Maine Revenue Services MRS Maine Income T 2024-2026

What is the Maine Revenue Services “MRS” Maine Income Tax?

The Maine Revenue Services “MRS” Maine Income Tax is a state tax that residents of Maine must file annually to report their income and calculate their tax liability. This form is essential for individuals earning income within the state, including wages, self-employment earnings, and other forms of taxable income. The tax is based on a progressive rate structure, meaning that tax rates increase as income levels rise. Understanding the specifics of this tax is crucial for compliance and financial planning.

Steps to complete the Maine Revenue Services “MRS” Maine Income Tax

Completing the Maine Income Tax form involves several key steps to ensure accurate reporting and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status, as this will affect your tax rates and deductions. Calculate your total income and allowable deductions, then apply the appropriate tax rates to determine your liability. Finally, review your completed form for accuracy before submission.

How to obtain the Maine Revenue Services “MRS” Maine Income Tax

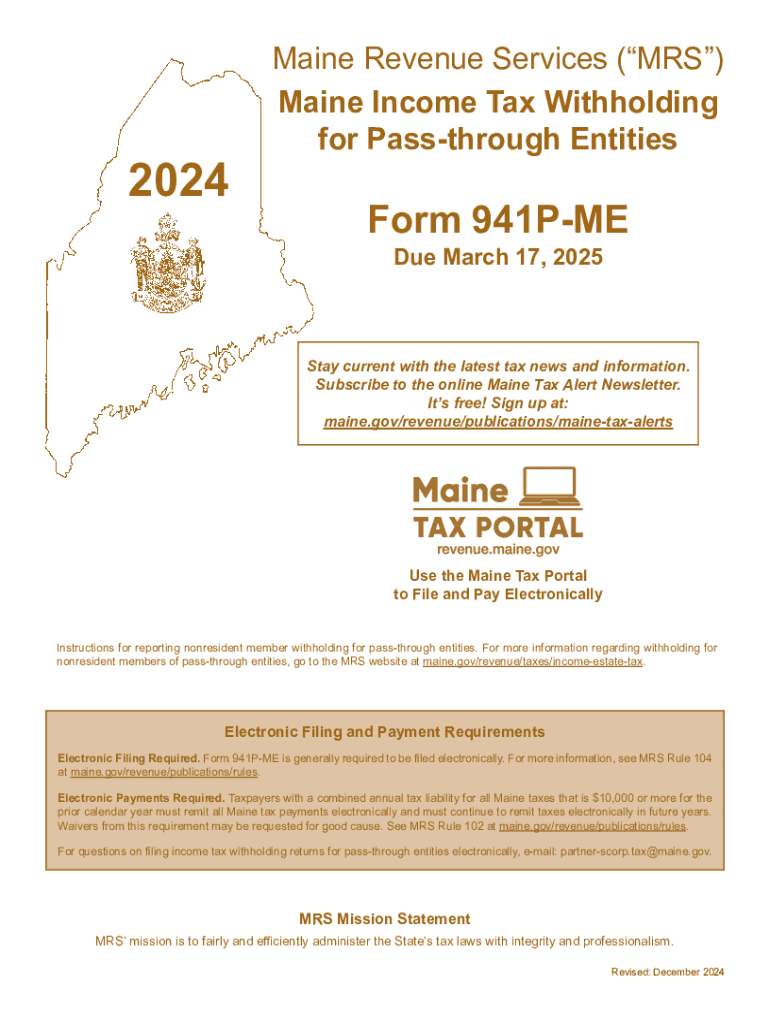

The Maine Revenue Services “MRS” Maine Income Tax form can be obtained directly from the Maine Revenue Services website. The form is available in a downloadable PDF format, which can be printed and completed by hand. Additionally, many tax preparation software programs include this form, allowing for electronic completion and submission. It is important to ensure that you are using the most current version of the form to avoid any issues with filing.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Income Tax typically align with federal tax deadlines. Generally, individual taxpayers must file their returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific deadlines for estimated tax payments, which are usually due quarterly. Keeping track of these dates is essential to avoid penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Maine Income Tax form, several documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation for deductions, such as mortgage interest statements, property tax receipts, and medical expenses, should be collected. Having all necessary documents on hand will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to comply with the Maine Income Tax filing requirements can result in significant penalties. Taxpayers who do not file their returns by the deadline may incur late fees and interest on any unpaid taxes. Additionally, the state may impose further penalties for underreporting income or failing to pay taxes owed. Understanding these potential consequences emphasizes the importance of timely and accurate tax filing.

Eligibility Criteria

Eligibility for filing the Maine Income Tax is generally determined by residency status and income level. Residents of Maine, including those who may have moved to another state but maintain their primary residence in Maine, are required to file. Additionally, individuals earning above a certain income threshold must file a return, regardless of their residency status. It is essential for taxpayers to review the specific eligibility criteria to ensure compliance with state tax laws.

Create this form in 5 minutes or less

Find and fill out the correct maine revenue services mrs maine income t

Create this form in 5 minutes!

How to create an eSignature for the maine revenue services mrs maine income t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Maine Revenue Services 'MRS' Maine Income T.?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the process of managing documents related to Maine Revenue Services 'MRS' Maine Income T., ensuring compliance and efficiency in handling tax-related paperwork.

-

How can airSlate SignNow help with filing Maine Income Tax forms?

With airSlate SignNow, you can easily prepare, send, and eSign Maine Income Tax forms, making the filing process more efficient. The platform ensures that all documents are securely stored and accessible, which is crucial for compliance with Maine Revenue Services 'MRS' Maine Income T.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while effectively managing documents related to Maine Revenue Services 'MRS' Maine Income T.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including customizable templates, real-time tracking, and secure cloud storage. These features are particularly beneficial for managing documents associated with Maine Revenue Services 'MRS' Maine Income T., ensuring that you stay organized and compliant.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration is essential for businesses dealing with Maine Revenue Services 'MRS' Maine Income T., as it allows for a smoother workflow and better data management.

-

What are the benefits of using airSlate SignNow for Maine Income Tax documentation?

Using airSlate SignNow for Maine Income Tax documentation offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. By leveraging this solution, businesses can ensure they meet the requirements set by Maine Revenue Services 'MRS' Maine Income T. while saving time and resources.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow employs advanced security measures to protect sensitive tax documents. This is particularly important when dealing with Maine Revenue Services 'MRS' Maine Income T., as it ensures that all information remains confidential and secure throughout the signing process.

Get more for Maine Revenue Services MRS Maine Income T

- Hr ch 7 terms flashcardsquizlet form

- Company and amending the operating agreement in connection therewith form

- The might do listmake timejake knapp ampamp john zeratsky form

- What is a mainframe its a style of computing ibm form

- Limited liability company law article 4 405 notice of form

- Phone call log form templatenet

- Polygraph consent templateword ampampamp pdfby business in a box form

- Operating agreement of l ampampamp l transportation llc form

Find out other Maine Revenue Services MRS Maine Income T

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word