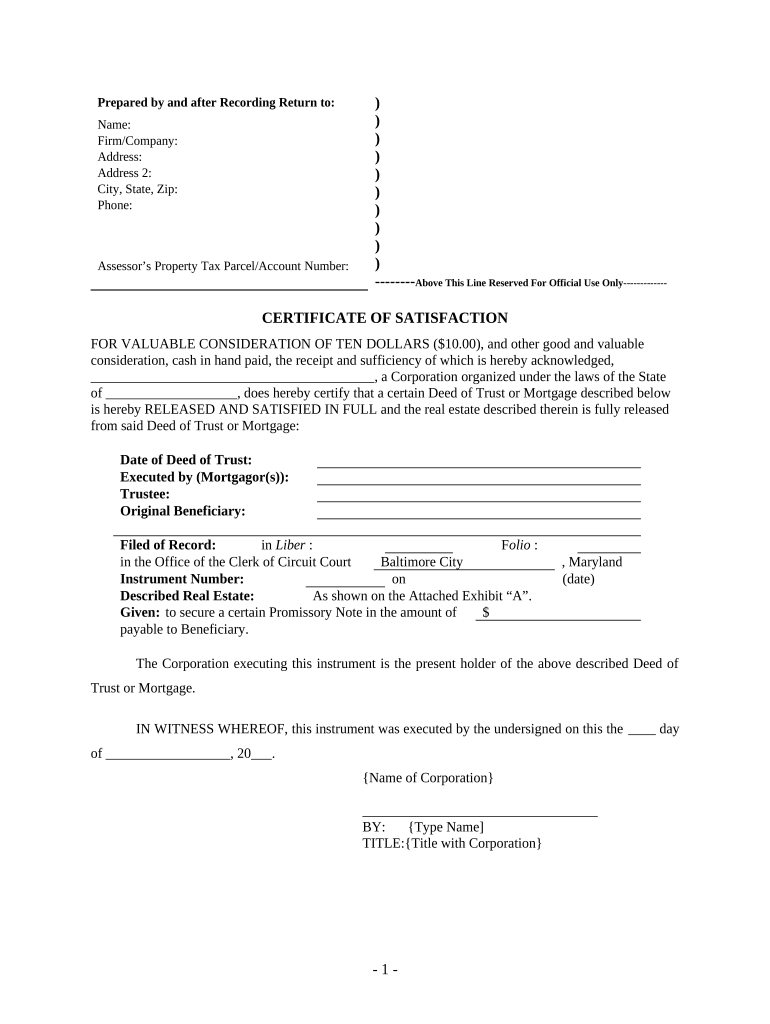

Md Cancellation Form

What is the Maryland Deed Trust?

The Maryland deed trust is a legal document used to establish a trust in which property is held for the benefit of designated beneficiaries. This type of trust allows the grantor to transfer ownership of real estate while retaining certain rights, such as the ability to manage the property. The deed trust can be particularly useful for estate planning, as it helps avoid probate and can provide tax benefits. In Maryland, the specifics of a deed trust are governed by state laws, ensuring that the rights and responsibilities of all parties involved are clearly defined.

Key Elements of the Maryland Deed Trust

A Maryland deed trust typically includes several essential components:

- Grantor: The individual who creates the trust and transfers property into it.

- Trustee: The person or entity responsible for managing the trust assets according to the terms set forth in the trust document.

- Beneficiaries: Individuals or entities that receive benefits from the trust, such as income generated from the property or the property itself upon the grantor's death.

- Trust terms: Specific instructions regarding how the trust assets should be managed, distributed, and any conditions that must be met by the beneficiaries.

Steps to Complete the Maryland Deed Trust

Completing a Maryland deed trust involves several important steps:

- Consult a legal professional: It is advisable to seek guidance from an attorney experienced in estate planning to ensure compliance with Maryland laws.

- Draft the trust document: Clearly outline the roles of the grantor, trustee, and beneficiaries, as well as the terms of the trust.

- Transfer property: Execute a deed transferring the property into the trust, which must be recorded with the local land records office.

- Sign and notarize: Ensure that all parties involved sign the trust document in the presence of a notary public to validate its legality.

Legal Use of the Maryland Deed Trust

The legal use of a Maryland deed trust provides several advantages. It allows for the efficient management of assets, ensures that property is distributed according to the grantor's wishes, and can help minimize estate taxes. Additionally, because the trust holds the property, it may help protect assets from creditors. It is important to follow Maryland's specific legal requirements when creating and executing a deed trust to ensure its enforceability.

State-Specific Rules for the Maryland Deed Trust

Maryland has unique regulations governing deed trusts. These include requirements for the trust document's content, the necessity of recording the deed with the local land records office, and specific tax implications. Understanding these state-specific rules is crucial for ensuring that the deed trust is valid and legally binding. Consulting with a legal expert familiar with Maryland law can help navigate these regulations effectively.

Quick guide on how to complete md cancellation 497310593

Prepare Md Cancellation effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly and without delays. Manage Md Cancellation on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Md Cancellation with ease

- Obtain Md Cancellation and click on Get Form to initiate.

- Use the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign Md Cancellation and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Maryland deed trust?

A Maryland deed trust is a legal agreement that allows you to designate a trust to hold the title of your property, while ensuring that a beneficiary receives its benefits. This type of arrangement can help streamline estate planning and asset management. It's crucial to understand how a Maryland deed trust works to ensure it meets your financial and legal objectives.

-

How does airSlate SignNow assist with Maryland deed trust documents?

airSlate SignNow provides tools to easily create, send, and eSign Maryland deed trust documents securely. With our user-friendly platform, you can generate templates for your deeds, making the process efficient and straightforward. Additionally, you can store these documents in a secure cloud environment, ensuring they are accessible whenever needed.

-

What are the benefits of using a Maryland deed trust?

Utilizing a Maryland deed trust can provide various benefits, such as avoiding probate, achieving privacy, and simplifying the transfer of assets. Moreover, it can also help in managing the property during the grantor's lifetime and after their passing. Understanding these advantages can help you make an informed decision about your estate planning needs.

-

Is airSlate SignNow a cost-effective solution for managing a Maryland deed trust?

Yes, airSlate SignNow offers a cost-effective solution for managing Maryland deed trust documentation. Our competitive pricing plans allow you to save on traditional notarization and mailing costs. Plus, with unlimited document signing capabilities, you can maximize your resources without exceeding your budget.

-

Can I integrate airSlate SignNow with other tools for managing my Maryland deed trust?

Absolutely! airSlate SignNow supports various integrations with popular applications, enhancing your workflow for managing your Maryland deed trust. Whether you're using CRM, accounting, or project management software, our seamless integrations allow for a comprehensive management approach.

-

What features does airSlate SignNow offer for Maryland deed trust management?

airSlate SignNow offers an array of features for managing Maryland deed trust documents, including customizable templates, advanced eSigning options, and real-time tracking. These features streamline document management and ensure compliance with legal requirements. Our platform is designed to empower users with efficient and effective document processes.

-

How can airSlate SignNow improve the speed of processing Maryland deed trust transactions?

By utilizing airSlate SignNow, you can signNowly improve the speed of processing Maryland deed trust transactions through our electronic signing capabilities. This eliminates the need for in-person meetings and paper-based processes, allowing documents to be signed and sent in minutes. Faster transactions mean more time to focus on what matters most.

Get more for Md Cancellation

Find out other Md Cancellation

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online