Dissolve Corporation Form

What is the Dissolve Corporation

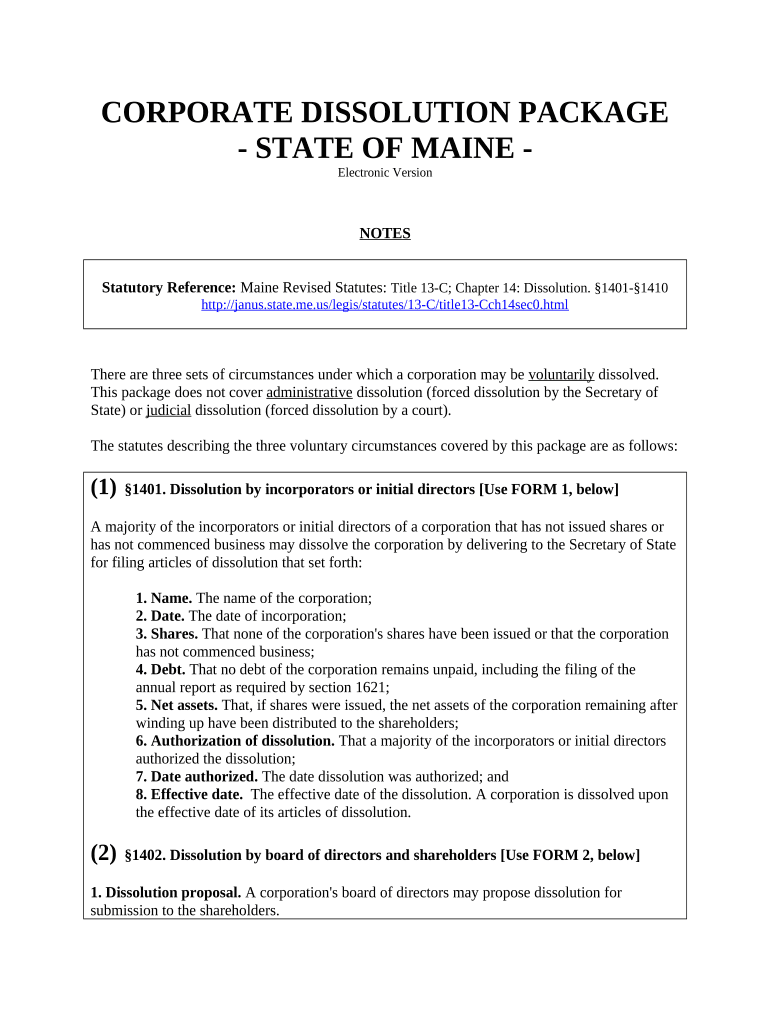

The dissolve corporation form is a legal document used to officially terminate a corporation's existence in the state of Maine. This process involves notifying the state and ensuring that all financial obligations are settled. By completing this form, a corporation can formally cease operations and avoid ongoing fees and taxes associated with maintaining its status. Understanding the implications of dissolution is crucial, as it affects the corporation's legal standing and responsibilities.

Steps to Complete the Dissolve Corporation

Completing the dissolve corporation form involves several key steps to ensure compliance with state regulations. First, gather all necessary information about the corporation, including its legal name, business identification number, and the reason for dissolution. Next, ensure that all debts and obligations are settled, as outstanding liabilities can complicate the process. After preparing the required information, fill out the dissolve corporation form accurately and completely. Finally, submit the form to the appropriate state office, either online or via mail, and retain a copy for your records.

Legal Use of the Dissolve Corporation

The legal use of the dissolve corporation form is vital for ensuring that the dissolution process is recognized by the state. This form serves as a formal declaration that the corporation is no longer conducting business and intends to terminate its legal existence. It is essential to comply with all state laws regarding dissolution to avoid potential legal repercussions. Proper use of the form protects the interests of shareholders and creditors, ensuring that all parties are informed of the corporation's status.

State-Specific Rules for the Dissolve Corporation

Maine has specific rules governing the dissolution of corporations that must be followed to ensure a smooth process. These rules may include requirements for notifying creditors, filing final tax returns, and obtaining necessary approvals from shareholders. It is important to familiarize yourself with Maine's regulations regarding the dissolution process, as non-compliance can result in penalties or delays. Consulting with a legal professional can provide valuable guidance in navigating these state-specific requirements.

Required Documents

To complete the dissolve corporation form in Maine, several documents may be required. These typically include the completed dissolution form, a resolution from the board of directors or shareholders approving the dissolution, and any final tax returns or clearance certificates from the state tax authority. Gathering these documents in advance can streamline the process and help ensure that all necessary information is submitted correctly.

Form Submission Methods

The dissolve corporation form can be submitted through various methods in Maine, including online submission, mailing the form to the appropriate state office, or delivering it in person. Each method has its own advantages, such as convenience or the ability to receive immediate confirmation of submission. It is essential to choose the method that best fits your needs while ensuring compliance with state regulations.

Penalties for Non-Compliance

Failing to properly complete and submit the dissolve corporation form can result in significant penalties in Maine. These may include ongoing tax liabilities, fines, and potential legal actions from creditors. Non-compliance can also complicate the dissolution process, leading to delays and additional costs. Therefore, it is crucial to adhere to all requirements and timelines associated with the dissolution to avoid these consequences.

Quick guide on how to complete dissolve corporation

Complete Dissolve Corporation effortlessly on any device

Digital document management has gained widespread acceptance among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Handle Dissolve Corporation on any system using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Dissolve Corporation seamlessly

- Obtain Dissolve Corporation and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important parts of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Dissolve Corporation and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Maine dissolution and why is it important?

Maine dissolution is the legal process through which a corporation is officially dissolved in the state of Maine. This process is important as it ensures that the business no longer has legal obligations or liabilities, protecting the owners from future legal complications. Utilizing airSlate SignNow during Maine dissolution can simplify document signing and approval, making the process more efficient.

-

How much does it cost to dissolve a corporation in Maine?

The cost to dissolve a corporation in Maine varies based on specific fees required by the state for filing dissolution documents. Additionally, using airSlate SignNow can save on administrative costs by simplifying the eSignature process, allowing you to focus your resources on completing your Maine dissolution effectively.

-

What documents do I need for Maine dissolution?

For Maine dissolution, you typically need to file a Certificate of Dissolution with the Secretary of State, along with any associated fees. airSlate SignNow can help streamline the gathering and signing of these documents, ensuring that you have everything ready for a smooth Maine dissolution process.

-

Can I dissolve my business online in Maine?

Yes, Maine allows businesses to initiate the dissolution process online. By using airSlate SignNow, you can conveniently upload, sign, and submit your dissolution documents electronically, making the Maine dissolution process faster and more accessible.

-

What features does airSlate SignNow offer for Maine dissolution?

airSlate SignNow offers intuitive eSignature features, document templates, and workflow automation that are particularly beneficial for Maine dissolution. These features ensure that your documents are signed quickly and efficiently, reducing paperwork and streamlining your dissolution process.

-

Are there any benefits to using airSlate SignNow for Maine dissolution?

Using airSlate SignNow for your Maine dissolution offers multiple benefits, including time savings, reduced paperwork, and enhanced compliance with state regulations. The platform's ease of use makes it simple to manage all your dissolution documents digitally, allowing for a more organized and efficient process.

-

Can airSlate SignNow integrate with other business tools for Maine dissolution?

Yes, airSlate SignNow seamlessly integrates with various business tools and platforms, enhancing your workflow during Maine dissolution. This capability ensures that you can manage all necessary documents and communications from a single dashboard, making your dissolution process even smoother.

Get more for Dissolve Corporation

Find out other Dissolve Corporation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation