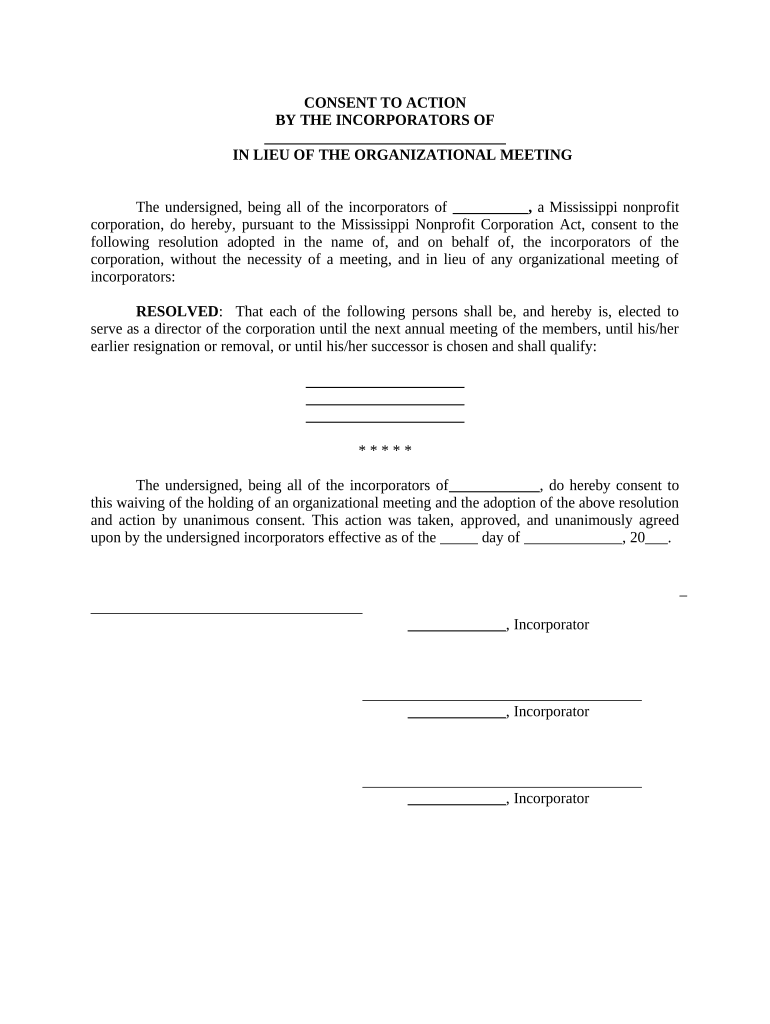

Mississippi Nonprofit Form

What is the Mississippi Nonprofit

The Mississippi nonprofit is a legal entity established to operate for charitable, educational, or other public benefit purposes without the intent of making a profit. This type of organization can engage in various activities, such as providing community services, supporting education, or promoting the arts. Nonprofits in Mississippi must adhere to specific regulations and requirements set by both state and federal laws to maintain their tax-exempt status.

How to use the Mississippi Nonprofit

Using the Mississippi nonprofit involves several steps, including registration, compliance with state laws, and maintaining good standing. Organizations must first file the necessary paperwork with the Mississippi Secretary of State to obtain their nonprofit status. Once established, nonprofits must comply with ongoing reporting requirements, such as submitting annual financial statements and maintaining accurate records of their activities and finances.

Steps to complete the Mississippi Nonprofit

Completing the Mississippi nonprofit involves a series of structured steps:

- Choose a unique name for the organization that complies with state naming regulations.

- Draft and adopt bylaws that outline the governance structure and operational procedures.

- File the Articles of Incorporation with the Mississippi Secretary of State, including the required fees.

- Apply for an Employer Identification Number (EIN) from the IRS, necessary for tax purposes.

- Complete the application for 501(c)(3) status to obtain federal tax-exempt status.

- Establish a board of directors to oversee the organization’s activities and ensure compliance.

Legal use of the Mississippi Nonprofit

The legal use of the Mississippi nonprofit is governed by both state and federal laws. To be legally recognized, the organization must operate within the scope defined in its Articles of Incorporation and bylaws. Compliance with tax regulations, including filing annual returns and maintaining records, is essential to uphold the nonprofit's status. Additionally, nonprofits must ensure that their activities align with their stated mission and do not engage in prohibited activities, such as political campaigning.

Required Documents

To establish a Mississippi nonprofit, several key documents are required:

- Articles of Incorporation, which outline the organization’s purpose and structure.

- Bylaws that govern the internal management of the organization.

- Employer Identification Number (EIN) application.

- Form 1023 or Form 1023-EZ for federal tax exemption.

- State registration forms as required by the Mississippi Secretary of State.

Eligibility Criteria

To qualify as a Mississippi nonprofit, an organization must meet specific eligibility criteria. These include having a defined charitable purpose, operating primarily for the public benefit, and ensuring that no part of the organization's income benefits any private individual or shareholder. Additionally, the organization must have a governing board that meets regularly and maintains appropriate records of its activities and finances.

Quick guide on how to complete mississippi nonprofit

Complete Mississippi Nonprofit seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-conscious alternative to conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Mississippi Nonprofit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Mississippi Nonprofit effortlessly

- Obtain Mississippi Nonprofit and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information, then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Alter and electronically sign Mississippi Nonprofit to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for Mississippi nonprofits?

airSlate SignNow offers an array of features tailored for Mississippi nonprofits, including customizable templates, secure document storage, and automated workflows. These features simplify the signing process and enhance productivity, making it easier for your organization to manage essential paperwork.

-

How can Mississippi nonprofits benefit from using airSlate SignNow?

Mississippi nonprofits can benefit from airSlate SignNow by reducing the time and costs associated with paper documents. The platform enables faster contract signing, improved compliance, and better document tracking, allowing organizations to focus more on their mission and less on administrative tasks.

-

What is the pricing structure for airSlate SignNow for Mississippi nonprofits?

airSlate SignNow offers competitive pricing designed for Mississippi nonprofits, with various plans to fit different budgets. Organizations can choose between monthly and annual subscriptions, ensuring affordability while providing access to essential e-signature features.

-

Is airSlate SignNow compliant with regulations for Mississippi nonprofits?

Yes, airSlate SignNow is fully compliant with applicable regulations for Mississippi nonprofits, including e-signature laws such as ESIGN and UETA. This compliance ensures that your documents are legally binding and secure, giving you peace of mind when managing sensitive information.

-

Can airSlate SignNow integrate with other tools I use as a Mississippi nonprofit?

Absolutely! airSlate SignNow seamlessly integrates with commonly used tools like Google Drive, Dropbox, and various CRM systems. This integration allows Mississippi nonprofits to streamline their processes and enhance overall efficiency.

-

How secure is airSlate SignNow for Mississippi nonprofit organizations?

Security is a top priority at airSlate SignNow. The platform utilizes industry-standard encryption and secure servers to protect the data of Mississippi nonprofits, ensuring that all documents and transactions are safeguarded against unauthorized access.

-

Does airSlate SignNow provide customer support for Mississippi nonprofits?

Yes, airSlate SignNow offers dedicated customer support for Mississippi nonprofits, assisting with any inquiries and providing guidance on using the platform effectively. Support is available through multiple channels, including email, chat, and phone, ensuring you receive timely assistance.

Get more for Mississippi Nonprofit

- Replacement application for concealed firearm permit publicsafety utah form

- Valero com newcard form

- Lesson 2 extra practice area of circles answer key 389281946 form

- Section 14 3 mechanical advantage and efficiency answer key pdf form

- Separation form buncombe county schools buncombe k12 nc

- Non compete confidentiality agreement template form

- Non compete employee agreement template form

- Non compete non disclosure agreement template form

Find out other Mississippi Nonprofit

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple