Petition for Estate Tax Refund Form Illinois State Treasurer Treasurer Il

Understanding the Petition for Estate Tax Refund Form

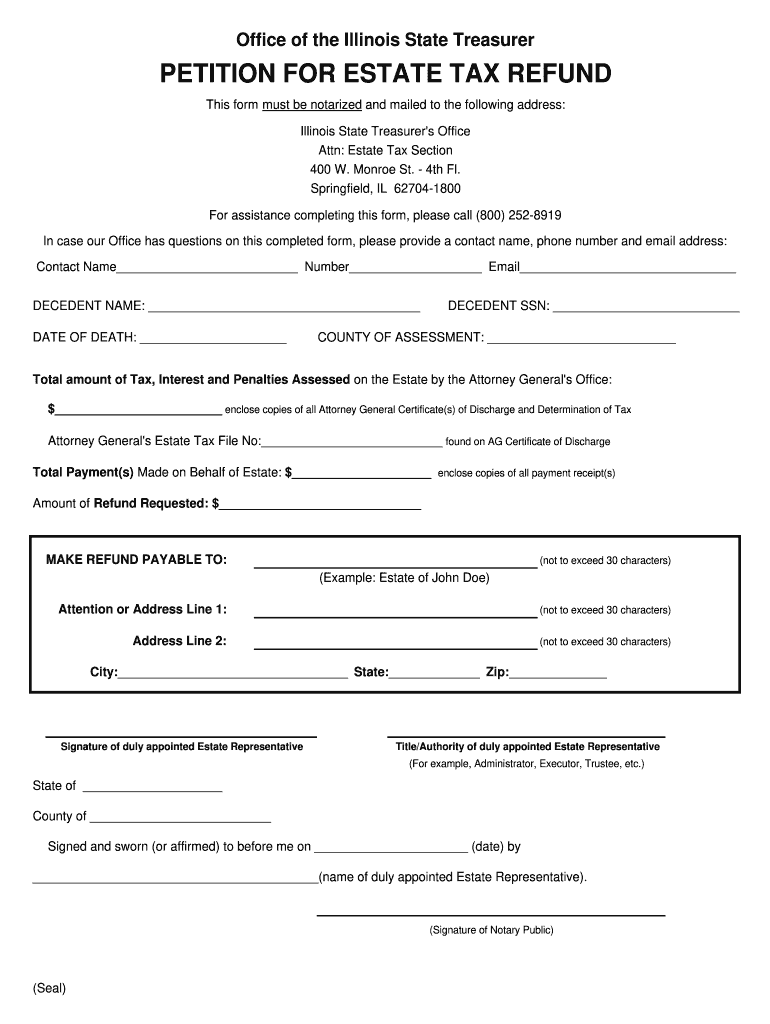

The Petition for Estate Tax Refund Form is a crucial document for individuals seeking to reclaim overpaid estate taxes in Illinois. This form is typically submitted to the Illinois State Treasurer's Office and serves as a formal request for a refund. It is important for taxpayers to understand the specific circumstances under which they can file this petition, including eligibility criteria and the necessary supporting documentation.

Steps to Complete the Petition for Estate Tax Refund Form

Completing the Petition for Estate Tax Refund Form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including proof of the original estate tax payment. Next, fill out the form with accurate information, ensuring that all required fields are completed. It is essential to double-check the details for any errors or omissions. Finally, sign and date the form before submission to the Illinois State Treasurer's Office.

Required Documents for Submission

When submitting the Petition for Estate Tax Refund Form, certain documents must accompany the application. These typically include:

- Proof of payment of the original estate tax.

- A copy of the death certificate of the decedent.

- Any relevant financial statements that support the claim for a refund.

Having these documents ready can expedite the processing of your petition.

Filing Methods for the Petition for Estate Tax Refund Form

The Petition for Estate Tax Refund Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the Illinois State Treasurer's website, send it via mail, or deliver it in person to the appropriate office. Each method has its own processing times, so it is advisable to select the one that best fits your needs.

Eligibility Criteria for Filing the Petition

Eligibility to file the Petition for Estate Tax Refund Form is generally based on specific criteria set by the state. Taxpayers must have paid estate taxes that exceed the amount owed or have experienced changes in their financial situation that warrant a refund. Additionally, the request must be made within a certain timeframe following the original payment to be considered valid.

Legal Use of the Petition for Estate Tax Refund Form

The legal use of the Petition for Estate Tax Refund Form is governed by Illinois state tax laws. It is essential for taxpayers to ensure that their petition complies with all legal requirements to avoid delays or rejections. Understanding the legal framework surrounding estate tax refunds can help individuals navigate the process more effectively.

Important Filing Deadlines

Filing deadlines for the Petition for Estate Tax Refund Form are critical to ensure that claims are processed in a timely manner. Generally, taxpayers must submit their petitions within a specific period following the payment of estate taxes. It is advisable to check the latest guidelines from the Illinois State Treasurer's Office to stay informed about any changes to these deadlines.

Quick guide on how to complete petition for estate tax refund form illinois state treasurer treasurer il

Complete Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il effortlessly on any gadget

Digital document management has become widely embraced by businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without interruptions. Manage Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The most efficient way to modify and eSign Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il with ease

- Find Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you prefer. Adapt and eSign Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the petition for estate tax refund form illinois state treasurer treasurer il

How to create an electronic signature for your Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il online

How to make an eSignature for the Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il in Chrome

How to make an electronic signature for putting it on the Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il in Gmail

How to generate an eSignature for the Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il right from your smartphone

How to make an eSignature for the Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il on iOS devices

How to make an electronic signature for the Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il on Android OS

People also ask

-

What is the inheritance tax waiver form Illinois?

The inheritance tax waiver form Illinois is a legal document that allows heirs to request an exemption from paying inheritance taxes on certain assets. This form is essential for simplifying the estate settlement process and ensuring that beneficiaries can receive their inheritance without undue financial burden.

-

How can I obtain the inheritance tax waiver form Illinois?

You can easily obtain the inheritance tax waiver form Illinois through your local county clerk's office or online via government websites. Utilizing airSlate SignNow, you can fill out and eSign this form online, making the process more efficient and convenient.

-

What are the benefits of using airSlate SignNow for the inheritance tax waiver form Illinois?

Using airSlate SignNow for the inheritance tax waiver form Illinois ensures a streamlined and secure signing process. Our platform allows you to fill, sign, and send documents all in one place, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the inheritance tax waiver form Illinois?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Our competitive pricing ensures that you have access to a robust platform for managing the inheritance tax waiver form Illinois and other important documents without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for the inheritance tax waiver form Illinois?

Absolutely! airSlate SignNow supports integration with numerous applications, allowing for a seamless workflow. This means you can easily link your inheritance tax waiver form Illinois processing with other tools you already use, enhancing your overall efficiency.

-

How does airSlate SignNow ensure the security of the inheritance tax waiver form Illinois?

airSlate SignNow employs industry-leading security measures, including encryption and secure data storage, to protect your documents. When handling important forms like the inheritance tax waiver form Illinois, you can trust that your information remains confidential and secure.

-

What features does airSlate SignNow offer for handling the inheritance tax waiver form Illinois?

airSlate SignNow provides essential features such as document templates, customizable workflows, and unlimited eSignatures. These features simplify the process for the inheritance tax waiver form Illinois, allowing you to manage your documents efficiently.

Get more for Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il

- Marital legal separation and property settlement agreement where minor children and no joint property or debts that is 497295933 form

- Marital legal separation and property settlement agreement where minor children and parties may have joint property or debts 497295934 form

- Alabama marital form

- Agreement no children form

- Marital legal separation and property settlement agreement where no children and parties may have joint property and or debts 497295937 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497295938 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts where form

- Legal separation and property settlement agreement with adult children marital parties may have joint property or debts form

Find out other Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist