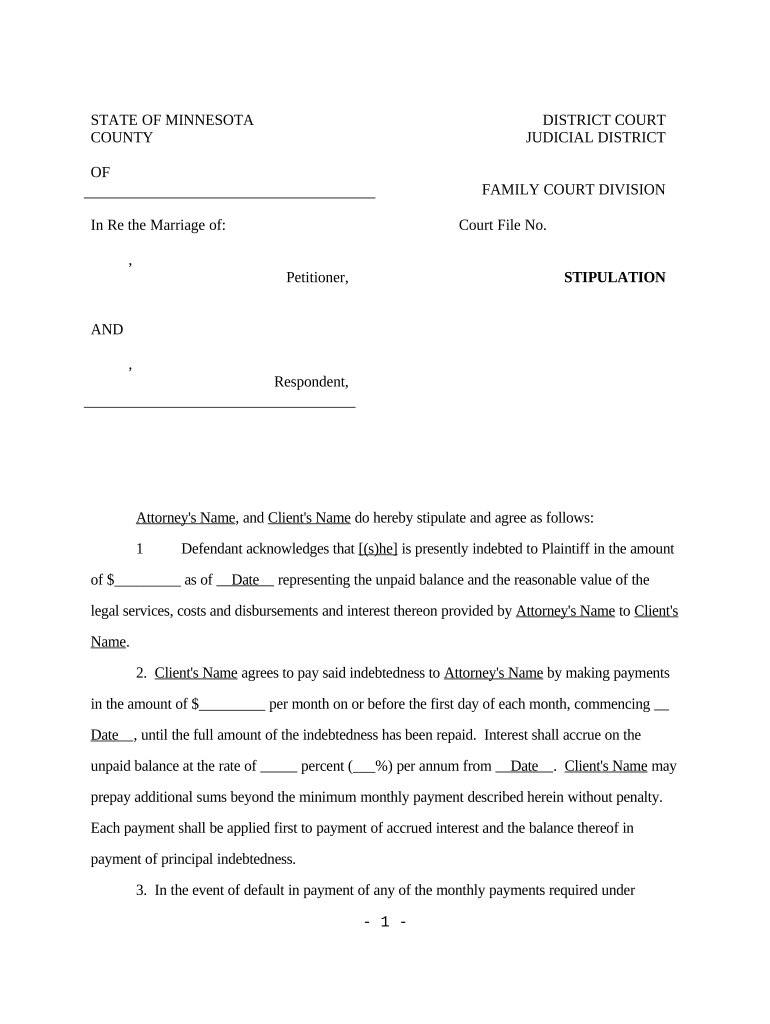

Mn Pay Form

What is the Mn Pay

The Mn Pay form is a specific document used for reporting and processing payroll-related information in Minnesota. This form is essential for employers to ensure compliance with state regulations regarding employee compensation and tax withholding. It captures vital details such as employee identification, earnings, and deductions, which are necessary for accurate tax reporting and payroll management.

How to use the Mn Pay

Using the Mn Pay form involves several steps to ensure that all required information is accurately reported. First, employers must gather necessary employee details, including Social Security numbers and wage information. Next, the form should be filled out carefully, ensuring that all sections are completed according to state guidelines. Once completed, the form can be submitted electronically or via mail, depending on the employer's preference and state requirements.

Steps to complete the Mn Pay

Completing the Mn Pay form involves a systematic approach to ensure accuracy and compliance:

- Gather employee information, including names, addresses, and Social Security numbers.

- Collect data on wages, hours worked, and any deductions applicable.

- Fill out the Mn Pay form, ensuring all fields are completed correctly.

- Review the form for accuracy, checking for any errors or omissions.

- Submit the form electronically through the designated state portal or send it via mail to the appropriate address.

Legal use of the Mn Pay

The Mn Pay form is legally binding when completed and submitted in accordance with Minnesota state laws. Employers must ensure that the information provided is truthful and accurate to avoid legal repercussions. Compliance with state regulations not only protects the employer but also ensures that employees receive their rightful compensation and tax benefits.

Key elements of the Mn Pay

Several key elements are crucial for the Mn Pay form to be valid and effective:

- Employee Information: Accurate details about the employee, including their full name and Social Security number.

- Wage Information: Clear reporting of hours worked and total earnings.

- Deductions: Any applicable deductions must be clearly stated, including taxes and benefits.

- Employer Signature: The form must be signed by an authorized representative of the employer to validate its submission.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the Mn Pay form to maintain compliance. Typically, these deadlines align with payroll periods, and late submissions can result in penalties. It is advisable to keep a calendar of important dates, including the end of each quarter and annual reporting deadlines, to ensure timely filing.

Quick guide on how to complete mn pay

Effortlessly Prepare Mn Pay on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without complications. Manage Mn Pay on any device using airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

The simplest way to modify and eSign Mn Pay effortlessly

- Locate Mn Pay and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Edit and eSign Mn Pay and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is mn pay with airSlate SignNow?

Mn pay with airSlate SignNow refers to the ability to process electronic payments through our eSignature platform. This feature allows users to collect payments directly within the signed documents, streamlining transactions and providing a seamless experience for businesses and clients alike.

-

How much does it cost to use mn pay on airSlate SignNow?

The pricing for mn pay on airSlate SignNow depends on the selected subscription plan. Generally, our plans are designed to be cost-effective, enabling businesses of all sizes to easily integrate payment solutions while ensuring comprehensive access to our eSignature features.

-

What features are included with mn pay on airSlate SignNow?

The mn pay feature on airSlate SignNow includes customizable payment options, invoice management, and secure payment processing. These features enhance the overall user experience by integrating payment collection directly into your workflow, making it effortless to manage transactions.

-

Is mn pay easy to integrate with existing systems?

Yes, mn pay is designed for easy integration with existing systems and platforms. airSlate SignNow supports various integrations that allow you to connect your CRM, accounting software, and other tools, ensuring a smooth transition and efficient use of the mn pay feature.

-

How secure are transactions processed with mn pay?

Transactions processed through mn pay on airSlate SignNow are highly secure, utilizing advanced encryption and security protocols. This ensures that sensitive payment information is protected, giving both businesses and clients peace of mind during transactions.

-

Can mn pay be used for different types of documents?

Absolutely! Mn pay can be utilized for various document types, such as contracts, invoices, and agreements. This versatility allows businesses to effectively manage payments across a wide range of documents, streamlining their operations signNowly.

-

What are the benefits of using mn pay for my business?

Using mn pay on airSlate SignNow offers numerous benefits, including increased efficiency in payment collection, reduced turnaround times for signed documents, and enhanced customer satisfaction. These advantages help businesses improve cash flow and streamline their document management processes.

Get more for Mn Pay

Find out other Mn Pay

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy