is any income/loss.To find residential status of a person please visit http://www.finmart.com/residenti...for income tax return advisory and return e-filing feel free to visit http://www.finmart.com/sr-it-ret...

Create this form in 5 minutes!

How to create an eSignature for the nj form630 application for extension of time to file nj gross income tax return

How to generate an electronic signature for the Nj Form630 Application For Extension Of Time To File Nj Gross Income Tax Return in the online mode

How to make an eSignature for your Nj Form630 Application For Extension Of Time To File Nj Gross Income Tax Return in Google Chrome

How to create an electronic signature for putting it on the Nj Form630 Application For Extension Of Time To File Nj Gross Income Tax Return in Gmail

How to generate an eSignature for the Nj Form630 Application For Extension Of Time To File Nj Gross Income Tax Return right from your mobile device

How to generate an electronic signature for the Nj Form630 Application For Extension Of Time To File Nj Gross Income Tax Return on iOS

How to create an eSignature for the Nj Form630 Application For Extension Of Time To File Nj Gross Income Tax Return on Android devices

People also ask

-

What are the state of New Jersey income tax forms available through airSlate SignNow?

airSlate SignNow provides access to a variety of state of New Jersey income tax forms, including the NJ-1040 and NJ-1040NR. These forms can be easily filled out, signed, and sent electronically, saving you time and ensuring accuracy in your submissions. Our platform simplifies the process of managing these important documents.

-

How does airSlate SignNow help in filling out state of New Jersey income tax forms?

airSlate SignNow features user-friendly tools that guide you through the process of filling out state of New Jersey income tax forms. You can input necessary data, save your progress, and even receive reminders to ensure your forms are completed on time. This streamlined approach minimizes errors and enhances your overall experience.

-

Can I eSign state of New Jersey income tax forms using airSlate SignNow?

Yes, airSlate SignNow allows you to electronically sign state of New Jersey income tax forms securely. Our eSignature solution is compliant with legal standards, ensuring that your signed documents are valid and recognized by tax authorities. This feature signNowly expedites the submission process.

-

Are there any costs associated with using airSlate SignNow for state of New Jersey income tax forms?

airSlate SignNow offers a cost-effective solution for managing state of New Jersey income tax forms. We provide various pricing plans designed to meet different user needs, ensuring you only pay for the features you require. Additionally, we offer a free trial to help you evaluate our platform before committing.

-

What benefits does airSlate SignNow offer when handling state of New Jersey income tax forms?

Using airSlate SignNow for state of New Jersey income tax forms provides numerous benefits, including enhanced efficiency, secure document storage, and easy sharing options. Our solution minimizes paperwork, reduces the risk of errors, and allows you to manage your tax forms from anywhere. This can save you valuable time during tax season.

-

Are state of New Jersey income tax forms customizable in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize state of New Jersey income tax forms according to your specific needs. You can add fields, adjust formatting, and ensure that all necessary information is collected. This level of customization helps improve the accuracy of your tax submissions.

-

How does airSlate SignNow integrate with other financial software for state of New Jersey income tax forms?

airSlate SignNow seamlessly integrates with various financial software platforms, allowing you to streamline the process of managing state of New Jersey income tax forms. By connecting your existing tools, you can automate data transfer and enhance workflow efficiency, reducing manual entry and potential errors.

Get more for Jersey Form

Find out other Jersey Form

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now