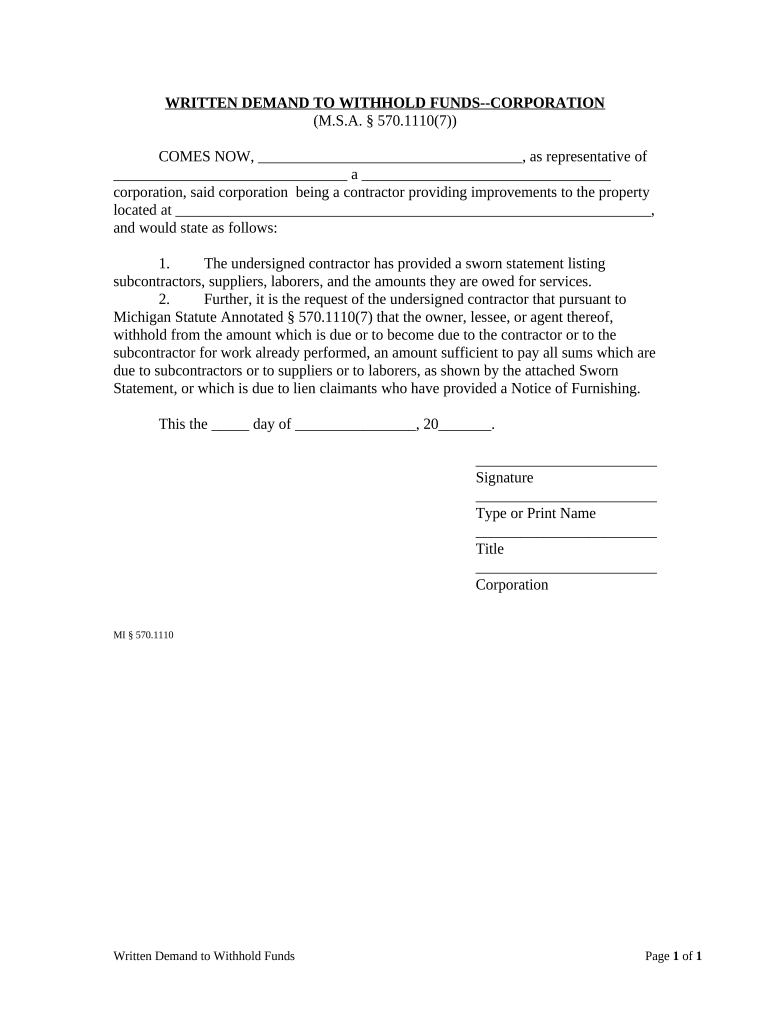

Michigan Corporation Llc Form

What is the Michigan Corporation LLC?

The Michigan Corporation LLC is a legal entity that combines the benefits of a corporation and a limited liability company (LLC). This structure protects its owners from personal liability for the debts and obligations of the business. Forming a Michigan Corporation LLC allows for flexibility in management and tax treatment, making it a popular choice for many entrepreneurs. The owners, known as members, can manage the business themselves or appoint managers, providing options for operational control.

Steps to complete the Michigan Corporation LLC

Completing the Michigan Corporation LLC involves several key steps:

- Choose a name: Ensure the name is unique and complies with Michigan naming requirements.

- Designate a registered agent: This person or business must have a physical address in Michigan and be available during business hours.

- File Articles of Organization: Submit this document to the Michigan Department of Licensing and Regulatory Affairs (LARA) to officially create your LLC.

- Create an Operating Agreement: Although not required, this document outlines the management structure and operating procedures of the LLC.

- Obtain necessary licenses and permits: Depending on your business type, you may need local, state, or federal permits.

Legal use of the Michigan Corporation LLC

The Michigan Corporation LLC is legally recognized and provides various protections and benefits. Members are not personally liable for the LLC’s debts, meaning their personal assets are generally safe from business creditors. This structure also allows for pass-through taxation, where profits are taxed only at the member level, avoiding double taxation faced by traditional corporations. Compliance with state regulations is essential to maintain the LLC’s legal standing.

Key elements of the Michigan Corporation LLC

Several key elements define the Michigan Corporation LLC:

- Limited Liability: Members are protected from personal liability for business debts.

- Flexible Management: Members can choose how to manage the LLC, either directly or through appointed managers.

- Pass-Through Taxation: Income is reported on members' personal tax returns, simplifying tax obligations.

- Perpetual Existence: The LLC can continue to exist beyond the life of its members, ensuring continuity.

How to obtain the Michigan Corporation LLC

To obtain a Michigan Corporation LLC, follow these steps:

- File Articles of Organization: This is the primary document needed to officially form your LLC.

- Pay the filing fee: There is a fee associated with submitting the Articles of Organization, which varies depending on the filing method.

- Receive confirmation: Once processed, the state will send confirmation of your LLC’s formation.

- Get an Employer Identification Number (EIN): This number is necessary for tax purposes and can be obtained from the IRS.

State-specific rules for the Michigan Corporation LLC

Michigan has specific rules governing the formation and operation of LLCs. These include:

- Annual Reporting: Michigan requires LLCs to file an annual report to maintain good standing.

- Registered Agent Requirement: Every LLC must designate a registered agent with a physical address in Michigan.

- Compliance with Local Laws: Depending on the business type and location, additional local permits or licenses may be required.

Quick guide on how to complete michigan corporation llc

Effortlessly Prepare Michigan Corporation Llc on Any Device

The management of documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage Michigan Corporation Llc on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Michigan Corporation Llc Seamlessly

- Locate Michigan Corporation Llc and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searches, or errors requiring new document printouts. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Michigan Corporation Llc to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Michigan corporation LLC?

A Michigan corporation LLC is a limited liability company registered in Michigan that provides personal liability protection for its owners, also known as members. It combines the advantages of both a corporation and a partnership, offering flexibility in management and taxation. By forming a Michigan corporation LLC, business owners can safeguard their personal assets while enjoying a simplified administrative process.

-

How do I form a Michigan corporation LLC?

To form a Michigan corporation LLC, you'll need to choose a unique name, file the Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs, and pay the required filing fee. Additionally, creating an operating agreement is recommended to outline the management structure and responsibilities. This process ensures compliance with state regulations and sets a solid foundation for your Michigan corporation LLC.

-

What are the costs associated with establishing a Michigan corporation LLC?

The costs to establish a Michigan corporation LLC include the state filing fee for the Articles of Organization, which can vary based on the service you choose. Additional expenses may include creating an operating agreement, obtaining necessary licenses, and possibly hiring legal assistance. Evaluating these costs upfront will help you budget effectively for your Michigan corporation LLC.

-

What are the benefits of choosing a Michigan corporation LLC?

One of the primary benefits of a Michigan corporation LLC is personal asset protection, which safeguards your personal finances from liabilities incurred by the business. This structure also offers flexibility in tax treatment, as profits can be passed through to members without facing double taxation. Additionally, forming a Michigan corporation LLC can enhance your business's credibility and attract potential investors.

-

Can I manage my Michigan corporation LLC by myself?

Yes, as the owner of a Michigan corporation LLC, you have the freedom to manage your business independently. You can act as the sole member and make decisions without the need for a formal board of directors or extensive paperwork. However, it's essential to comply with state regulations and maintain proper documentation to uphold your LLC's legal status.

-

What features does airSlate SignNow offer for Michigan corporation LLCs?

airSlate SignNow provides various features designed to streamline document management for Michigan corporation LLCs, including electronic signatures, document templates, and secure storage solutions. With its user-friendly interface, businesses can easily send contracts and obtain legally-binding signatures, enhancing productivity while ensuring compliance with Michigan state laws. Leveraging these features can signNowly benefit the operations of your Michigan corporation LLC.

-

How can airSlate SignNow integrate with my Michigan corporation LLC's workflows?

airSlate SignNow seamlessly integrates with various applications commonly used by Michigan corporation LLCs, such as Google Drive, Salesforce, and Microsoft Office. These integrations allow for the effective management of documents within your existing workflows, providing a cohesive experience that enhances efficiency. By using airSlate SignNow, you can ensure that your Michigan corporation LLC's document processes run smoothly.

Get more for Michigan Corporation Llc

Find out other Michigan Corporation Llc

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now