F8829 Form

What is the F8829 Form

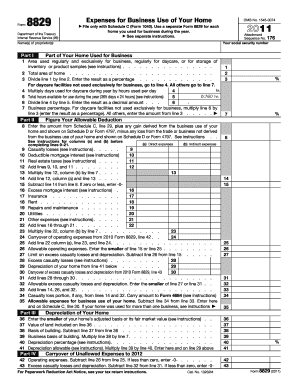

The F8829 form, officially known as the "Expenses for Business Use of Your Home," is a tax form used by self-employed individuals and certain employees to calculate and claim deductions for expenses related to the business use of their home. This form allows taxpayers to report the portion of their home that is used exclusively for business purposes, enabling them to deduct related expenses such as mortgage interest, utilities, and repairs. Understanding the F8829 form is essential for maximizing potential tax benefits while ensuring compliance with IRS regulations.

How to Use the F8829 Form

Using the F8829 form involves several steps to ensure accurate reporting of home office expenses. First, taxpayers must determine the area of their home used for business and calculate the percentage of the home that is dedicated to business activities. Next, they should gather all necessary documentation, including receipts and bills related to home expenses. The form requires specific information about the home office, including its dimensions and the nature of the business conducted there. Finally, taxpayers must complete the form and attach it to their tax return when filing.

Steps to Complete the F8829 Form

Completing the F8829 form involves a series of methodical steps:

- Measure the space used for business to determine the square footage.

- Calculate the total square footage of the home.

- Divide the business space by the total space to find the business use percentage.

- List all eligible expenses, including direct expenses (specific to the office) and indirect expenses (shared with the home).

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for accuracy before submission.

Legal Use of the F8829 Form

The legal use of the F8829 form is governed by IRS guidelines, which stipulate that only expenses related to the business use of a home can be claimed. To qualify, the space must be used regularly and exclusively for business activities. It is crucial to maintain proper documentation to support claims made on the form, as the IRS may request this information during audits. Compliance with these regulations ensures that taxpayers can legitimately benefit from the deductions available through the F8829 form.

IRS Guidelines

The IRS provides specific guidelines for the use of the F8829 form, detailing eligibility criteria and acceptable expenses. Taxpayers must ensure that their home office meets the "exclusive use" requirement, meaning that the designated area is not used for personal activities. The IRS also outlines which expenses can be deducted, including mortgage interest, rent, utilities, and depreciation. Familiarizing oneself with these guidelines is essential for accurate completion of the form and for avoiding potential penalties.

Eligibility Criteria

To use the F8829 form, taxpayers must meet certain eligibility criteria. Primarily, the individual must be self-employed or an employee who uses a portion of their home for business purposes. The space must be used regularly and exclusively for business activities, and it should be the principal place of business or a place where clients meet. Additionally, the taxpayer must maintain accurate records of expenses related to the business use of the home to substantiate their claims on the form.

Quick guide on how to complete f8829 form

Effortlessly Manage F8829 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle F8829 Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

The Easiest Method to Modify and Electronically Sign F8829 Form with Ease

- Find F8829 Form and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as an ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign F8829 Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8829 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is f8829 and how does it relate to airSlate SignNow?

The f8829 form is used for claiming a home office deduction, and airSlate SignNow streamlines the process by allowing you to eSign this document quickly. By using airSlate SignNow, you can effortlessly prepare, send, and track your f8829 submissions without the hassle of traditional paperwork.

-

How can airSlate SignNow assist in completing the f8829 form?

With airSlate SignNow, you can easily fill out the f8829 form digitally, ensuring accuracy and convenience. The platform allows for seamless electronic signatures, making the submission process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for f8829?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs. You can choose a plan that fits your budget while gaining access to features that simplify the signing and submission of your f8829 form.

-

What features does airSlate SignNow offer for managing documents like f8829?

airSlate SignNow provides features such as customizable templates, document tracking, and secure cloud storage for your f8829 forms. These tools help you manage your documents efficiently and ensure that they are always accessible when needed.

-

Can airSlate SignNow help with team collaboration on the f8829 process?

Absolutely! airSlate SignNow allows multiple users to collaborate on completing the f8829 form. You can share documents, add comments, and track changes, which enhances the teamwork process while ensuring everyone is on the same page.

-

Are there integrations available with airSlate SignNow for f8829 submissions?

Yes, airSlate SignNow integrates with various business tools, making it easy to incorporate f8829 form submissions into your existing workflows. Whether you use CRM systems or project management tools, these integrations enhance productivity and streamline document handling.

-

What are the benefits of using airSlate SignNow for tax-related documents like f8829?

Using airSlate SignNow for tax-related documents such as the f8829 form offers signNow benefits including time savings and reduced paperwork. The ability to eSign and manage documents from anywhere ensures that your tax submission process is efficient and compliant.

Get more for F8829 Form

Find out other F8829 Form

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later