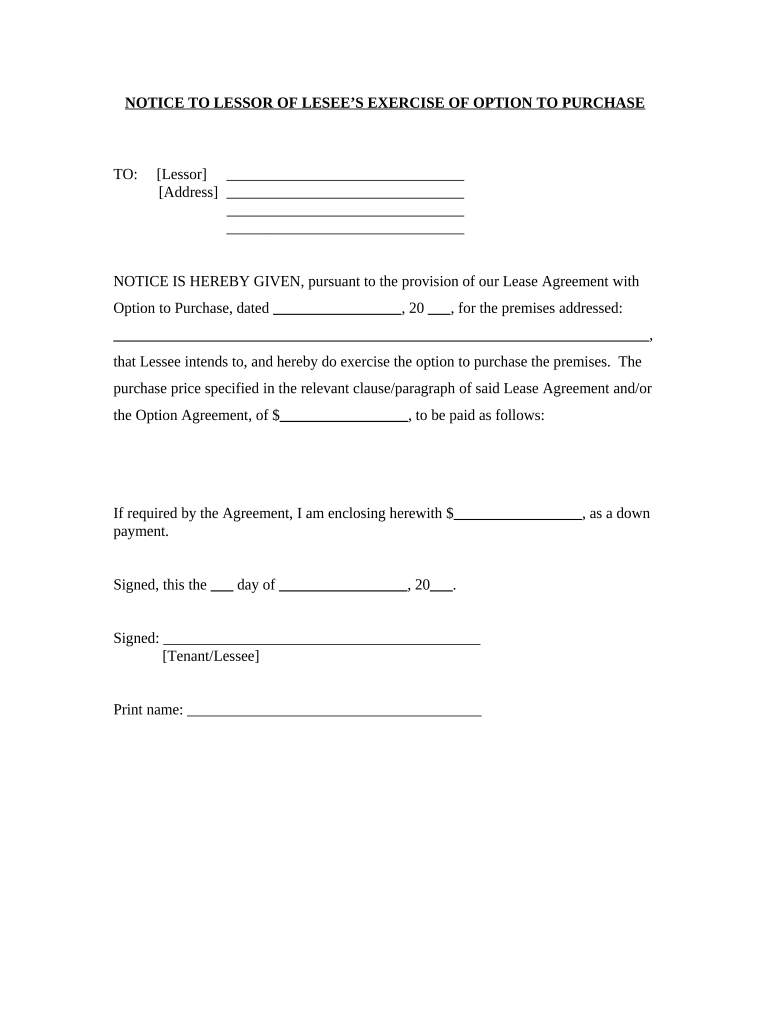

Michigan Option Form

What is the Michigan Option

The Michigan Option refers to a specific choice available to taxpayers in Michigan regarding their tax filings. It allows eligible individuals to select a different method of reporting income and deductions, which may result in various tax benefits. Understanding this option is crucial for maximizing potential savings and ensuring compliance with state tax regulations.

How to use the Michigan Option

Utilizing the Michigan Option involves several steps. First, determine your eligibility based on your income level and filing status. Next, gather all necessary documentation to support your claims. After that, fill out the appropriate forms accurately, ensuring that you follow the guidelines provided by the Michigan Department of Treasury. Finally, submit your forms through the designated channels, either online or by mail, to complete the process.

Steps to complete the Michigan Option

Completing the Michigan Option requires careful attention to detail. Start by reviewing the eligibility criteria to confirm that you qualify. Then, collect all relevant documents, such as W-2s and 1099s. Fill out the Michigan Option form, ensuring that all information is accurate and complete. Double-check your calculations and any deductions you plan to claim. Finally, submit your completed form by the deadline to avoid any penalties.

Legal use of the Michigan Option

The Michigan Option is legally recognized under state tax law, provided that all requirements are met. It is essential to adhere to the guidelines set forth by the Michigan Department of Treasury to ensure that your submission is valid. This includes maintaining accurate records and being aware of any changes in legislation that may affect your eligibility or the process itself.

Eligibility Criteria

To qualify for the Michigan Option, taxpayers must meet specific criteria. Generally, this includes residency in Michigan and adherence to income limits set by state regulations. Additionally, certain filing statuses, such as single or married filing jointly, may also impact eligibility. It is advisable to review the latest guidelines from the Michigan Department of Treasury to confirm your status.

Required Documents

When preparing to utilize the Michigan Option, gather all necessary documents. Key items typically include your W-2 forms, 1099 forms, and any other income statements. You may also need documentation for deductions, such as receipts for medical expenses or educational costs. Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods

Taxpayers can submit the Michigan Option form through various methods. The most common ways include online submission via the Michigan Department of Treasury’s e-filing system, mailing a paper form to the appropriate address, or delivering it in person at designated offices. Each method has its own guidelines and deadlines, so it is important to choose the one that best fits your situation.

Quick guide on how to complete michigan option

Effortlessly Prepare Michigan Option on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Michigan Option on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-centric task today.

How to Edit and eSign Michigan Option with Ease

- Get Form to begin.

- Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Done button to save your modifications.

No more worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Michigan Option while ensuring effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Michigan option for eSigning documents?

The Michigan option refers to the specific features and compliance standards that airSlate SignNow offers for users in Michigan. This includes legally binding eSignatures, customizable templates, and secure storage solutions designed to cater to local businesses. By utilizing the Michigan option, businesses can streamline their document workflows while ensuring compliance with state regulations.

-

How much does the Michigan option cost?

The pricing for the Michigan option with airSlate SignNow varies based on the plan you choose. Our plans are designed to be cost-effective, providing businesses with various subscription tiers that fit all budgets. By selecting the Michigan option, you not only gain access to essential eSigning features but also enjoy value-added services tailored for local needs.

-

What features are included in the Michigan option?

The Michigan option comes with a robust set of features, including legally compliant eSignatures, customizable workflows, and user-friendly templates. Additionally, it offers integrations with popular apps and services, making it easy to incorporate into your existing business processes. This ensures that all your signing needs are met efficiently and effectively.

-

Can I integrate the Michigan option with other software?

Yes, the Michigan option seamlessly integrates with a variety of software, including CRM and project management tools. This allows businesses in Michigan to enhance their document management processes without disruptions. By using the Michigan option, you can connect with other applications to create a more streamlined workflow.

-

What are the benefits of using the Michigan option?

Using the Michigan option provides numerous benefits, including increased efficiency and reduced turnaround times for document approvals. It also ensures compliance with Michigan state laws, making it a reliable choice for local businesses. Furthermore, the Michigan option offers a user-friendly interface, helping teams adopt the solution with minimal training.

-

Is the Michigan option secure for sensitive documents?

Absolutely! The Michigan option ensures that all sensitive documents are protected with advanced security measures, including encryption and secure cloud storage. This means that businesses can have peace of mind knowing their data is safe and compliant with state regulations. Thus, the Michigan option is ideal for organizations prioritizing security.

-

How does the Michigan option enhance collaboration?

The Michigan option enhances collaboration by enabling multiple users to review and sign documents in real-time. This reduces the back-and-forth emails and accelerates the decision-making process. With real-time updates and notifications, teams can work together more efficiently using the Michigan option.

Get more for Michigan Option

Find out other Michigan Option

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed