Michigan Trust Form

What is the Michigan Trust

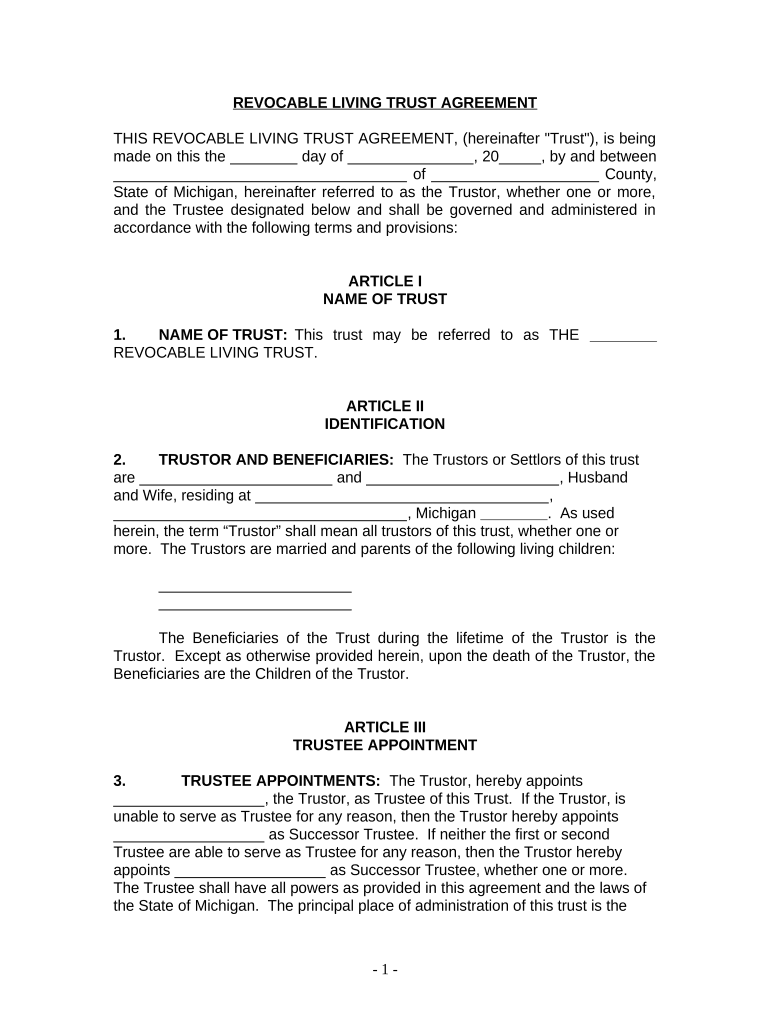

The Michigan Trust is a legal arrangement that allows individuals to transfer assets into a trust for the benefit of designated beneficiaries, such as adult children. This type of trust can help manage assets, provide financial support, and ensure that the assets are distributed according to the grantor's wishes. In Michigan, trusts can be revocable or irrevocable, each serving different purposes based on the grantor's needs and goals.

Key elements of the Michigan Trust

When establishing a Michigan Trust, several key elements must be considered:

- Trustee: The individual or institution responsible for managing the trust and its assets.

- Beneficiaries: The individuals or entities designated to receive benefits from the trust, which can include adult children.

- Trust Document: A legal document outlining the terms of the trust, including how assets are to be managed and distributed.

- Funding the Trust: The process of transferring assets into the trust, which can include real estate, bank accounts, and investments.

Steps to complete the Michigan Trust

Completing a Michigan Trust involves several important steps:

- Determine the type of trust: Decide whether a revocable or irrevocable trust best suits your needs.

- Select a trustee: Choose a reliable individual or institution to manage the trust.

- Draft the trust document: Create a legal document that outlines the terms and conditions of the trust.

- Fund the trust: Transfer assets into the trust to ensure it is operational and effective.

- Review and update: Regularly review the trust to ensure it meets your current needs and make adjustments as necessary.

Legal use of the Michigan Trust

The legal use of a Michigan Trust provides various benefits, such as asset protection and tax advantages. Trusts can help avoid probate, which can be a lengthy and costly process. Additionally, trusts can be structured to provide for the financial needs of adult children while maintaining control over asset distribution. It is important to ensure that the trust complies with Michigan laws to be considered valid and enforceable.

Required Documents

To establish a Michigan Trust, certain documents are typically required:

- Trust Agreement: The primary document that outlines the terms of the trust.

- Asset Deeds: Documentation for any real estate or property being transferred into the trust.

- Financial Statements: Records of bank accounts, investments, and other assets included in the trust.

- Identification: Personal identification for the grantor, trustee, and beneficiaries.

Who Issues the Form

In Michigan, the trust form is typically created by the grantor or their legal representative. There is no specific governmental body that issues a standard trust form, as trusts can be customized to fit individual needs. However, legal professionals often assist in drafting the trust document to ensure compliance with state laws.

Quick guide on how to complete michigan trust

Complete Michigan Trust seamlessly on any device

Online document management has gained popularity among companies and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and electronically sign Michigan Trust effortlessly

- Find Michigan Trust and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Michigan Trust and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow help trust adult children manage their documents?

airSlate SignNow provides a secure platform for trust adult children to manage essential documents like wills and trusts. Our easy-to-use interface allows users to eSign and send documents quickly, ensuring that all necessary paperwork is handled efficiently, which is crucial for family peace of mind.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of trust adult children. Whether you're an individual or a business, our plans provide cost-effective solutions that allow you to eSign and manage documents without breaking the bank. You can choose from monthly or annual subscriptions that fit your budget.

-

What features does airSlate SignNow offer for trust adult children?

Trust adult children can benefit from features such as secure eSigning, document storage, and template creation. With our advanced features, you can customize documents, track signatures, and collaborate with family members seamlessly. This ensures that all important documents are easily accessible and properly signed.

-

Are there any benefits to using airSlate SignNow for family-related documents?

Yes, using airSlate SignNow helps trust adult children ensure that important family documents are managed securely and efficiently. The platform reduces the stress associated with paperwork by allowing easy access and collaboration, fostering better communication among family members regarding important legal documents.

-

Can airSlate SignNow integrate with other tools for trust adult children?

Absolutely! airSlate SignNow seamlessly integrates with popular tools like Google Drive and Dropbox, which is beneficial for trust adult children who need to manage their documents alongside their favorite software. This integration streamlines the document workflow, making it easier to keep everything organized and accessible.

-

Is airSlate SignNow a secure option for trust adult children?

Yes, airSlate SignNow uses top-notch security measures to ensure that trust adult children’s sensitive documents are protected. Our platform employs encryption and secure cloud storage, giving you peace of mind that your important family documents are safeguarded against unauthorized access.

-

How user-friendly is the airSlate SignNow platform for trust adult children?

The airSlate SignNow platform is designed with user-friendliness in mind, making it ideal for trust adult children of all technological skill levels. With a simple and intuitive interface, users can easily upload, sign, and send documents without any technical difficulties, ensuring a smooth experience.

Get more for Michigan Trust

- City of lighthouse point structural addendum form

- Body wrap intake form my vida spa

- Texas hhsc form 4108 pna

- How to file a complaint against a dentist in texas form

- Maryland 502su instructions form

- Yacht guest preference form

- Utah group fishing license form

- Transcript request form hawkeye community college

Find out other Michigan Trust

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free