Mn Collect Form

What is the Mn Collect?

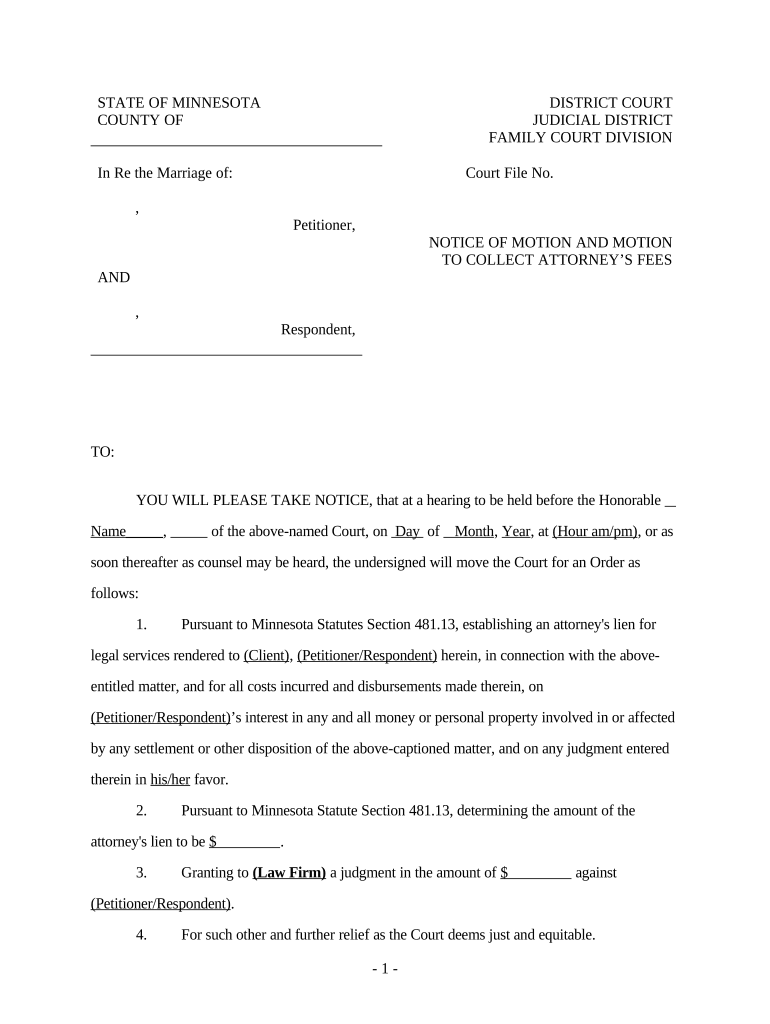

The Mn Collect form is a specific document used in the state of Minnesota, primarily for collecting certain types of information or fees. It is often utilized by various organizations, including educational institutions and governmental bodies, to gather necessary data from individuals or entities. This form plays a crucial role in ensuring compliance with state regulations and is essential for maintaining accurate records.

How to use the Mn Collect

Using the Mn Collect form involves several straightforward steps. First, individuals should obtain the form from the relevant issuing authority, which may vary depending on the context of its use. Once the form is in hand, users should carefully fill out all required fields, ensuring that all information is accurate and complete. After completing the form, it can be submitted electronically or via traditional mail, depending on the specific guidelines provided by the issuing agency.

Steps to complete the Mn Collect

Completing the Mn Collect form involves a series of clear steps:

- Obtain the latest version of the Mn Collect form from the appropriate source.

- Review the instructions accompanying the form to understand the requirements.

- Fill in all necessary information, ensuring accuracy to avoid delays.

- Attach any required documents, if applicable.

- Submit the form as directed, either online or through the mail.

Legal use of the Mn Collect

The legal use of the Mn Collect form is governed by state laws and regulations. To ensure that the form is legally binding, it must be filled out correctly and submitted in accordance with the guidelines provided by the issuing authority. Compliance with these regulations is crucial, as improper use may lead to penalties or rejection of the form.

Key elements of the Mn Collect

Key elements of the Mn Collect form include:

- Identification information of the individual or entity submitting the form.

- Specific data fields relevant to the purpose of the collection.

- Signature or acknowledgment section to validate the submission.

- Instructions for submission and any additional requirements.

Examples of using the Mn Collect

The Mn Collect form can be used in various scenarios, such as:

- Collecting student information for enrollment in educational programs.

- Gathering data for state-funded projects or grants.

- Processing applications for licenses or permits.

Form Submission Methods

Submitting the Mn Collect form can typically be done through multiple methods, including:

- Online submission via a designated portal.

- Mailing the completed form to the appropriate address.

- In-person delivery at specified offices or agencies.

Quick guide on how to complete mn collect

Effortlessly Prepare Mn Collect on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any delays. Handle Mn Collect on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Edit and Electronically Sign Mn Collect with Ease

- Locate Mn Collect and click Get Form to begin.

- Use the available tools to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your updates.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mn Collect to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is mn collect in airSlate SignNow?

Mn collect is a feature within airSlate SignNow that allows users to manage and collect signatures on documents efficiently. With this tool, businesses can streamline their document workflow and ensure that signatures are obtained promptly, enhancing the overall operational efficiency.

-

How much does the mn collect feature cost?

The mn collect feature is part of the airSlate SignNow subscription plans, which offer various pricing options to suit different business needs. Users can choose from basic to advanced plans, ensuring that they only pay for the features they require, including the highly useful mn collect functionality.

-

What are the main benefits of using mn collect?

Utilizing mn collect in airSlate SignNow provides numerous benefits, including faster document turnaround times and improved customer satisfaction. It also reduces administrative burdens, allowing team members to focus on core tasks while effectively managing document signing processes.

-

Is mn collect easy to integrate with other tools?

Yes, mn collect is designed for easy integration with a variety of third-party applications and tools. airSlate SignNow offers robust APIs and pre-built integrations, making it simple for businesses to incorporate mn collect into their existing workflows and enhance productivity.

-

Can I track the status of documents with mn collect?

Absolutely! The mn collect feature allows users to track the status of documents in real-time. This transparency helps businesses stay organized and informed on the progress of their document signing processes, ensuring timely follow-ups if necessary.

-

What types of documents can I collect signatures on using mn collect?

With mn collect, you can request signatures on a wide range of documents, including contracts, agreements, and forms. This versatility ensures that all your important documents can be handled efficiently, providing a comprehensive solution for various business needs.

-

Does airSlate SignNow offer support for users of mn collect?

Yes, airSlate SignNow provides comprehensive support for users utilizing mn collect. Their customer service team is available to assist with any questions or challenges, ensuring that you get the most out of this powerful document management tool.

Get more for Mn Collect

- Jenness hannigan research fellowship application form cgu

- New owners eog resources direct deposit invitation and enrollment form 10 15 18 docx

- Fna form

- C o m drapery order form castec

- Misconduct restraining order application childrenamp39s court of childrenscourt wa gov form

- It nrcohio nonresident credit calculationu form

- Non disclosure for software development agreement template form

- Music artist investor contract template form

Find out other Mn Collect

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors