Living Trust for Husband and Wife with No Children Maryland Form

What is the Living Trust For Husband And Wife With No Children Maryland

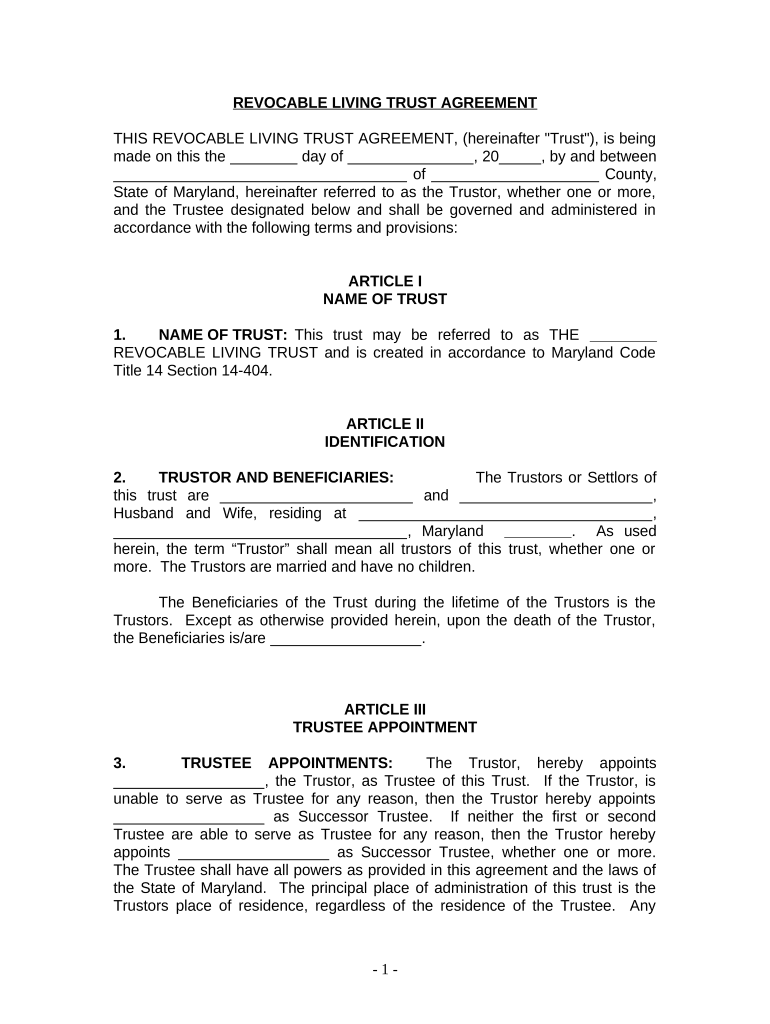

A living trust for husband and wife with no children in Maryland is a legal arrangement that allows couples to manage their assets during their lifetime and specify how these assets will be distributed upon their passing. This type of trust is particularly beneficial for couples without children, as it provides a clear framework for asset management and inheritance. The trust can help avoid probate, streamline the transfer of assets, and ensure that the couple's wishes are honored after death. It can include various types of assets, such as real estate, bank accounts, and investments.

How to Use the Living Trust For Husband And Wife With No Children Maryland

Using a living trust involves several steps. First, the couple must decide what assets to include in the trust. Next, they will need to draft the trust document, which outlines the terms of the trust, including the management of assets and distribution upon death. Once the trust is created, the couple should transfer ownership of their assets into the trust. This process may involve changing titles on property deeds and updating bank account information. Lastly, it is essential to review and update the trust periodically to reflect any changes in circumstances or wishes.

Steps to Complete the Living Trust For Husband And Wife With No Children Maryland

Completing a living trust involves the following steps:

- Determine the assets to be included in the trust.

- Choose a trustee, who will manage the trust.

- Draft the trust document, detailing the terms and conditions.

- Sign the trust document in the presence of a notary.

- Transfer ownership of assets into the trust.

- Store the trust document in a safe place and inform relevant parties.

Legal Use of the Living Trust For Husband And Wife With No Children Maryland

The legal use of a living trust in Maryland is governed by state law. It is essential that the trust is properly executed to ensure its validity. This includes having the trust document signed by both spouses and notarized. The trust must also comply with Maryland's laws regarding asset transfer and management. Properly established, a living trust can help avoid probate, reduce estate taxes, and provide a clear plan for asset distribution, making it a valuable tool for estate planning.

Key Elements of the Living Trust For Husband And Wife With No Children Maryland

Key elements of a living trust for husband and wife with no children include:

- The names of the grantors (the couple creating the trust).

- The designation of a trustee to manage the trust.

- A detailed list of assets included in the trust.

- Instructions for asset distribution upon the death of the grantors.

- Provisions for the management of the trust during the grantors' lifetime.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Maryland

Maryland has specific rules regarding living trusts. For instance, the trust must be in writing and signed by the grantors. Additionally, Maryland law requires that the trust be funded with assets to be effective. It is also important to note that while living trusts can help avoid probate, they do not exempt the estate from estate taxes. Couples should consult with a legal professional familiar with Maryland estate laws to ensure compliance and proper execution of the trust.

Quick guide on how to complete living trust for husband and wife with no children maryland

Easily Prepare Living Trust For Husband And Wife With No Children Maryland on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow offers you all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Manage Living Trust For Husband And Wife With No Children Maryland on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Edit and eSign Living Trust For Husband And Wife With No Children Maryland Effortlessly

- Obtain Living Trust For Husband And Wife With No Children Maryland and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal weight as a traditional ink signature.

- Review all the information carefully, then click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Living Trust For Husband And Wife With No Children Maryland to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Maryland?

A Living Trust For Husband And Wife With No Children in Maryland is a legal document that allows couples to manage their assets during their lifetime and distribute them after death without going through probate. This type of trust provides flexibility and ensures that your wishes are honored regarding asset management and distribution.

-

How does a Living Trust For Husband And Wife With No Children in Maryland benefit us?

Creating a Living Trust For Husband And Wife With No Children in Maryland can help you maintain control over your assets while avoiding the lengthy probate process. This trust also offers privacy, as it does not become a matter of public record, and can reduce your estate's tax liabilities, ensuring more assets pass to your beneficiaries.

-

What are the costs associated with setting up a Living Trust For Husband And Wife With No Children in Maryland?

The costs for establishing a Living Trust For Husband And Wife With No Children in Maryland vary depending on the complexity of your assets and the legal fees involved. Typically, you may incur costs for legal assistance, filing fees, and potential ongoing maintenance fees. It is advisable to consult with a legal expert to get an accurate estimate.

-

Can we change or revoke our Living Trust For Husband And Wife With No Children in Maryland?

Yes, one of the signNow advantages of a Living Trust For Husband And Wife With No Children in Maryland is the ability to modify or revoke it at any time while you are alive. This flexibility allows you to update your trust as your circumstances or wishes change, ensuring your estate plan remains relevant.

-

What assets can be included in a Living Trust For Husband And Wife With No Children in Maryland?

You can include various types of assets in a Living Trust For Husband And Wife With No Children in Maryland, such as real estate, bank accounts, investments, and personal property. However, it's important to ensure these assets are properly titled in the name of the trust to ensure they are managed according to your wishes.

-

What happens to our Living Trust For Husband And Wife With No Children in Maryland if one spouse passes away?

If one spouse passes away, the Living Trust For Husband And Wife With No Children in Maryland remains intact and continues to operate. The surviving spouse will typically retain control over the trust assets, ensuring a seamless transition without the need for probate, according to the terms set forth in the trust.

-

Can we use airSlate SignNow to create our Living Trust For Husband And Wife With No Children in Maryland?

Yes, airSlate SignNow offers a user-friendly, cost-effective solution for creating and electronically signing documents, including your Living Trust For Husband And Wife With No Children in Maryland. With airSlate SignNow, you can easily collaborate with legal experts and ensure that your trust is drafted correctly.

Get more for Living Trust For Husband And Wife With No Children Maryland

- Specialty pharmacy intake form

- Trust agreement sample form

- Whole foods markets store level giving program is dedicated to helping nonprofit organizations in our stores local form

- Plate method a visual tool in diabetes control diabetes form

- 1041 schedule b pdf form

- Hours record form baltimore city public schools baltimorecityschools

- Manulife drug prior authorization form fill out ampamp sign online

- Board observer agreement template form

Find out other Living Trust For Husband And Wife With No Children Maryland

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free