Assumption Agreement of Mortgage and Release of Original Mortgagors Maine Form

What is the Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

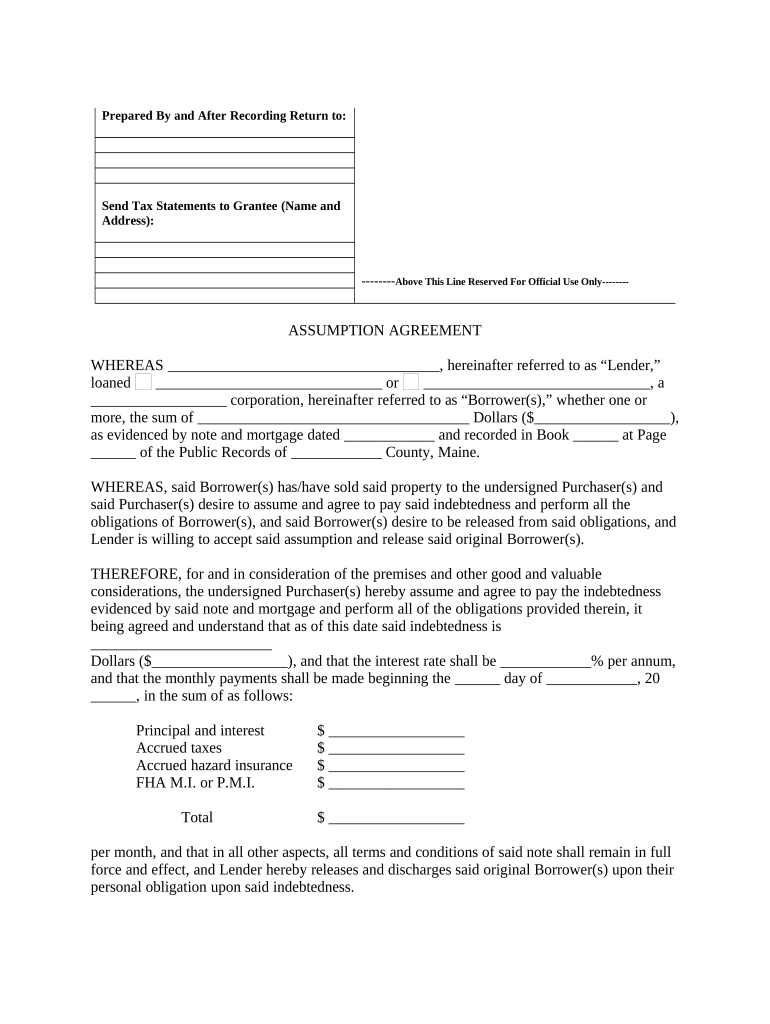

The Assumption Agreement of Mortgage and Release of Original Mortgagors in Maine is a legal document that allows a new borrower to assume the mortgage obligations of the original borrower. This agreement typically includes the release of the original mortgagors from their obligations under the mortgage, transferring responsibility to the new borrower. This form is essential in real estate transactions where a buyer takes over an existing mortgage rather than obtaining a new one. Understanding its components and implications is crucial for both buyers and sellers involved in such transactions.

Key elements of the Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

This agreement generally includes several key elements: the identification of the original mortgagors and the new borrower, the details of the mortgage being assumed, and the terms under which the assumption is made. Additionally, it outlines the release of the original mortgagors from liability, ensuring that they are no longer responsible for the mortgage payments. Other important components may include any conditions that the new borrower must meet, such as creditworthiness or financial stability, to complete the assumption process.

Steps to complete the Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

Completing the Assumption Agreement of Mortgage and Release of Original Mortgagors involves several steps:

- Gather necessary information about the mortgage, including the loan number and payment details.

- Obtain consent from the lender, as most mortgages require lender approval for assumptions.

- Fill out the assumption agreement form accurately, providing all required details about the parties involved.

- Review the terms of the agreement to ensure mutual understanding and compliance.

- Sign the document in the presence of a notary public, if required.

- Submit the completed form to the lender for final approval.

Legal use of the Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

The legal use of the Assumption Agreement of Mortgage and Release of Original Mortgagors is governed by state laws in Maine. This document must comply with all relevant legal requirements to be enforceable. It is important for all parties to understand their rights and obligations under this agreement. Consulting with a legal professional can help ensure that the document is properly executed and that all legal standards are met, protecting the interests of both the original and new mortgagors.

How to obtain the Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

To obtain the Assumption Agreement of Mortgage and Release of Original Mortgagors in Maine, interested parties can typically acquire the form through the lender or financial institution that holds the mortgage. Many lenders provide these forms online, allowing for easy access and completion. Additionally, legal professionals or real estate agents may offer assistance in obtaining and filling out the necessary documents, ensuring compliance with state regulations.

State-specific rules for the Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

Maine has specific rules governing the assumption of mortgages that must be adhered to when using the Assumption Agreement. These rules may include requirements for lender approval, specific disclosures that must be made to the new borrower, and any state-specific regulations regarding real estate transactions. It is essential for both parties to be aware of these rules to ensure that the assumption process is conducted legally and smoothly.

Quick guide on how to complete assumption agreement of mortgage and release of original mortgagors maine

Complete Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without issues. Handle Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine effortlessly

- Obtain Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine?

An Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine is a legal document that allows a new borrower to assume responsibility for an existing mortgage while releasing the original mortgagors from their obligations. This agreement is important in real estate transactions, ensuring clear terms and conditions for both parties involved.

-

How does airSlate SignNow simplify the process of creating an Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine?

airSlate SignNow offers an intuitive platform that allows users to create, send, and eSign an Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine quickly and efficiently. With easy-to-use templates and customizable options, users can ensure their documents meet legal standards without having to deal with complicated formatting.

-

What are the pricing options for airSlate SignNow when dealing with Assumption Agreements?

airSlate SignNow provides flexible pricing plans to suit different business needs, including those that require Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine. Customers can choose plans based on their usage requirements, and the cost is highly competitive, especially for businesses handling multiple documents regularly.

-

Are there any integrations available with airSlate SignNow for managing mortgages?

Yes, airSlate SignNow seamlessly integrates with various platforms and tools, enabling efficient management of Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine. These integrations help streamline workflows, making it easier for users to access data and collaborate with team members during the document preparation and signing process.

-

What are the key benefits of using airSlate SignNow for Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine?

Using airSlate SignNow for your Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine offers multiple benefits, including enhanced security, reduced turnaround times, and improved client satisfaction. The platform ensures that your documents are legally binding and secure, making it a trusted choice for many businesses.

-

Can airSlate SignNow help ensure compliance with Maine laws regarding mortgage assumptions?

Absolutely! airSlate SignNow is designed to assist users in creating compliant Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine. The platform provides up-to-date legal templates and guidance to ensure that all documents meet state-specific regulations and requirements.

-

How quickly can I get my Assumption Agreement Of Mortgage And Release Of Original Mortgagors signed using airSlate SignNow?

With airSlate SignNow, you can send your Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Maine for eSigning and receive signed copies back within minutes. The platform's efficient notification system keeps all signers informed, helping expedite the process signNowly compared to traditional methods.

Get more for Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

Find out other Assumption Agreement Of Mortgage And Release Of Original Mortgagors Maine

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online