Minnesota State Form

What is the Minnesota State Form

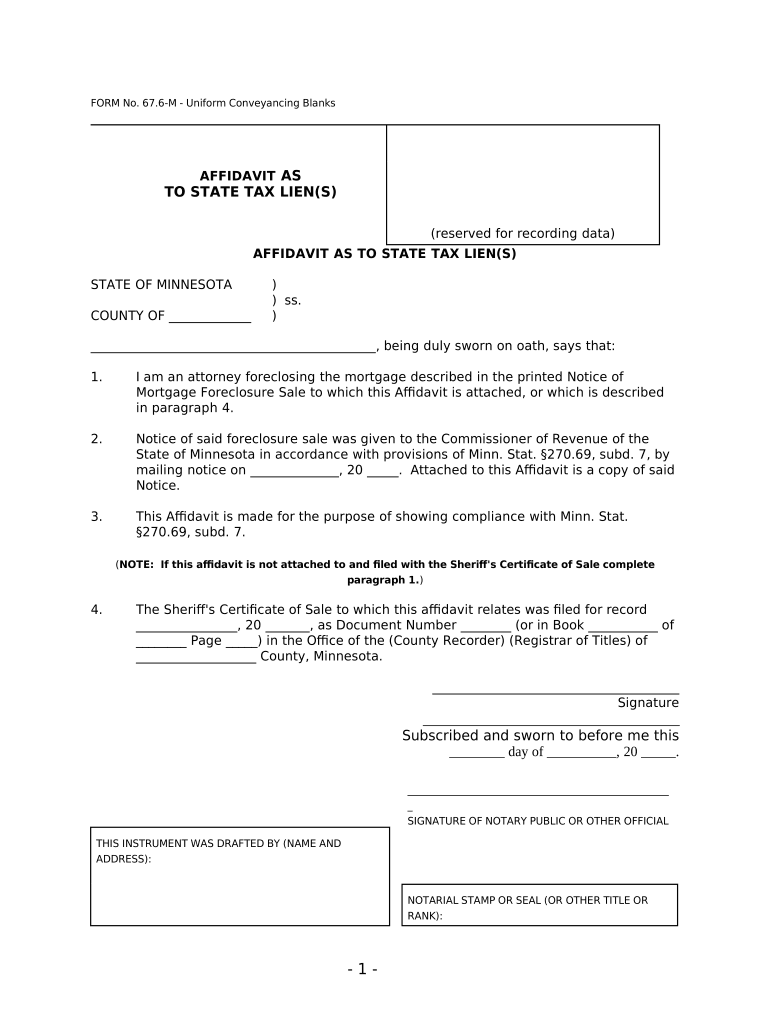

The Minnesota State Form is a specific document required for various administrative and legal processes within the state of Minnesota. This form is often utilized for tax purposes, including the state tax form MN, which is essential for individuals and businesses to report their income and calculate their tax obligations. Understanding the purpose and requirements of this form is crucial for compliance with Minnesota state laws.

How to use the Minnesota State Form

Using the Minnesota State Form involves several key steps to ensure accurate completion and submission. First, gather all necessary information, including personal details, income sources, and deductions. Next, carefully fill out the form, ensuring that all entries are accurate and complete. It is advisable to review the form for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on the specific requirements of the form.

Steps to complete the Minnesota State Form

Completing the Minnesota State Form requires a systematic approach. Begin by downloading the appropriate version of the form, ensuring it is the latest edition. Follow these steps:

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and dividends.

- Calculate any deductions or credits you may be eligible for.

- Review your entries for accuracy.

- Sign and date the form before submission.

Legal use of the Minnesota State Form

The legal use of the Minnesota State Form is governed by state regulations that dictate how the form must be completed and submitted. To ensure that the form is legally binding, it must be filled out accurately and submitted within the specified deadlines. Additionally, using a reliable eSignature solution can enhance the legal standing of the form, as it complies with relevant eSignature laws such as ESIGN and UETA.

Form Submission Methods

The Minnesota State Form can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online: Many forms can be completed and submitted electronically through the Minnesota Department of Revenue website.

- Mail: Completed forms can be printed and mailed to the appropriate state agency.

- In-Person: Some forms may be submitted directly at designated state offices.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota State Form are critical to avoid penalties and ensure compliance. Typically, individual income tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check the Minnesota Department of Revenue for any updates or changes to these dates.

Quick guide on how to complete minnesota state form

Complete Minnesota State Form effortlessly on any device

Online document administration has gained popularity with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without any holdups. Manage Minnesota State Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Minnesota State Form with ease

- Find Minnesota State Form and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Minnesota State Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the standard deduction for M1 in Minnesota?

These are the standard deduc- tion amounts determined for your filing status: • $13,825 for Single • $27,650 for Married Filing Jointly or Qualifying Surviving Spouse • $13,825 for Married Filing Separately • $20,800 for Head of Household If you are married and filing a separate return, you may only claim the standard ...

-

Where do I get Minnesota state tax forms?

You can get Minnesota tax forms either by mail or in person. To get forms by mail, call 651-296-3781 or 1-800-652-9094 to have forms mailed to you. You can pick up forms at our St. Paul office.

-

What is a MN ST3 form?

Page Menu. A completed Form ST3 is provided by colleges, universities, and the System Office to vendors to exempt most official expenditures from Minnesota sales tax.

-

Who has to file a Minnesota estate tax return?

If the gross estate of a Minnesota resident has a value of more than $3 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.) Your gross estate will include just about all of the property you own at your death: Real estate.

-

What is the M1 form for Minnesota?

Use Form M1 , Individual Income Tax , to estimate your Minnesota tax ... income you calculated in Step 1 on Form M1 , line 1.

-

What is a Minnesota form M8?

Corporations doing business in Minnesota that have elected to be taxed as S corporations under IRC section 1362 must file Form M8. The entire share of an entity's income is taxed to the shareholder, whether or not it is actually distributed. Each shareholder must include their share of income on their tax return.

-

Can you still get paper tax forms?

Get federal tax forms for current and prior years Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

-

How much will my Social Security be taxed in Minnesota?

Social Security Benefits Subject to Minnesota Income Tax Federal Adjusted Gross IncomeSocial Security benefits (millions)% of benefits taxable, Minnesota Less than $25,000 $3,604 0.4% $25,000 to $50,000 2,408 16.9 $50,000 to $75,000 2,076 52.3 $75,000 to $100,000 1,679 72.64 more rows

Get more for Minnesota State Form

- Basic allowance for housing bah authorization and dependency declaration da form 5960 jan

- Application for compassionate actions da form 3739 aug

- Dd form 2278 washington headquarters services

- Yuptair force form 24

- Public adjuster contract template 559731293 form

- Application for nonappropriated fund employment da form 3433 aug

- Parental release form pdf united states department of

- Publications and forms for the self employed

Find out other Minnesota State Form

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter