Financial Account Transfer to Living Trust Minnesota Form

What is the Financial Account Transfer To Living Trust Minnesota

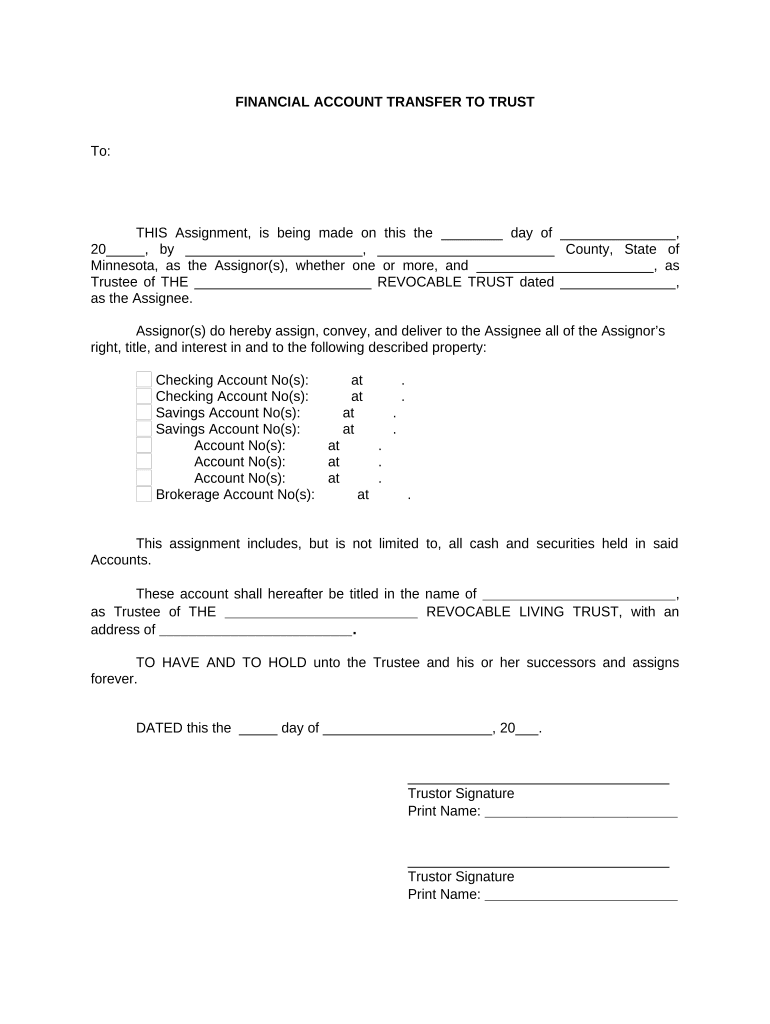

The Financial Account Transfer To Living Trust Minnesota form is a legal document that facilitates the transfer of financial assets into a living trust. This process allows individuals to manage their assets during their lifetime and ensures a smooth transition of ownership upon death. By placing financial accounts, such as bank accounts, investment accounts, and retirement accounts, into a living trust, individuals can avoid probate and maintain privacy regarding their estate. This form is essential for those looking to establish a living trust in Minnesota, ensuring compliance with state laws and regulations.

Steps to Complete the Financial Account Transfer To Living Trust Minnesota

Completing the Financial Account Transfer To Living Trust Minnesota form involves several key steps:

- Gather necessary information, including the names of the trust, trustee, and beneficiaries.

- Identify the financial accounts to be transferred, ensuring they are eligible for inclusion in the trust.

- Complete the form accurately, providing all required details about the financial accounts and the living trust.

- Sign the form in accordance with Minnesota state laws, ensuring that all signatures are properly witnessed or notarized if required.

- Submit the completed form to the relevant financial institutions to initiate the transfer process.

Legal Use of the Financial Account Transfer To Living Trust Minnesota

The Financial Account Transfer To Living Trust Minnesota form is legally binding when executed correctly. To ensure its validity, it must comply with Minnesota state laws regarding trusts and estates. This includes proper signatures, potential notarization, and adherence to any specific requirements set forth by the financial institutions involved. Utilizing this form helps protect the interests of the trust and its beneficiaries, ensuring that assets are managed according to the grantor's wishes.

State-Specific Rules for the Financial Account Transfer To Living Trust Minnesota

In Minnesota, specific rules govern the creation and management of living trusts. These include:

- The trust must be established in writing and signed by the grantor.

- Trustees must act in the best interest of the beneficiaries and follow the terms outlined in the trust document.

- Assets transferred into the trust must be properly titled in the name of the trust to avoid legal complications.

Understanding these state-specific rules is crucial for ensuring that the Financial Account Transfer To Living Trust Minnesota form is completed and executed correctly.

Required Documents for the Financial Account Transfer To Living Trust Minnesota

To effectively complete the Financial Account Transfer To Living Trust Minnesota form, certain documents may be required:

- A copy of the living trust document, which outlines the terms and conditions of the trust.

- Identification documents for the grantor and trustee, such as a driver's license or passport.

- Account statements or documentation from the financial institutions holding the accounts to be transferred.

Having these documents ready can streamline the process and reduce potential delays in transferring financial accounts into the trust.

How to Use the Financial Account Transfer To Living Trust Minnesota

Using the Financial Account Transfer To Living Trust Minnesota form involves several straightforward steps:

- Review the trust document to ensure all details are current and accurate.

- Fill out the transfer form with the necessary account information and trust details.

- Submit the completed form to the financial institutions managing the accounts.

- Confirm with the institutions that the transfer has been processed and that the accounts are now titled in the name of the trust.

Following these steps helps ensure that the financial accounts are properly integrated into the living trust, facilitating effective management and distribution of assets.

Quick guide on how to complete financial account transfer to living trust minnesota

Easily Prepare Financial Account Transfer To Living Trust Minnesota on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Financial Account Transfer To Living Trust Minnesota on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Optimal Method to Edit and Electronically Sign Financial Account Transfer To Living Trust Minnesota Effortlessly

- Locate Financial Account Transfer To Living Trust Minnesota and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize critical parts of your documents or obscure sensitive details using tools specifically designed for this purpose by airSlate SignNow.

- Formulate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your delivery method, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget the hassles of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Financial Account Transfer To Living Trust Minnesota and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a financial account transfer to a living trust in Minnesota?

A financial account transfer to a living trust in Minnesota involves moving your bank and investment accounts into a trust to ensure your assets are managed according to your wishes. This process helps avoid probate and can provide a smoother transition for your beneficiaries. It’s important to understand the legal requirements in Minnesota for making this transfer effectively.

-

Why should I consider transferring my financial accounts to a living trust in Minnesota?

Transferring your financial accounts to a living trust in Minnesota enhances asset protection and allows for efficient management of your estate after your passing. This process also helps reduce probate costs and delays, ensuring that your beneficiaries can access their inheritance without unnecessary legal hurdles. It's a proactive step in estate planning.

-

How can airSlate SignNow help with the financial account transfer to a living trust in Minnesota?

airSlate SignNow provides a seamless platform for securely signing and managing documents related to your financial account transfer to a living trust in Minnesota. With our user-friendly interface, you can efficiently eSign necessary forms, and ensure that your estate planning documents are handled securely and timely. Our solution simplifies the process and helps you keep track of all documents.

-

Are there any fees associated with the financial account transfer to a living trust in Minnesota?

Yes, there may be fees related to transferring financial accounts to a living trust in Minnesota, which can include attorney fees, filing fees, or costs associated with document preparation. However, using airSlate SignNow can help minimize costs associated with document management and signing. It's advisable to consult with a financial advisor or estate attorney for a full breakdown of potential expenses.

-

What types of accounts can be transferred to a living trust in Minnesota?

In Minnesota, you can transfer various financial accounts to a living trust, including bank accounts, brokerage accounts, retirement accounts, and more. Each type of account may have specific procedures or forms required to facilitate the transfer. Utilizing airSlate SignNow streamlines the documentation process, ensuring accuracy and compliance with state laws.

-

Is it necessary to update my financial documents after transferring to a living trust in Minnesota?

Yes, it is essential to update any relevant financial documents after completing a financial account transfer to a living trust in Minnesota. This ensures that all your assets are correctly aligned with your estate planning intentions. Regularly reviewing and updating your documents will help maintain clarity and prevent future disputes among beneficiaries.

-

What benefits does a living trust offer compared to a will in Minnesota?

A living trust in Minnesota offers several advantages over a will, including avoiding probate, maintaining privacy, and providing greater control over asset distribution. Unlike a will, which becomes public upon death, a living trust remains private. Additionally, a living trust allows for continuous management of assets during your lifetime, offering peace of mind and flexibility.

Get more for Financial Account Transfer To Living Trust Minnesota

- Candidate application form

- 1 form no 35 see rule 45 appeal to the commissioner

- Model cerere inscriere politie completata form

- Tpri student summary sheet form

- Laptop checkout form 367911859

- Schedule z additional information required for net nstar

- Petition for an incomplete columbus college of art and design ccad form

- Parenting plan co parenting agreement template form

Find out other Financial Account Transfer To Living Trust Minnesota

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now