Financing Statement Amendment Form

What is the Financing Statement Amendment

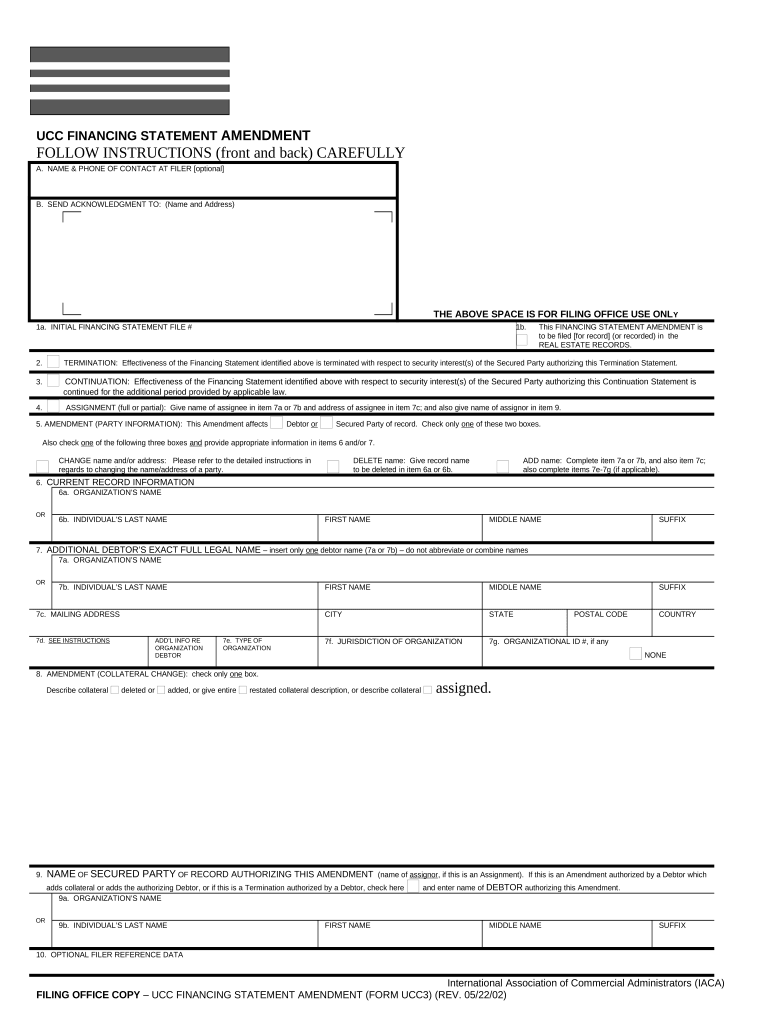

The financing statement amendment is a legal document used to modify an existing financing statement, typically filed under the Uniform Commercial Code (UCC). This amendment is essential for updating information regarding secured transactions, such as changes in the debtor's name, the secured party's details, or the collateral description. It ensures that the public record accurately reflects the current status of the security interest, which is crucial for both creditors and debtors in maintaining their rights and obligations.

Steps to complete the Financing Statement Amendment

Completing the financing statement amendment involves several key steps to ensure accuracy and compliance. First, gather the necessary information, including the original financing statement details and the specific changes required. Next, fill out the amendment form, ensuring that all fields are completed correctly. It is important to provide the UCC filing number from the original statement, as this links the amendment to the correct record. After completing the form, review it for any errors before proceeding to submit it for filing.

Legal use of the Financing Statement Amendment

The legal use of the financing statement amendment is governed by UCC regulations, which vary by state. This document must be filed with the appropriate state authority to be effective. The amendment serves to protect the interests of secured parties by ensuring that any changes to the security interest are officially recorded. Failure to file the amendment can result in the loss of priority over other creditors, making it vital for parties involved in secured transactions to understand the legal implications of this document.

State-specific rules for the Financing Statement Amendment

Each state has its own rules and procedures regarding the filing of financing statement amendments. These rules dictate where the amendment must be filed, the required fees, and any specific forms that must be used. It is important for individuals and businesses to familiarize themselves with their state's regulations to ensure compliance. Some states may have additional requirements, such as notarization or specific formatting, which can affect the validity of the amendment.

Form Submission Methods (Online / Mail / In-Person)

Submitting the financing statement amendment can be done through various methods, including online, by mail, or in person. Many states offer online filing options, which provide a convenient way to submit documents quickly. Alternatively, amendments can be mailed to the appropriate state office, but this method may take longer for processing. In-person submissions are also an option, allowing for immediate confirmation of filing. Each method has its own advantages, and the choice may depend on urgency and the specific requirements of the state.

Key elements of the Financing Statement Amendment

Key elements of the financing statement amendment include the original UCC filing number, the names and addresses of the debtor and secured party, and a detailed description of the changes being made. It is crucial to ensure that all information is accurate and complete, as any discrepancies can lead to delays or rejections. Additionally, the amendment should specify whether it is adding or removing collateral or changing the debtor's name, as these distinctions impact the legal standing of the secured interest.

Examples of using the Financing Statement Amendment

Examples of using the financing statement amendment include situations where a business changes its legal name or when additional collateral is added to an existing security interest. For instance, if a company acquires new equipment and wants to secure it under the same financing agreement, an amendment would be necessary to include this new collateral. Another example is when a debtor undergoes a merger or acquisition, which may require updating the financing statement to reflect the new entity's name and structure.

Quick guide on how to complete financing statement amendment 497310612

Effortlessly Prepare Financing Statement Amendment on Any Device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Financing Statement Amendment on any platform using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and Electronically Sign Financing Statement Amendment with Ease

- Locate Financing Statement Amendment and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing fresh document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Financing Statement Amendment and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Maryland financing statement?

A Maryland financing statement is a legal document used to record a secured transaction between a lender and borrower. It helps establish the lender's interest in the borrower's collateral. This statement is crucial for protecting the lender's rights and ensuring the proper handling of assets.

-

How can airSlate SignNow assist with Maryland financing statements?

airSlate SignNow simplifies the process of creating and signing Maryland financing statements. It offers a user-friendly interface that allows businesses to upload, edit, and eSign documents efficiently. This ensures a smooth transaction and compliance with legal requirements.

-

What are the pricing options for using airSlate SignNow for Maryland financing statements?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Plans include features specifically designed for managing documents like Maryland financing statements. By choosing airSlate SignNow, you can ensure a cost-effective solution for all your eSigning needs.

-

Are there any specific features that aid in managing Maryland financing statements?

Yes, airSlate SignNow provides features such as templates, document sharing, and comprehensive tracking for Maryland financing statements. These tools streamline the workflow of creating and managing these documents, ensuring that all necessary steps are followed efficiently.

-

Can I integrate airSlate SignNow with other software for managing Maryland financing statements?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms. This allows you to connect your existing systems and enhance your document workflows related to Maryland financing statements, making the process even more efficient.

-

What benefits does using airSlate SignNow provide for Maryland financing statements?

Using airSlate SignNow for Maryland financing statements enhances the speed and accuracy of document processing. It allows for quick eSignatures and real-time collaboration, minimizing the chances of errors. This ultimately leads to faster transaction times and improved business operations.

-

Is the eSigning process legally binding for Maryland financing statements?

Yes, the eSigning process through airSlate SignNow is legally binding. Maryland complies with the Electronic Signatures in Global and National Commerce Act (E-Sign Act), ensuring that eSigned Maryland financing statements hold the same legal validity as traditional handwritten signatures.

Get more for Financing Statement Amendment

- College student information form

- Delivery log sheet form

- Mext medical certificate form

- Cookie booth etiquette 210855967 form

- Ged duplicate diploma request motlow state community college mscc form

- Credit card authorization form 100059626

- Campus formsassessment office

- Microsoft enterprise agreement program signature form

Find out other Financing Statement Amendment

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template