Financial Account Transfer to Living Trust Maryland Form

What is the Financial Account Transfer To Living Trust Maryland

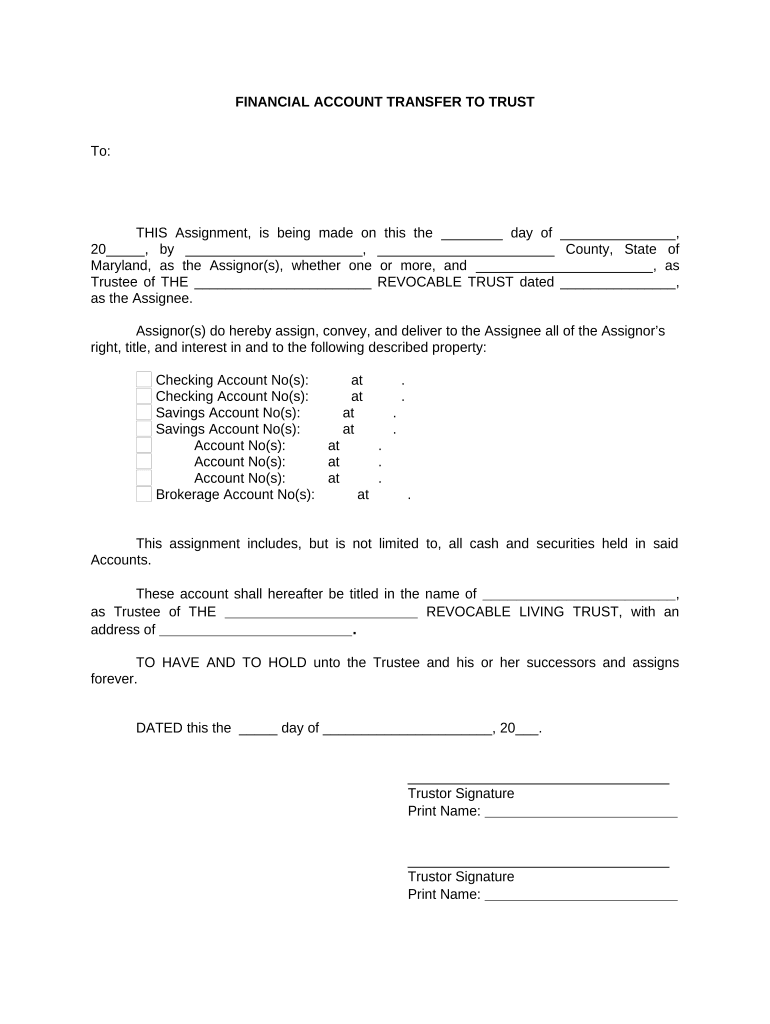

The Financial Account Transfer To Living Trust Maryland form is a legal document that facilitates the transfer of financial assets into a living trust. This process allows individuals to manage their assets during their lifetime and ensures a smooth transition of those assets to beneficiaries upon their passing. A living trust can help avoid probate, maintain privacy, and provide greater control over how assets are distributed. In Maryland, this form must comply with state laws to be considered valid and enforceable.

Steps to complete the Financial Account Transfer To Living Trust Maryland

Completing the Financial Account Transfer To Living Trust Maryland involves several key steps:

- Review your living trust document to ensure it is up to date and accurately reflects your wishes.

- Gather all necessary financial account information, including account numbers and institution details.

- Fill out the Financial Account Transfer To Living Trust Maryland form, ensuring all information is accurate and complete.

- Sign the form in accordance with Maryland state requirements, which may include notarization.

- Submit the completed form to your financial institution to initiate the transfer of assets into the trust.

Legal use of the Financial Account Transfer To Living Trust Maryland

The legal use of the Financial Account Transfer To Living Trust Maryland form is crucial for ensuring that the transfer of assets is recognized by financial institutions and courts. To be legally binding, the form must comply with Maryland state laws regarding trusts and estate planning. This includes proper execution, which may involve notarization and witnessing, depending on the type of assets being transferred. Adhering to these legal requirements helps prevent disputes and ensures that the trust operates as intended.

State-specific rules for the Financial Account Transfer To Living Trust Maryland

Maryland has specific rules governing the creation and transfer of assets into living trusts. These rules include:

- Trust documentation must be properly drafted and executed to be recognized by the state.

- Assets must be clearly identified in the trust document to avoid ambiguity.

- Maryland law may require certain formalities, such as notarization, for the transfer of real estate into a trust.

- Beneficiaries must be named in the trust to ensure proper distribution of assets.

Required Documents

To complete the Financial Account Transfer To Living Trust Maryland, you will need several documents:

- The original living trust document, which outlines the terms and conditions of the trust.

- The Financial Account Transfer To Living Trust Maryland form, filled out and signed.

- Identification documents, such as a driver’s license or passport, to verify your identity.

- Any additional documentation required by your financial institution, which may vary by bank or investment firm.

Examples of using the Financial Account Transfer To Living Trust Maryland

Here are some common scenarios where the Financial Account Transfer To Living Trust Maryland form is utilized:

- A married couple transfers their joint bank accounts into a living trust to ensure seamless management and distribution of assets.

- An individual places their investment accounts into a living trust to avoid probate and maintain privacy regarding their financial affairs.

- A parent transfers a property into a living trust to ensure that their children inherit the asset without going through the probate process.

Quick guide on how to complete financial account transfer to living trust maryland

Complete Financial Account Transfer To Living Trust Maryland effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Financial Account Transfer To Living Trust Maryland on any device with the airSlate SignNow apps for Android or iOS and enhance any document-oriented task today.

The easiest way to adjust and electronically sign Financial Account Transfer To Living Trust Maryland seamlessly

- Obtain Financial Account Transfer To Living Trust Maryland and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Financial Account Transfer To Living Trust Maryland while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust Maryland?

The process for Financial Account Transfer To Living Trust Maryland typically involves documenting your assets and completing the necessary forms. You may need to contact your financial institutions to initiate the transfer, providing them with the trust documents. It's advisable to consult with a legal professional to ensure compliance with Maryland laws.

-

What are the benefits of Financial Account Transfer To Living Trust Maryland?

Transferring financial accounts to a living trust in Maryland can help avoid probate, provide more control over asset distribution, and offer privacy regarding your financial matters. Additionally, it ensures a smoother transition of your financial affairs in case of incapacity or death. These benefits make Financial Account Transfer To Living Trust Maryland a preferred choice for many.

-

Are there fees associated with Financial Account Transfer To Living Trust Maryland?

Yes, there may be fees associated with the Financial Account Transfer To Living Trust Maryland, including attorney fees, filing fees, and potential costs from financial institutions. It's essential to review these potential expenses with a professional to understand the total cost involved. Many find that the long-term savings on probate fees justify the initial costs.

-

Can I use airSlate SignNow for Financial Account Transfer To Living Trust Maryland?

Absolutely! airSlate SignNow provides an efficient platform for managing the documents required for Financial Account Transfer To Living Trust Maryland. You can easily create, send, and eSign necessary documents, which streamlines the process signNowly and saves time. It's an ideal solution for easily managing your estate planning paperwork.

-

What documents are needed for Financial Account Transfer To Living Trust Maryland?

You'll typically need the trust document, asset statements, and possibly a Certificate of Trust for Financial Account Transfer To Living Trust Maryland. Depending on the financial institution, additional paperwork may be required. Ensuring that you have all necessary documents can expedite the transfer process.

-

How long does the Financial Account Transfer To Living Trust Maryland take?

The timeline for Financial Account Transfer To Living Trust Maryland can vary depending on the complexity of your assets and the financial institutions involved. Generally, once forms are submitted, it can take a few weeks for processing. Working with a legal professional can help speed up the process by ensuring everything is completed correctly.

-

Will I still have access to my accounts after the Financial Account Transfer To Living Trust Maryland?

Yes, you will maintain access to your accounts after completing the Financial Account Transfer To Living Trust Maryland. The transfer does not change your ability to manage or access your assets during your lifetime. The living trust is a tool designed to facilitate asset management without disrupting your control over your finances.

Get more for Financial Account Transfer To Living Trust Maryland

- Isef forms

- Sample contract for nps in primary care setting napnap career form

- Weekly staff supervision form

- Eastern shawnee tribe of oklahoma forms

- Reiwa forms printable 490885910

- The difference between fair market value and fair value business form

- Boat purchase and sale agreement template form

- Boat sale agreement template form

Find out other Financial Account Transfer To Living Trust Maryland

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample