Notice of Assignment to Living Trust Massachusetts Form

What is the Notice Of Assignment To Living Trust Massachusetts

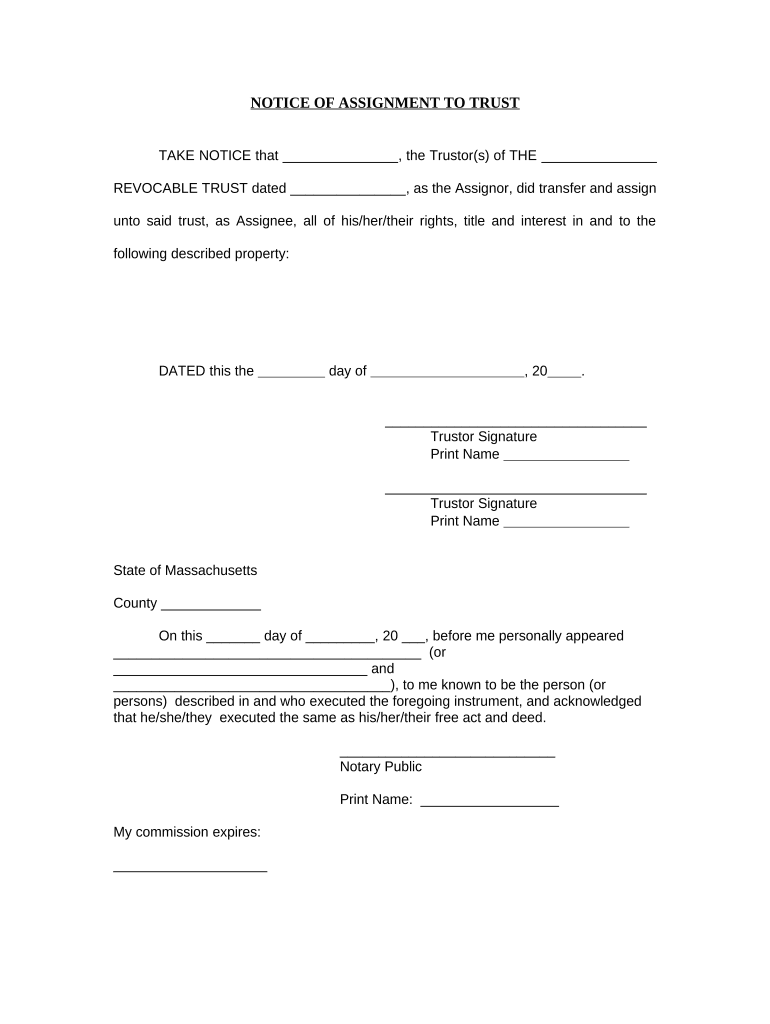

The Notice Of Assignment To Living Trust in Massachusetts is a legal document that formally notifies interested parties about the transfer of assets into a living trust. This document serves to clarify the ownership and management of the assets assigned to the trust, ensuring that they are handled according to the trust's terms. By using this notice, individuals can help prevent disputes regarding asset ownership and provide transparency for beneficiaries and other stakeholders.

How to use the Notice Of Assignment To Living Trust Massachusetts

Using the Notice Of Assignment To Living Trust involves several key steps. First, individuals must identify the assets they wish to transfer into the living trust. Next, they should complete the notice form with accurate details regarding the trust and the assets involved. Once the form is filled out, it should be signed by the trust creator and any necessary witnesses, if applicable. Finally, this notice should be distributed to all relevant parties, including beneficiaries and financial institutions, to ensure everyone is informed of the asset assignment.

Steps to complete the Notice Of Assignment To Living Trust Massachusetts

Completing the Notice Of Assignment To Living Trust requires careful attention to detail. The following steps outline the process:

- Gather necessary information about the living trust and the assets being assigned.

- Fill out the notice form, including the names of the trust creator and beneficiaries, as well as a description of the assets.

- Review the completed form for accuracy and completeness.

- Sign the notice in the presence of a notary or witnesses, if required by Massachusetts law.

- Distribute copies of the signed notice to all relevant parties, including financial institutions and beneficiaries.

Legal use of the Notice Of Assignment To Living Trust Massachusetts

The legal use of the Notice Of Assignment To Living Trust is crucial for maintaining the integrity of the trust and its assets. This document must comply with Massachusetts laws regarding trusts and estate planning. It is essential to ensure that the notice is executed properly, as failure to do so may lead to challenges regarding the validity of the trust or the assignment of assets. Consulting with a legal professional can help ensure compliance and proper execution.

Key elements of the Notice Of Assignment To Living Trust Massachusetts

Several key elements must be included in the Notice Of Assignment To Living Trust to ensure its effectiveness and legal standing:

- The full name and contact information of the trust creator.

- The name of the living trust and its date of creation.

- A detailed description of the assets being assigned to the trust.

- The names and contact information of all beneficiaries.

- Signatures of the trust creator and any required witnesses or notaries.

State-specific rules for the Notice Of Assignment To Living Trust Massachusetts

Massachusetts has specific rules governing the execution and use of the Notice Of Assignment To Living Trust. These rules include requirements for signatures, notarization, and the distribution of the notice. It is important to familiarize oneself with these regulations to ensure that the notice is legally binding and enforceable. Failure to adhere to state-specific rules may result in complications regarding the trust and its assets.

Quick guide on how to complete notice of assignment to living trust massachusetts

Effortlessly prepare Notice Of Assignment To Living Trust Massachusetts on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Notice Of Assignment To Living Trust Massachusetts on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

Easily edit and eSign Notice Of Assignment To Living Trust Massachusetts without any hassle

- Find Notice Of Assignment To Living Trust Massachusetts and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Notice Of Assignment To Living Trust Massachusetts while ensuring excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice Of Assignment To Living Trust Massachusetts?

A Notice Of Assignment To Living Trust Massachusetts is a legal document that informs relevant parties about the assignment of assets to a living trust. This document is essential for ensuring proper asset management and transfer upon the trustor's passing. airSlate SignNow simplifies the process of creating and signing this document electronically.

-

How can airSlate SignNow help with the Notice Of Assignment To Living Trust Massachusetts?

airSlate SignNow provides a user-friendly platform for creating and signing your Notice Of Assignment To Living Trust Massachusetts. Our electronic signature solutions ensure that documents are completed quickly and securely, saving time and effort for users. You can easily manage all your trust-related documents in one place.

-

What are the costs associated with using airSlate SignNow for my Notice Of Assignment To Living Trust Massachusetts?

airSlate SignNow offers a variety of pricing plans to suit different needs, starting with a free trial. Our competitive pricing ensures that you can affordably create and manage your Notice Of Assignment To Living Trust Massachusetts without sacrificing quality or service. Special packages may be available for businesses looking to manage multiple documents.

-

What features does airSlate SignNow offer for estate planning documents like the Notice Of Assignment To Living Trust Massachusetts?

airSlate SignNow includes features such as customizable templates, secure e-signatures, and document management to streamline your estate planning. With these tools, creating your Notice Of Assignment To Living Trust Massachusetts becomes efficient and straightforward. You can also track the signing process in real-time.

-

Are there any integrations available with airSlate SignNow to enhance my Notice Of Assignment To Living Trust Massachusetts?

Yes, airSlate SignNow integrates with several popular applications like Google Drive, Dropbox, and CRM systems. These integrations make it easy to store and manage your Notice Of Assignment To Living Trust Massachusetts along with other essential documents. Streamlining your workflow enhances productivity and ensures data consistency.

-

Is airSlate SignNow secure for signing legal documents like the Notice Of Assignment To Living Trust Massachusetts?

Absolutely. airSlate SignNow employs industry-standard encryption and compliance protocols to ensure that your Notice Of Assignment To Living Trust Massachusetts is securely signed and stored. Our commitment to security means you can trust that your important documents remain confidential and protected.

-

How can I get started with airSlate SignNow for my Notice Of Assignment To Living Trust Massachusetts?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, choose a plan that fits your needs, and explore our library of templates, including the Notice Of Assignment To Living Trust Massachusetts. You'll be up and running in no time, ready to streamline your document signing process.

Get more for Notice Of Assignment To Living Trust Massachusetts

- Associated employers exemption allocation form

- Kotak common application form

- Montgomery county jurisdictional addendum to sales contract form

- Construction change directive form

- 877 824 1411 form

- Break phrasal verb exercises pdf form

- Notary certificate annuities form

- Friends and family loan agreement template form

Find out other Notice Of Assignment To Living Trust Massachusetts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors