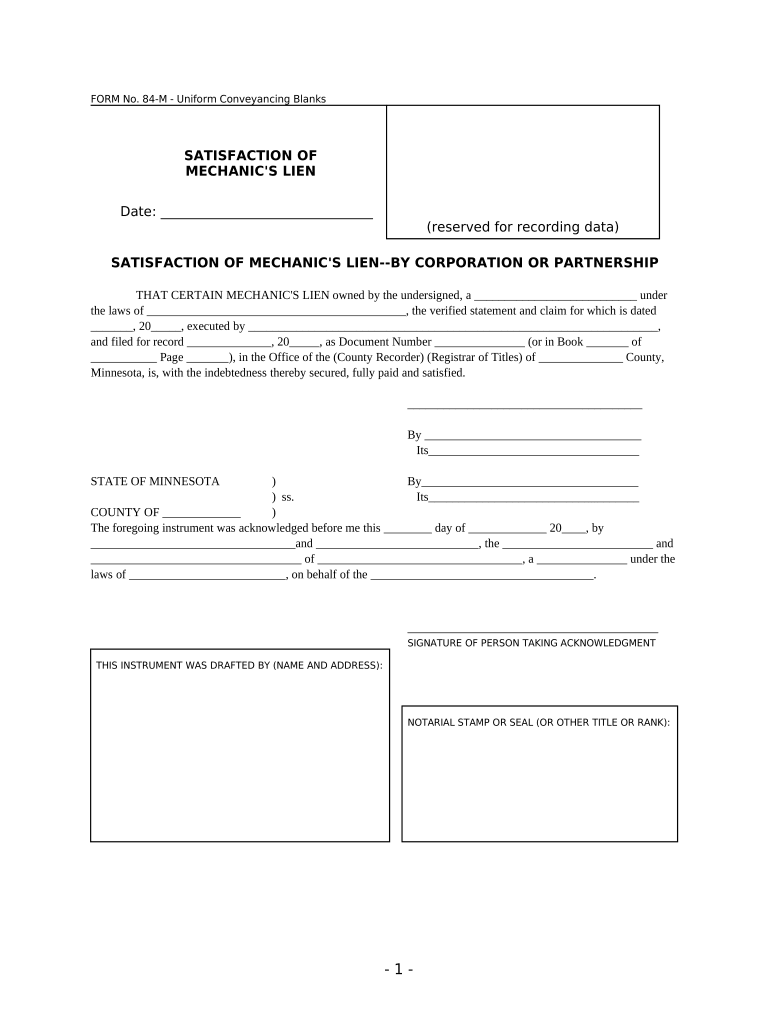

Minnesota Entity Form

What is the Minnesota Entity

The Minnesota entity refers to a legal structure established under Minnesota state law for businesses operating within the state. This can include various types of organizations, such as Limited Liability Companies (LLCs), corporations, partnerships, and sole proprietorships. Each entity type has distinct characteristics, including liability protection, tax implications, and governance structures. Understanding the differences between these entities is crucial for business owners to choose the most suitable form for their operations.

How to use the Minnesota Entity

Using the Minnesota entity involves several key steps, including registration, compliance with state regulations, and maintaining proper records. Business owners must first select the appropriate entity type based on their goals and needs. Once the entity is chosen, they must complete the necessary forms and submit them to the Minnesota Secretary of State. This process may include providing information about the business’s name, address, and ownership structure. After registration, ongoing compliance with state laws is essential to maintain the entity’s good standing.

Steps to complete the Minnesota Entity

Completing the Minnesota entity registration involves a series of steps:

- Choose the appropriate business structure (LLC, corporation, etc.).

- Select a unique business name that complies with state naming rules.

- Prepare and file the Articles of Organization or Articles of Incorporation with the Minnesota Secretary of State.

- Obtain any necessary licenses or permits required for your specific industry.

- Set up a registered agent to receive legal documents on behalf of the business.

- Pay the required filing fees to complete the registration process.

Legal use of the Minnesota Entity

The legal use of the Minnesota entity is governed by state laws that outline the rights and responsibilities of business owners. Each entity type offers different levels of liability protection and tax treatment. For example, LLCs provide personal liability protection for owners, while corporations have more complex governance requirements. It is essential for business owners to understand these legal frameworks to ensure compliance and protect their interests. Additionally, maintaining accurate records and adhering to reporting requirements is vital for the legal standing of the entity.

Key elements of the Minnesota Entity

Several key elements define the Minnesota entity, including:

- Entity Type: The classification of the business (LLC, corporation, etc.) determines its legal structure.

- Registration: Formal registration with the state is required to establish the entity legally.

- Operating Agreement: For LLCs, this document outlines the management structure and operating procedures.

- Compliance: Ongoing adherence to state regulations, including annual filings and tax obligations, is necessary.

State-specific rules for the Minnesota Entity

Each state has specific rules governing business entities, and Minnesota is no exception. Key state-specific rules include the requirement for entities to file annual reports, maintain a registered agent, and comply with state tax laws. Additionally, certain industries may have unique licensing requirements. Business owners should familiarize themselves with these regulations to ensure compliance and avoid penalties. Consulting with a legal professional can provide valuable insights into navigating Minnesota's business laws.

Quick guide on how to complete minnesota entity

Effortlessly prepare Minnesota Entity on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Minnesota Entity on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to edit and eSign Minnesota Entity with ease

- Locate Minnesota Entity and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or cover sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or downloading it to your computer.

Leave behind concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Minnesota Entity while ensuring seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota entity?

A Minnesota entity refers to a business structure formed under Minnesota state law, such as a corporation, LLC, or partnership. Understanding the specifics of Minnesota entities is crucial for compliance and operational efficiency. Choosing the right Minnesota entity can influence your business’s tax obligations and personal liability.

-

How does airSlate SignNow benefit Minnesota entities?

airSlate SignNow provides Minnesota entities with a seamless way to send and eSign documents, ensuring compliance with state regulations. This platform enhances the efficiency of document management, allowing Minnesota businesses to focus on growth rather than paperwork. With its easy-to-use interface, any Minnesota entity can quickly adopt this eSignature solution.

-

What are the pricing plans for airSlate SignNow for Minnesota entities?

airSlate SignNow offers various pricing plans to suit the needs of Minnesota entities, from small startups to larger organizations. The plans are designed to be cost-effective, enabling Minnesota entities to choose a package that aligns with their document management needs. You can select from monthly or annual subscriptions to maximize your savings.

-

Are there any special features for Minnesota entities on airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for Minnesota entities such as document templates tailored to Minnesota regulations. These features streamline the eSigning process and ensure that all documents meet state requirements. Additionally, the platform offers robust security measures to protect sensitive information pertinent to Minnesota entities.

-

Can airSlate SignNow integrate with other tools used by Minnesota entities?

Absolutely! airSlate SignNow offers integrations with various popular platforms that Minnesota entities commonly use, such as CRM systems and cloud storage solutions. This enables businesses to automate workflows and manage documents more effectively. The flexibility of integrations helps Minnesota entities to maintain productivity across different applications.

-

Is airSlate SignNow compliant with Minnesota state laws?

Yes, airSlate SignNow is compliant with Minnesota state laws regarding electronic signatures and document management. This compliance assures Minnesota entities that their electronic transactions meet legal standards. Using a compliant solution like airSlate SignNow helps to protect your business from potential legal issues.

-

How secure is airSlate SignNow for Minnesota entities?

airSlate SignNow prioritizes security by implementing industry-standard encryption and robust access controls, ensuring that documents for Minnesota entities are safe from unauthorized access. The platform regularly undergoes security audits to maintain high standards of data protection. Minnesota entities can confidently use airSlate SignNow knowing their sensitive information is secure.

Get more for Minnesota Entity

Find out other Minnesota Entity

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe