Sa370 Form

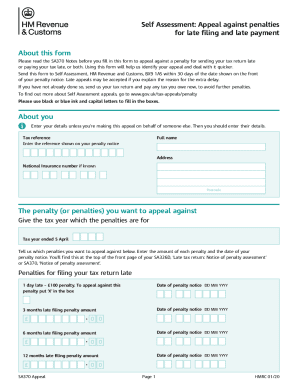

What is the SA370?

The SA370 is a specific form used in various administrative processes, primarily related to tax and compliance matters. It serves as a declaration or report that individuals or businesses may need to file with relevant authorities. Understanding the purpose and requirements of the SA370 is crucial for ensuring compliance and avoiding potential penalties.

How to Use the SA370

Using the SA370 involves several steps to ensure that the form is completed accurately and submitted on time. Users should start by gathering all necessary information and documents required for completion. This includes personal identification details, financial information, and any supporting documentation that may be relevant to the form's purpose. Once the necessary information is collected, the form can be filled out either digitally or on paper, depending on the preferred method of submission.

Steps to Complete the SA370

Completing the SA370 requires careful attention to detail. Here are the general steps to follow:

- Review the instructions provided with the form to understand specific requirements.

- Gather all necessary documents and information needed for completion.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Double-check the information for accuracy and completeness.

- Submit the completed form by the designated deadline through the chosen submission method.

Legal Use of the SA370

The legal use of the SA370 is governed by specific regulations that outline how the form should be completed and submitted. Compliance with these regulations is essential to ensure that the form is accepted by authorities. The SA370 must be filled out truthfully and accurately, as any discrepancies or false information can lead to legal consequences, including fines or penalties.

Filing Deadlines / Important Dates

Timely submission of the SA370 is critical. Each year, specific deadlines are set for filing the form, which may vary based on the type of entity or individual filing. It is important to stay informed about these deadlines to avoid late fees or penalties. Marking these dates on a calendar can help ensure that submissions are made promptly.

Required Documents

When completing the SA370, certain documents may be required to support the information provided on the form. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Financial statements or records relevant to the filing.

- Any additional forms or documentation specified in the SA370 instructions.

Form Submission Methods

The SA370 can typically be submitted through various methods, including online, by mail, or in person. Each method has its own advantages and considerations:

- Online: This is often the fastest method, allowing for immediate processing.

- By Mail: This method may take longer, so it is essential to account for mailing times.

- In Person: Submitting the form in person can provide immediate confirmation of receipt.

Quick guide on how to complete sa370

Effortlessly Prepare Sa370 on Any Device

The popularity of online document management has surged among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Sa370 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Sa370 with Ease

- Find Sa370 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, and the need to print additional copies due to errors. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Sa370 to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa370

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are SA370 notes and how can they be used with airSlate SignNow?

SA370 notes are critical documents that can be effectively managed and eSigned using airSlate SignNow. This tool streamlines the process of sending, receiving, and storing SA370 notes in a secure environment, making it ideal for businesses seeking efficiency.

-

How does airSlate SignNow ensure the security of SA370 notes?

airSlate SignNow employs multiple security measures such as encryption and secure cloud storage to protect SA370 notes. These features ensure that only authorized users can access the documents, maintaining the confidentiality and integrity of sensitive information.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs, starting from a free trial to more comprehensive packages. Each plan includes features tailored to help manage SA370 notes efficiently, making it a cost-effective solution for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for managing SA370 notes?

Yes, airSlate SignNow provides seamless integration with various applications like CRM and document management systems. This enables users to handle SA370 notes alongside other business processes, enhancing workflow efficiency.

-

What features does airSlate SignNow offer for managing SA370 notes?

Key features of airSlate SignNow for managing SA370 notes include customizable templates, automated workflows, and real-time tracking. These tools facilitate faster, more efficient handling of documents while ensuring compliance and accuracy.

-

How does airSlate SignNow benefit businesses that use SA370 notes?

Using airSlate SignNow for SA370 notes allows businesses to streamline their document workflows and reduce turnaround times. This results in improved productivity and better client satisfaction as documents are processed and signed electronically.

-

Is airSlate SignNow user-friendly for managing SA370 notes?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy to manage SA370 notes, even for users with minimal technical expertise. Its straightforward process simplifies document management and eSigning.

Get more for Sa370

- Warranty deed for parents to child with reservation of life estate georgia form

- Warranty deed for separate or joint property to joint tenancy georgia form

- Warranty deed to separate property of one spouse to both as joint tenants with right of survivorship georgia form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries georgia form

- Warranty deed from limited partnership or llc is the grantor or grantee georgia form

- Georgia warranty deed form

- Warranty deed form 497304177

- Ga warranty deed 497304178 form

Find out other Sa370

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors