Contract for Deed Seller's Annual Accounting Statement Minnesota Form

What is the Contract For Deed Seller's Annual Accounting Statement Minnesota

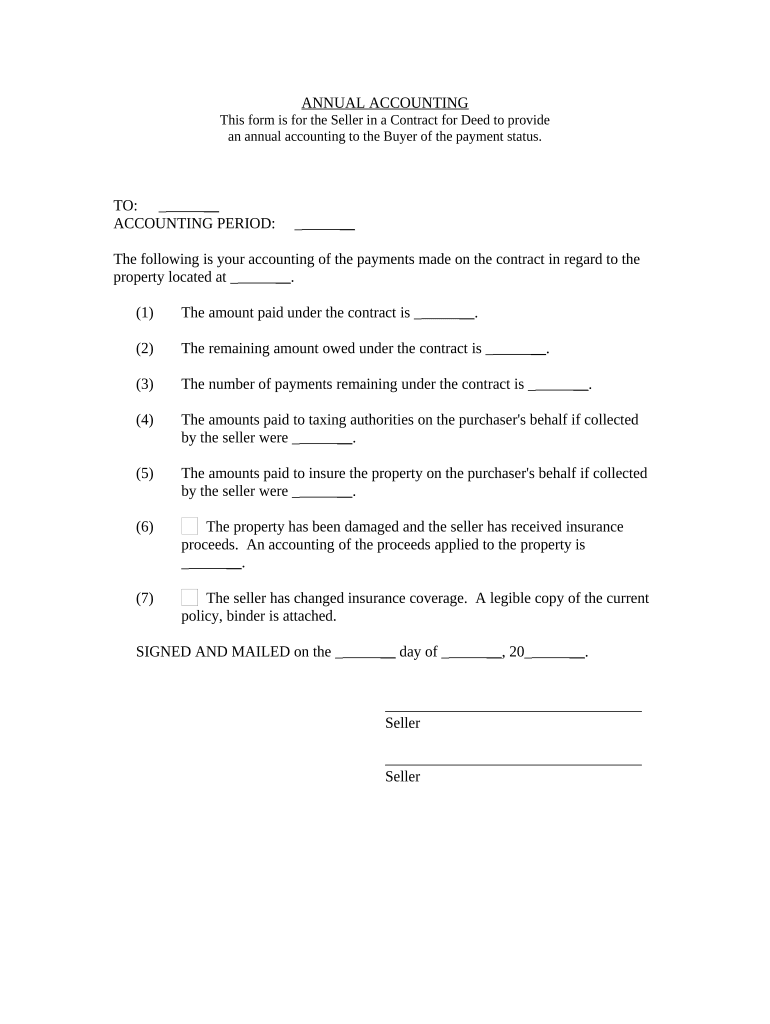

The Contract For Deed Seller's Annual Accounting Statement in Minnesota is a formal document that outlines the financial transactions between a seller and a buyer in a contract for deed arrangement. This statement is essential for both parties as it provides a detailed account of payments made, outstanding balances, and any other financial obligations. It serves as a record that helps ensure transparency and accountability in the transaction, which is crucial for maintaining trust between the seller and buyer.

Key elements of the Contract For Deed Seller's Annual Accounting Statement Minnesota

This accounting statement typically includes several key elements:

- Payment History: A detailed record of all payments made by the buyer throughout the year.

- Outstanding Balance: The remaining amount owed by the buyer as of the statement date.

- Interest Rates: Information regarding any interest charged on the outstanding balance.

- Fees and Charges: Any additional fees or charges that may apply, such as late fees.

- Contact Information: Details for both the seller and buyer for any inquiries or clarifications.

Steps to complete the Contract For Deed Seller's Annual Accounting Statement Minnesota

Completing the Contract For Deed Seller's Annual Accounting Statement involves several straightforward steps:

- Gather Financial Records: Collect all payment records, including receipts and bank statements.

- Calculate Total Payments: Sum up all payments made by the buyer during the year.

- Determine Outstanding Balance: Subtract total payments from the original contract amount to find the remaining balance.

- Include Interest and Fees: Add any applicable interest and fees to the outstanding balance.

- Review and Verify: Double-check all calculations and ensure accuracy before finalizing the statement.

- Distribute the Statement: Provide a copy of the completed statement to the buyer and retain a copy for your records.

How to use the Contract For Deed Seller's Annual Accounting Statement Minnesota

The Contract For Deed Seller's Annual Accounting Statement is used primarily for record-keeping and financial transparency. Sellers should use this document to:

- Provide buyers with a clear overview of their financial obligations.

- Facilitate communication regarding payments and outstanding balances.

- Support tax reporting and compliance by maintaining accurate financial records.

Legal use of the Contract For Deed Seller's Annual Accounting Statement Minnesota

This document is legally binding and must adhere to Minnesota state laws governing contracts for deed. It is crucial for both sellers and buyers to understand their rights and obligations as outlined in the statement. The seller must ensure that the statement is accurate and comprehensive to avoid disputes. Additionally, maintaining proper documentation can protect both parties in case of legal issues arising from the contract.

State-specific rules for the Contract For Deed Seller's Annual Accounting Statement Minnesota

In Minnesota, specific rules govern the use of the Contract For Deed Seller's Annual Accounting Statement. Sellers must comply with state regulations regarding the disclosure of financial information. This includes providing accurate accounting statements annually and ensuring that all calculations are correct. Failure to comply with these regulations can lead to legal consequences and disputes between the parties involved.

Quick guide on how to complete contract for deed sellers annual accounting statement minnesota

Manage Contract For Deed Seller's Annual Accounting Statement Minnesota with ease on any device

Digital document management has become widely adopted by both companies and individuals. It offers a superb environmentally friendly substitute to conventional printed and signed paperwork, as you can find the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage Contract For Deed Seller's Annual Accounting Statement Minnesota on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to alter and eSign Contract For Deed Seller's Annual Accounting Statement Minnesota effortlessly

- Find Contract For Deed Seller's Annual Accounting Statement Minnesota and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Contract For Deed Seller's Annual Accounting Statement Minnesota and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Contract For Deed Seller's Annual Accounting Statement Minnesota?

The Contract For Deed Seller's Annual Accounting Statement Minnesota is a document that sellers need to provide to buyers annually. It outlines all financial transactions related to a Contract for Deed, including payments received and remaining balances. This statement is essential for both parties to keep accurate records and ensure compliance with state regulations.

-

How does airSlate SignNow simplify the creation of a Contract For Deed Seller's Annual Accounting Statement Minnesota?

airSlate SignNow streamlines the process of creating a Contract For Deed Seller's Annual Accounting Statement Minnesota by providing customizable templates. Users can easily fill in the required information and generate the document quickly. Our platform also offers eSignature capabilities, ensuring that all necessary parties can sign the statement digitally.

-

What are the benefits of using airSlate SignNow for managing my Contract For Deed Seller's Annual Accounting Statement Minnesota?

Using airSlate SignNow for your Contract For Deed Seller's Annual Accounting Statement Minnesota enhances efficiency by providing an automated solution for document management. You can track document status in real-time, reduce printing costs, and access your statements from any device. Additionally, the electronic signature feature speeds up the approval process.

-

Is airSlate SignNow cost-effective for small businesses handling Contract For Deed Seller's Annual Accounting Statement Minnesota?

Yes, airSlate SignNow offers a cost-effective solution ideal for small businesses managing Contract For Deed Seller's Annual Accounting Statement Minnesota. With flexible pricing plans that cater to various needs, small businesses can take advantage of our comprehensive features without breaking the bank. The potential savings on paper and postage further enhance its value.

-

What integrations does airSlate SignNow offer for managing Contract For Deed Seller's Annual Accounting Statement Minnesota?

airSlate SignNow integrates seamlessly with popular accounting and document management software, enhancing your workflow for Contract For Deed Seller's Annual Accounting Statement Minnesota. This includes integration with platforms like QuickBooks and Salesforce, allowing users to sync data and maintain consistency across applications. These integrations help streamline your accounting processes.

-

How secure is the information in my Contract For Deed Seller's Annual Accounting Statement Minnesota when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use industry-standard encryption to protect your information in every Contract For Deed Seller's Annual Accounting Statement Minnesota. Additionally, we implement strict access controls and comply with privacy regulations to ensure that your data remains safe throughout the document lifecycle.

-

Can I customize my Contract For Deed Seller's Annual Accounting Statement Minnesota template in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize templates for Contract For Deed Seller's Annual Accounting Statement Minnesota to meet their specific needs. You can add your branding, adjust formatting, and include any additional information necessary for compliance. This customization ensures that your documents reflect your business professionally.

Get more for Contract For Deed Seller's Annual Accounting Statement Minnesota

Find out other Contract For Deed Seller's Annual Accounting Statement Minnesota

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online