Retained Earning on Income Stetement Form

What is the Retained Earning On Income Statement

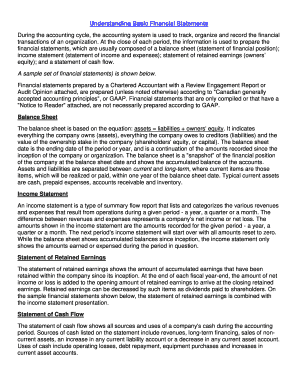

The retained earning on income statement reflects the cumulative amount of net income that a company retains, rather than distributing it as dividends to shareholders. This figure is crucial for understanding a company's financial health and its ability to reinvest in the business. It is typically found in the equity section of the balance sheet and is derived from the net income reported on the income statement. The retained earnings can be influenced by various factors, including profitability, dividend policies, and overall business strategy.

How to Use the Retained Earning On Income Statement

Utilizing the retained earning on income statement involves analyzing how much profit a company has retained over time. This analysis can help stakeholders assess the company's growth potential and financial stability. Investors often look at retained earnings to determine how effectively a company is reinvesting its profits. Additionally, businesses may use this information to make strategic decisions regarding future investments or dividend distributions.

Steps to Complete the Retained Earning On Income Statement

Completing the retained earning on income statement involves several key steps:

- Start with the previous period's retained earnings balance.

- Add the net income from the current period, as reported on the income statement.

- Subtract any dividends paid to shareholders during the period.

- The resulting figure is the retained earnings balance for the current period.

This process ensures that the retained earnings accurately reflect the company's financial performance and decisions regarding profit allocation.

Key Elements of the Retained Earning On Income Statement

Several key elements define the retained earning on income statement:

- Net Income: The profit earned during the period, which contributes to retained earnings.

- Dividends: Any distributions made to shareholders that reduce retained earnings.

- Previous Retained Earnings: The starting point for calculating the current period's retained earnings.

- Current Retained Earnings: The final figure that indicates the total retained earnings at the end of the period.

Legal Use of the Retained Earning On Income Statement

The retained earning on income statement is legally significant for businesses as it provides transparency regarding profit allocation. Accurate reporting of retained earnings is essential for compliance with financial reporting standards and regulations. Companies must ensure that their financial statements, including the retained earnings section, are prepared in accordance with Generally Accepted Accounting Principles (GAAP) to avoid legal repercussions and maintain investor trust.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how retained earnings should be reported for tax purposes. While retained earnings themselves are not taxed, the net income that contributes to retained earnings is subject to taxation. Companies must accurately report their net income on their tax returns, which ultimately affects the retained earnings reflected in their financial statements. Adhering to IRS guidelines ensures compliance and helps avoid potential audits or penalties.

Quick guide on how to complete retained earning on income stetement

Effortlessly Prepare Retained Earning On Income Stetement on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Retained Earning On Income Stetement on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-centric operation today.

How to Alter and eSign Retained Earning On Income Stetement with Ease

- Obtain Retained Earning On Income Stetement and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select signNow sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the details and then click the Done button to preserve your changes.

- Decide how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious search for forms, or errors that require printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Retained Earning On Income Stetement and ensure top-notch communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retained earning on income stetement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is retained earning on income statement?

Retained earning on income statement refers to the portion of a company's net income that is retained rather than distributed as dividends. This figure reflects how much profit is reinvested into the business over time, contributing to growth and financial stability.

-

How does airSlate SignNow help with managing retained earnings?

With airSlate SignNow, you can easily send and eSign financial documents, including income statements that detail retained earning. This streamlines the process of tracking financial performance and ensures that your documents are handled securely and efficiently.

-

What features does airSlate SignNow offer for financial documentation?

AirSlate SignNow offers a variety of features for managing financial documents, such as customizable templates and automated workflow processes. This allows you to create and manage documents that accurately reflect retained earning on income statement and other critical financial data.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Its cost-effective solution helps small businesses effectively manage their documents including those related to retained earning on income statement without overspending on software.

-

How can I integrate airSlate SignNow with existing accounting software?

AirSlate SignNow provides seamless integrations with popular accounting software, allowing you to automate the flow of information. This integration helps in ensuring that retained earning on income statement is accurately updated in your financial records.

-

Can I track changes in retained earnings using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to track all changes made to your documents, including those detailing retained earning on income statement. This feature is crucial for maintaining transparency and accuracy in your financial reporting.

-

What are the benefits of using airSlate SignNow for financial documents?

Using airSlate SignNow enhances efficiency by simplifying document management related to retained earning on income statement. It ensures secure and fast eSigning and allows multiple parties to collaborate, which saves time and reduces errors.

Get more for Retained Earning On Income Stetement

- 735 6776 farm endorsement application form

- Form 735 7266 state of oregon

- Meur reports oregon form

- A farm endorsement on a regular class c driver license allows operation of vehicles which are form

- Real id faqslinks to state by state guides dmvorg form

- State of montana montana department of transportation driveway approach application permit form

- Driving record montana form

- Pdf release of driving records personal info express consent forms

Find out other Retained Earning On Income Stetement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement