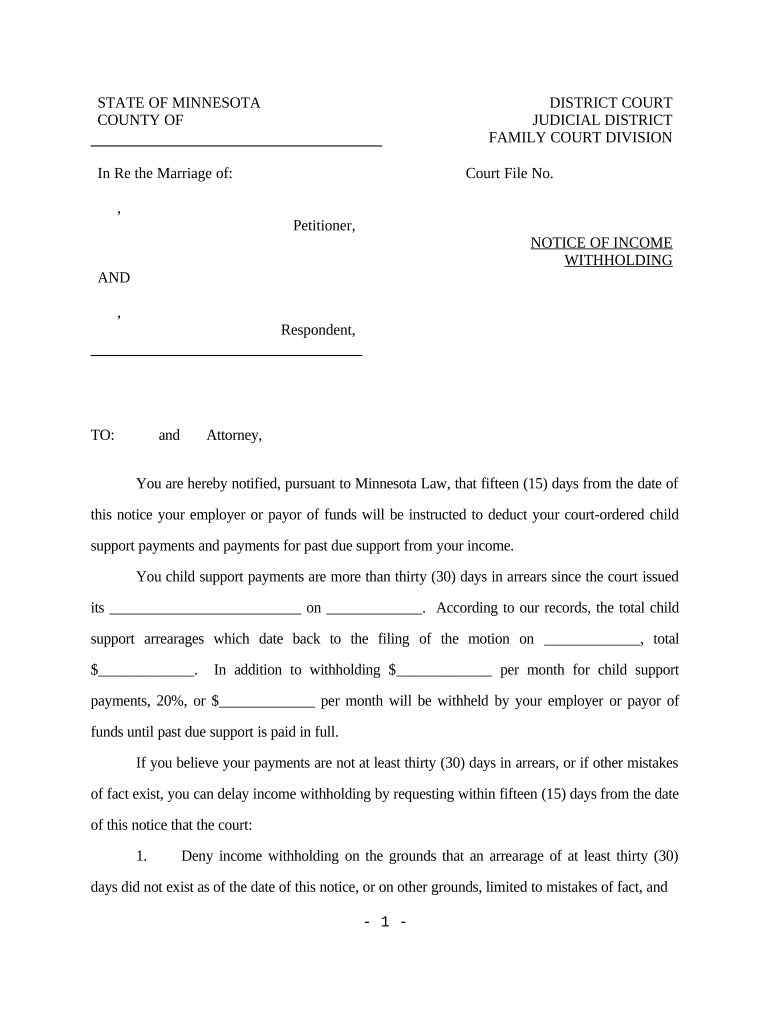

Mn Withholding Form

What is the Minnesota Withholding?

The Minnesota withholding refers to the process by which employers deduct state income tax from employees' wages. This system ensures that employees contribute to state revenue throughout the year rather than in a lump sum at tax time. The amount withheld is based on the employee's earnings and the information provided on their Minnesota Employee Withholding Allowance Certificate, commonly known as the MN W-4. Understanding this process is crucial for both employers and employees to ensure compliance with state tax laws.

Steps to Complete the Minnesota Withholding

Completing the Minnesota withholding process involves several key steps:

- Obtain the Minnesota Employee Withholding Allowance Certificate (MN W-4) from the employee.

- Calculate the appropriate withholding amount based on the employee's income and the allowances claimed.

- Deduct the calculated amount from each paycheck.

- Report and remit the withheld amounts to the Minnesota Department of Revenue according to the established schedule.

Employers should ensure that they keep accurate records of all withholdings and any changes made to employee withholding allowances throughout the year.

Legal Use of the Minnesota Withholding

The legal use of the Minnesota withholding is governed by state tax laws and regulations. Employers are required to withhold state income tax from employee wages and remit these amounts to the state. Failure to comply with these regulations can result in penalties for both the employer and the employee. It is essential for employers to stay informed about any changes in withholding laws to ensure ongoing compliance.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for remitting withheld income taxes to the Minnesota Department of Revenue. Key dates include:

- Monthly filers must remit taxes by the 15th of the following month.

- Quarterly filers must submit their payments by the last day of the month following the end of the quarter.

- Annual filers must submit their payment by January 31 of the following year.

Staying aware of these deadlines helps avoid late fees and penalties.

Who Issues the Form?

The Minnesota Employee Withholding Allowance Certificate (MN W-4) is issued by the Minnesota Department of Revenue. This form is essential for employees to indicate their withholding preferences, including the number of allowances they wish to claim. Employers should provide this form to new hires and ensure it is completed accurately to facilitate proper withholding.

Penalties for Non-Compliance

Non-compliance with Minnesota withholding regulations can lead to significant penalties for employers. These may include:

- Fines for failure to withhold the correct amount of state income tax.

- Interest on unpaid taxes.

- Potential audits from the Minnesota Department of Revenue.

Employers are encouraged to regularly review their withholding practices to ensure compliance and avoid these penalties.

Eligibility Criteria

Eligibility for Minnesota withholding applies to all employers with employees working in Minnesota. Employers must withhold state income tax from wages paid to employees unless specific exemptions apply. Employees must complete the MN W-4 to establish their withholding allowances, which will determine the amount of tax withheld from their earnings. Understanding these criteria is vital for both employers and employees to ensure proper tax compliance.

Quick guide on how to complete mn withholding 497312495

Manage Mn Withholding seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers a fantastic environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents promptly without interruptions. Process Mn Withholding on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and electronically sign Mn Withholding effortlessly

- Locate Mn Withholding and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Adjust and electronically sign Mn Withholding to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota notice in the context of electronic signatures?

A Minnesota notice refers to the legal requirements for certain documents that must be properly notified when signed electronically. Using airSlate SignNow, you can ensure your Minnesota notice complies with state laws, making it easy to manage important notifications remotely.

-

How does airSlate SignNow ensure compliance with Minnesota notice regulations?

airSlate SignNow is designed with compliance in mind, including features that help you adhere to Minnesota notice regulations. Our platform includes built-in notifications and eSignature verification processes that align with Minnesota's legal standards for document execution.

-

What features does airSlate SignNow offer for managing Minnesota notices?

Our platform offers features such as customizable templates, automated reminders, and tracking for Minnesota notices. These tools allow you to manage the entire signing process efficiently while ensuring your documents meet state compliance requirements.

-

Is airSlate SignNow suitable for individuals and businesses handling Minnesota notices?

Yes, airSlate SignNow is suitable for both individuals and businesses that need to manage Minnesota notices. Our cost-effective solution is designed to cater to diverse user needs, streamlining document management for any scale of operation.

-

What are the pricing options for airSlate SignNow when dealing with Minnesota notices?

airSlate SignNow offers flexible pricing plans that accommodate various budgets, making it easier to manage Minnesota notices without breaking the bank. Whether you're a solo entrepreneur or part of a large organization, you can choose a plan that fits your needs.

-

Can I integrate airSlate SignNow with other applications for managing Minnesota notices?

Absolutely! airSlate SignNow supports integration with various applications such as CRM tools and project management software, allowing you to streamline the handling of Minnesota notices. This integration enhances your workflow and ensures that all necessary documentation is efficiently managed.

-

How can airSlate SignNow improve my workflow for sending Minnesota notices?

By utilizing airSlate SignNow, you can automate the process of sending Minnesota notices, reducing manual tasks and minimizing errors. Our user-friendly interface and automation features help you save time and maintain a smooth workflow when managing important documents.

Get more for Mn Withholding

- Application for transport concession card sa gov au home sa gov form

- Hud vash handbook form

- Montana mw3 form

- Professional hours request form 1508224

- Schoolcraft college transcript request form send transcript schoolcraft

- Comprehensive physical exam form

- Fillable 1348 form

- Event oriented counseling pdf form

Find out other Mn Withholding

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship