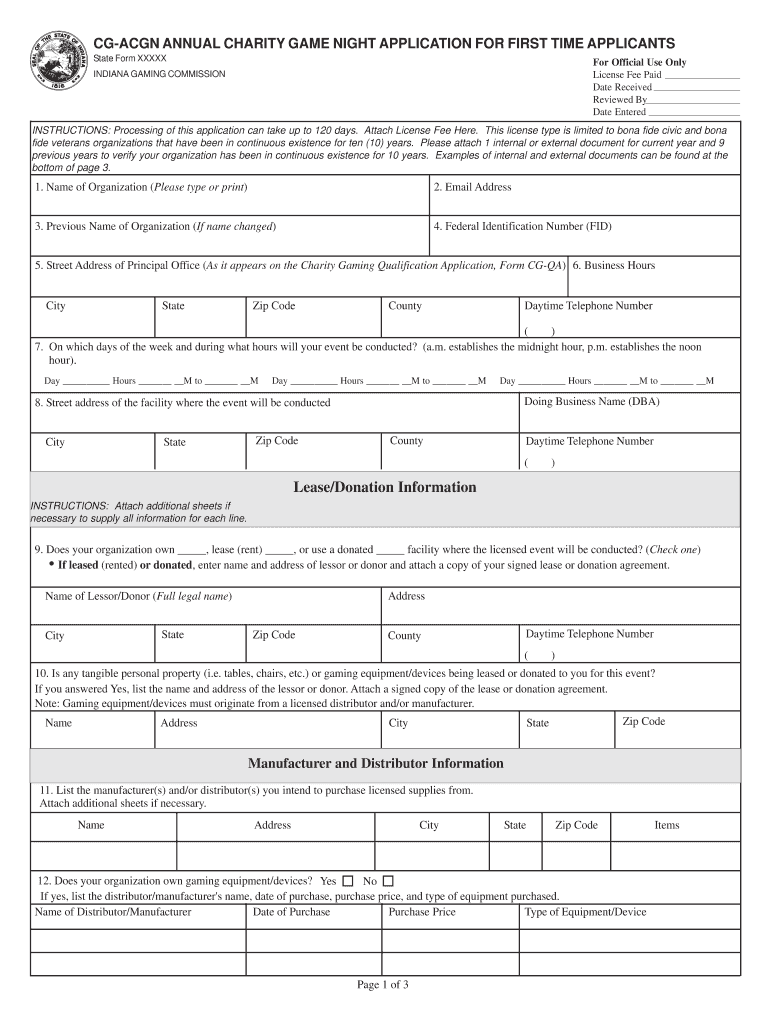

LeaseDonation Information in

What is the LeaseDonation Information In

The LeaseDonation Information In is a specific form used for reporting and documenting lease donation transactions. This form is particularly relevant for individuals and businesses engaged in leasing property or equipment and donating it for charitable purposes. By completing the 45016 form, users can ensure compliance with IRS regulations while facilitating the donation process. This form captures essential details about the lease agreement, the parties involved, and the nature of the donation, making it a critical document for both the donor and the recipient organization.

Steps to complete the LeaseDonation Information In

Completing the LeaseDonation Information In involves several key steps to ensure accuracy and compliance. First, gather all necessary information related to the lease, including the lease terms, property details, and the recipient organization’s information. Next, accurately fill out each section of the 45016 form, ensuring that all required fields are completed. It is important to review the form for any errors or omissions before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements of the IRS or the organization receiving the donation.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the LeaseDonation Information In. These guidelines outline the eligibility criteria for donations, the documentation required, and the reporting obligations for both donors and recipients. It is essential to follow these guidelines to ensure that the donation is recognized as tax-deductible. Additionally, understanding the IRS requirements can help prevent any potential issues during the filing process. Donors should consult the IRS website or a tax professional to stay updated on any changes to these guidelines.

Required Documents

When completing the LeaseDonation Information In, several documents may be required to support the information provided in the form. These documents typically include the original lease agreement, proof of the donation (such as a receipt from the charitable organization), and any correspondence related to the donation. Having these documents readily available not only facilitates the completion of the form but also ensures that all necessary information is accurately reported to the IRS.

Form Submission Methods

The LeaseDonation Information In can be submitted through various methods, depending on the preferences of the donor and the requirements of the IRS. Common submission methods include online submission through authorized e-filing services, mailing a hard copy of the completed form to the appropriate IRS address, or delivering it in person to a local IRS office. Each method has its own advantages, and users should choose the one that best fits their needs while ensuring compliance with submission deadlines.

Eligibility Criteria

To qualify for using the LeaseDonation Information In, certain eligibility criteria must be met. Generally, the donor must be the legal owner of the leased property and have the authority to donate it. Additionally, the recipient organization must be a qualified charitable organization recognized by the IRS. It is important for donors to verify the status of the recipient organization to ensure that the donation is eligible for tax deductions. Understanding these criteria helps streamline the donation process and ensures compliance with IRS regulations.

Quick guide on how to complete leasedonation information in

Complete LeaseDonation Information In seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your paperwork quickly without interruptions. Handle LeaseDonation Information In on any device with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign LeaseDonation Information In effortlessly

- Locate LeaseDonation Information In and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Wave goodbye to lost or mislaid documents, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign LeaseDonation Information In to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

What tax for do I need to fill out if I make donations and invest in stocks?

The simple tax form allows deductions for charitable donations as well as any income from stocks or banks. Your gains/losses investments in stocks aren’t reported until you sell them.

-

Is it mandatory to fill out community or caste information in school admission forms in India?

Please visit Home or JatiMuktBharat.blogspot.com to know more about this issue.

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

-

Is the information I fill out about myself on the PSAT/SAT tests sold to colleges?

A lot of these questions are used in the Student Search Service for colleges who are looking to signNow out to a specific group of students. If you opted in for that, you will definitely get a considerable amount of mail/email.

Create this form in 5 minutes!

How to create an eSignature for the leasedonation information in

How to create an electronic signature for your Leasedonation Information In in the online mode

How to make an electronic signature for the Leasedonation Information In in Google Chrome

How to generate an electronic signature for signing the Leasedonation Information In in Gmail

How to make an eSignature for the Leasedonation Information In straight from your smart phone

How to generate an electronic signature for the Leasedonation Information In on iOS

How to generate an eSignature for the Leasedonation Information In on Android devices

People also ask

-

What is the 45016 form and how can airSlate SignNow help with it?

The 45016 form is a request for transcripts of tax returns, commonly used by businesses and individuals needing financial documentation. airSlate SignNow simplifies the process of sending and electronically signing the 45016 form, ensuring that the paperwork can be completed quickly and securely.

-

Is airSlate SignNow suitable for sending the 45016 form?

Yes, airSlate SignNow is perfectly suited for sending the 45016 form. With our user-friendly interface, you can easily upload, send, and eSign the form, making it a hassle-free experience for both you and the recipient.

-

What are the main features of airSlate SignNow for handling the 45016 form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and cloud storage. These functionalities make managing the 45016 form straightforward and efficient, allowing users to track and organize their documents seamlessly.

-

How much does it cost to use airSlate SignNow for the 45016 form?

airSlate SignNow offers various pricing plans to accommodate different needs, starting at competitive rates. No matter the plan you choose, the cost-effective solution enables you to manage the 45016 form without breaking the bank.

-

Can I integrate airSlate SignNow with other software to manage the 45016 form?

Absolutely! airSlate SignNow integrates with a wide array of software applications, streamlining your workflow when dealing with the 45016 form. This compatibility ensures that you can easily synchronize your documents and data across platforms.

-

What are the benefits of using airSlate SignNow for the 45016 form?

Using airSlate SignNow for the 45016 form offers numerous benefits, such as reducing paper usage, speeding up the signing process, and enhancing security. Our platform also provides a clear audit trail, giving you peace of mind that the document is handled correctly.

-

How secure is airSlate SignNow when handling the 45016 form?

Security is a top priority at airSlate SignNow. When handling the 45016 form, we utilize encryption and secure access protocols to protect your sensitive information, ensuring your documents remain safe and confidential throughout the signing process.

Get more for LeaseDonation Information In

Find out other LeaseDonation Information In

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation