Mn Payment Agreement Form

What is the Minnesota Payment Agreement?

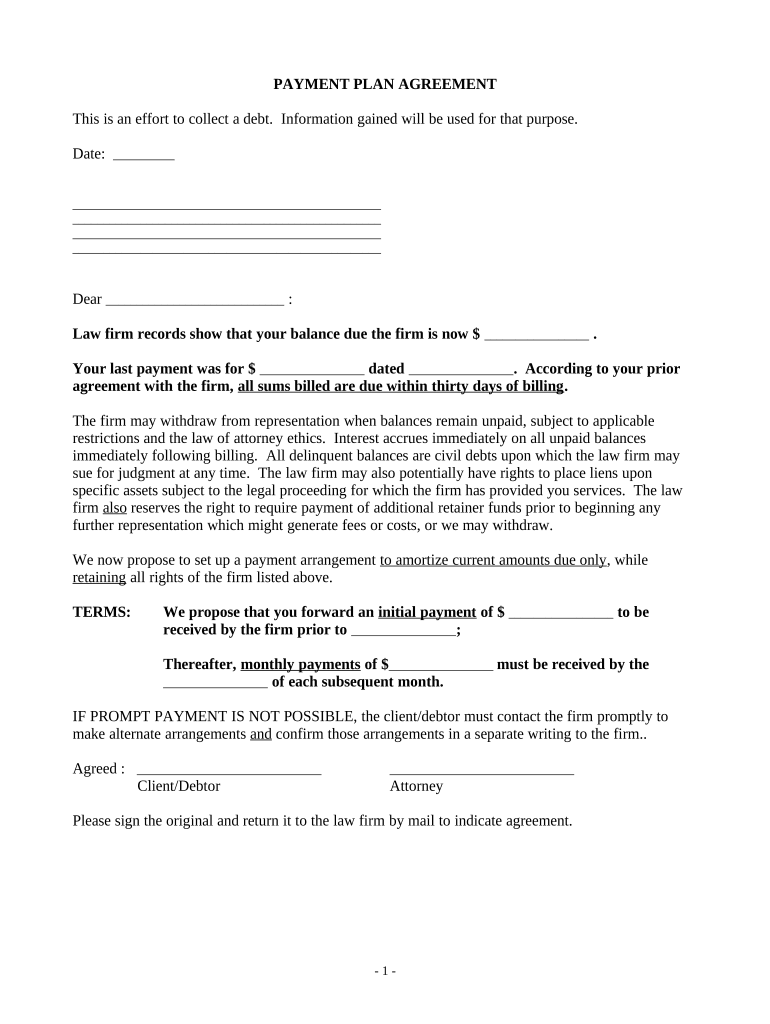

The Minnesota Payment Agreement is a formal document that outlines the terms and conditions under which a payment plan is established between a debtor and a creditor. This agreement is particularly useful for individuals or businesses facing financial difficulties, allowing them to repay their debts over a specified period. The document typically includes details such as the total amount owed, the payment schedule, interest rates, and any penalties for late payments. By formalizing the payment terms, both parties can ensure clarity and mutual understanding, reducing the likelihood of disputes.

Steps to Complete the Minnesota Payment Agreement

Completing the Minnesota Payment Agreement involves several key steps to ensure accuracy and compliance with legal standards. First, gather all necessary financial information, including the total debt amount and any relevant documentation. Next, fill out the agreement form, ensuring that all fields are completed accurately. It is crucial to include both parties' names, contact information, and signatures. After completing the form, review it for any errors or omissions. Finally, submit the agreement to the creditor for approval, keeping a copy for your records.

Legal Use of the Minnesota Payment Agreement

The Minnesota Payment Agreement serves as a legally binding contract once signed by both parties. To ensure its legal enforceability, it must meet specific requirements, such as clarity in terms and conditions and the inclusion of both parties' signatures. The agreement should also comply with Minnesota state laws regarding debt repayment and consumer protection. If a dispute arises, the agreement can be presented in court as evidence of the agreed-upon terms, making it essential to adhere to legal standards during its creation.

Key Elements of the Minnesota Payment Agreement

Several key elements must be included in the Minnesota Payment Agreement to ensure its effectiveness and legality. These elements typically encompass:

- Debtor and Creditor Information: Full names and contact details of both parties.

- Total Amount Owed: The complete debt amount that is being addressed.

- Payment Schedule: Specific dates and amounts for each payment.

- Interest Rates: Any applicable interest charges on the outstanding balance.

- Late Payment Penalties: Consequences for failing to make payments on time.

- Signatures: Both parties must sign the agreement to validate it.

How to Obtain the Minnesota Payment Agreement

To obtain the Minnesota Payment Agreement, individuals can typically access it through various channels. Many creditors provide their own version of the agreement upon request, especially if a payment plan is being negotiated. Additionally, templates for the Minnesota Payment Agreement can be found online, allowing users to customize them according to their specific needs. It is advisable to consult with a legal professional to ensure that the agreement meets all necessary legal requirements before use.

Examples of Using the Minnesota Payment Agreement

The Minnesota Payment Agreement can be utilized in various scenarios, such as:

- Individuals negotiating a payment plan for overdue utility bills.

- Businesses establishing a repayment schedule for outstanding invoices.

- Consumers working with credit card companies to settle debt over time.

- Landlords and tenants agreeing on a payment plan for overdue rent.

These examples illustrate the flexibility of the Minnesota Payment Agreement in addressing diverse financial situations while providing a structured approach to debt repayment.

Quick guide on how to complete mn payment agreement

Complete Mn Payment Agreement effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Mn Payment Agreement on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Mn Payment Agreement with ease

- Locate Mn Payment Agreement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Mn Payment Agreement to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is mn payment printable, and how does it benefit my business?

The mn payment printable refers to a feature that allows users to create, send, and eSign payment documents efficiently. This capability streamlines your payment processes, ensuring that all transactions are quick and secure. By utilizing mn payment printable, you can save time and reduce errors in payment documentation, enhancing overall business productivity.

-

How does airSlate SignNow assist with mn payment printable?

airSlate SignNow provides tools specifically designed to facilitate mn payment printable, allowing users to easily generate templates and send them for electronic signatures. This enables seamless transactions and provides a clear record of agreements. The platform’s user-friendly interface means that anyone can quickly create and manage their payment documents.

-

What are the pricing options for using airSlate SignNow for mn payment printable?

airSlate SignNow offers various pricing plans tailored to meet different business needs when utilizing mn payment printable. The pricing is competitive and based on features, such as the number of users and the volume of documents processed. You can choose a plan that aligns with your budget while ensuring you have access to powerful eSigning capabilities.

-

Is it possible to integrate mn payment printable into existing systems?

Yes, airSlate SignNow allows seamless integration with various business applications, enabling you to incorporate mn payment printable into your existing workflow easily. This integration ensures that your payment processes are not only efficient but also cohesive with other tools you may already be using. This flexibility can greatly enhance your operational efficiency.

-

What security measures are in place for mn payment printable?

AirSlate SignNow prioritizes security, offering features such as encrypted data transmission and secure cloud storage for all mn payment printable documents. This ensures that sensitive financial information remains protected during the eSigning process. You can manage access levels, providing peace of mind knowing that your documents are secure.

-

Can I customize the mn payment printable templates?

Absolutely! With airSlate SignNow, you can customize your mn payment printable templates to suit your specific business needs. This allows you to add your branding, specify fields for signatures, and adjust the layout as needed. Customizable templates enhance the professionalism and effectiveness of your payment documents.

-

How does using mn payment printable improve turnaround times?

Using mn payment printable with airSlate SignNow signNowly accelerates the document turnaround process. Traditional methods of sending payment documents can be slow and cumbersome, but with electronic signatures, approvals can be obtained in minutes. This efficiency not only improves cash flow but also enhances customer satisfaction.

Get more for Mn Payment Agreement

Find out other Mn Payment Agreement

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now