Quitclaim Deed from Corporation to LLC Michigan Form

What is the Quitclaim Deed From Corporation To LLC Michigan

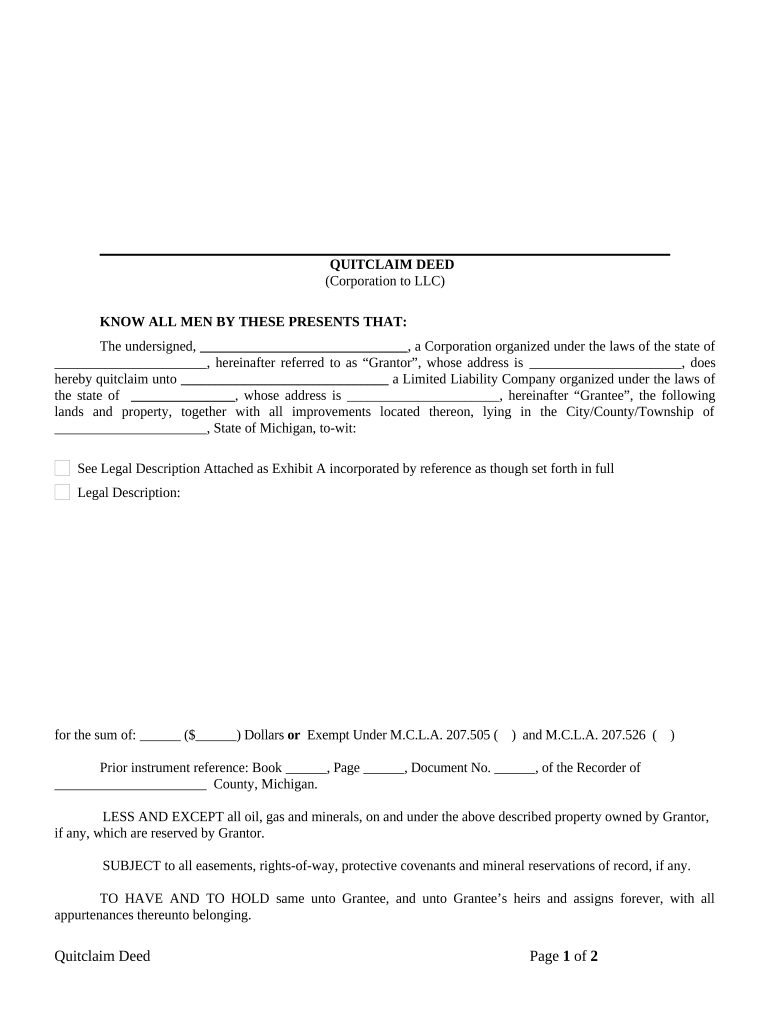

A quitclaim deed from a corporation to an LLC in Michigan is a legal document used to transfer ownership of real property from a corporate entity to a limited liability company (LLC). This type of deed does not guarantee that the title is free of claims; rather, it conveys whatever interest the corporation holds in the property at the time of transfer. The quitclaim deed serves as a straightforward method for changing the ownership structure of the property, often utilized for internal business reorganizations or asset management purposes.

Steps to Complete the Quitclaim Deed From Corporation To LLC Michigan

Completing a quitclaim deed from a corporation to an LLC in Michigan involves several key steps:

- Identify the parties involved: Ensure that the corporation and LLC are correctly named in the deed.

- Describe the property: Provide a clear legal description of the property being transferred, including parcel numbers and addresses.

- Draft the deed: Use a standard quitclaim deed format, ensuring all necessary details are included.

- Sign the deed: The authorized representative of the corporation must sign the deed in the presence of a notary public.

- File the deed: Submit the completed quitclaim deed to the local county register of deeds to make the transfer official.

Key Elements of the Quitclaim Deed From Corporation To LLC Michigan

Several key elements must be included in a quitclaim deed from a corporation to an LLC in Michigan to ensure its validity:

- Grantor and Grantee Information: Clearly state the names and addresses of both the corporation (grantor) and the LLC (grantee).

- Property Description: Include a detailed legal description of the property being transferred.

- Consideration: Indicate any consideration exchanged for the property, even if it is nominal.

- Execution: The deed must be signed by an authorized representative of the corporation and notarized.

- Recording Information: Provide information on where the deed will be recorded, typically at the county register of deeds.

Legal Use of the Quitclaim Deed From Corporation To LLC Michigan

The quitclaim deed from a corporation to an LLC is legally recognized in Michigan as a valid means of transferring property ownership. It is particularly useful for businesses looking to streamline their asset management or reorganize their ownership structure. However, it is important to note that this type of deed does not provide warranties or guarantees regarding the title, which means that the grantee assumes the risk of any existing claims or encumbrances on the property.

State-Specific Rules for the Quitclaim Deed From Corporation To LLC Michigan

In Michigan, specific rules govern the execution and recording of quitclaim deeds. These include:

- The deed must be signed by an authorized representative of the corporation.

- It must be notarized to ensure authenticity.

- Filing the deed with the local county register of deeds is mandatory to complete the transfer.

- Michigan law requires that the property description be accurate and detailed to avoid disputes.

How to Obtain the Quitclaim Deed From Corporation To LLC Michigan

Obtaining a quitclaim deed from a corporation to an LLC in Michigan can be done through several methods. You can either draft the deed using templates available online or consult with a legal professional to ensure compliance with state laws. Many counties also provide forms that can be used for this purpose. Once the deed is prepared, it must be signed, notarized, and filed with the appropriate county office to be legally effective.

Quick guide on how to complete quitclaim deed from corporation to llc michigan

Complete Quitclaim Deed From Corporation To LLC Michigan seamlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without issues. Manage Quitclaim Deed From Corporation To LLC Michigan on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Quitclaim Deed From Corporation To LLC Michigan effortlessly

- Obtain Quitclaim Deed From Corporation To LLC Michigan and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Quitclaim Deed From Corporation To LLC Michigan and guarantee exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To LLC Michigan?

A Quitclaim Deed From Corporation To LLC Michigan is a legal document that transfers ownership of property from a corporation to a limited liability company (LLC) in Michigan. This type of deed is often used to simplify and clarify property transactions between entities, ensuring a smooth transfer of assets.

-

How do I create a Quitclaim Deed From Corporation To LLC Michigan?

Creating a Quitclaim Deed From Corporation To LLC Michigan typically involves drafting the deed using specific language that complies with Michigan legal requirements. You can utilize airSlate SignNow’s easy-to-use platform to create and eSign these documents quickly and efficiently to ensure all necessary fields are accurately filled.

-

What are the benefits of using a Quitclaim Deed From Corporation To LLC Michigan?

The primary benefits of using a Quitclaim Deed From Corporation To LLC Michigan include reduced complexity in property transfers and avoidance of excessive taxation during the transaction. This deed allows for a quick transfer of rights, which can be essential for businesses looking to streamline operations.

-

Is there a cost associated with filing a Quitclaim Deed From Corporation To LLC Michigan?

Yes, there may be fees associated with filing a Quitclaim Deed From Corporation To LLC Michigan at your local county clerk's office. Additionally, using airSlate SignNow provides an affordable subscription model that can help manage the cost of preparing and eSigning documents seamlessly.

-

Can I eSign a Quitclaim Deed From Corporation To LLC Michigan on airSlate SignNow?

Absolutely! airSlate SignNow allows you to eSign a Quitclaim Deed From Corporation To LLC Michigan securely and legally. Its user-friendly interface and electronic signature features comply with Michigan's e-signature laws, making the signing process efficient and reliable.

-

Are there any special considerations for a Quitclaim Deed From Corporation To LLC Michigan?

When preparing a Quitclaim Deed From Corporation To LLC Michigan, it's important to accurately describe the property being transferred and identify both parties clearly. Ensure that the deed is executed properly to avoid any future disputes, and consider consulting with a legal professional for assistance.

-

What integrations does airSlate SignNow offer for managing Quitclaim Deeds?

airSlate SignNow integrates with various applications, including Google Drive, Dropbox, and other cloud storage services, making it easy to manage your Quitclaim Deed From Corporation To LLC Michigan documents in one place. These integrations enhance efficiency and ensure all documents are readily accessible.

Get more for Quitclaim Deed From Corporation To LLC Michigan

Find out other Quitclaim Deed From Corporation To LLC Michigan

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship