Business Credit Application Mississippi Form

What is the Business Credit Application Mississippi

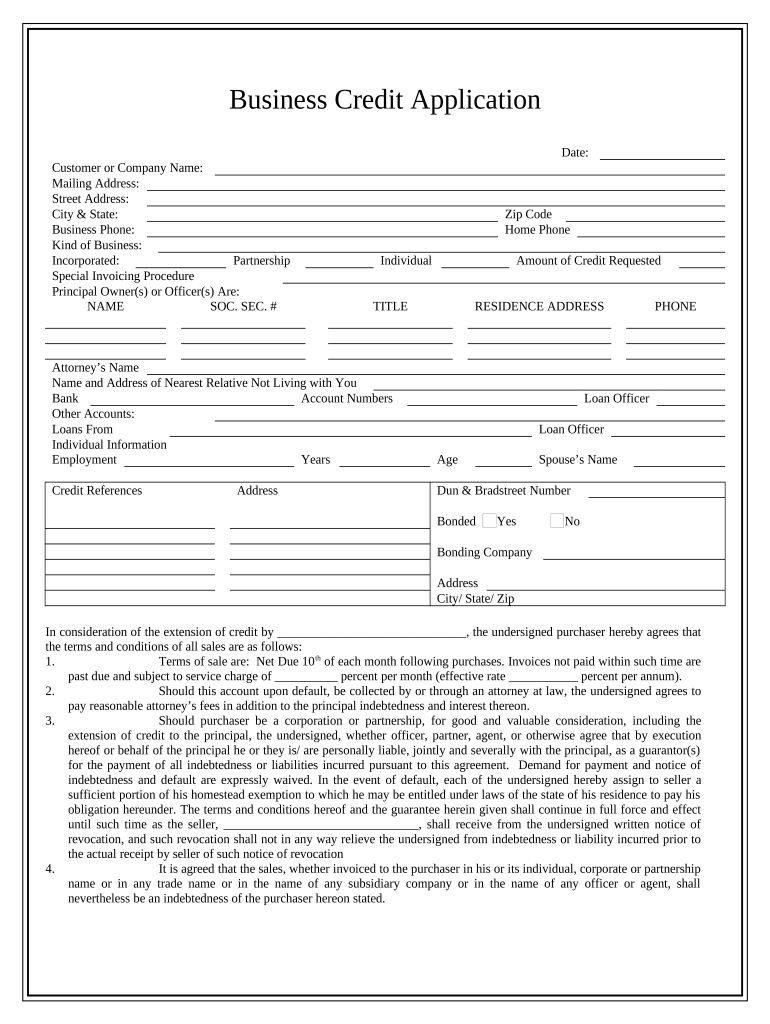

The Business Credit Application Mississippi is a formal document used by businesses in Mississippi to apply for credit from lenders or suppliers. This application collects essential information about the business, including its legal structure, financial status, and credit history. It serves as a critical tool for assessing the creditworthiness of a business, allowing lenders to make informed decisions regarding credit limits and terms. Completing this application accurately is vital for a successful credit request.

Key elements of the Business Credit Application Mississippi

Understanding the key elements of the Business Credit Application Mississippi is essential for successful completion. The application typically includes:

- Business Information: Name, address, and contact details of the business.

- Ownership Structure: Details about the business owners, including their names and ownership percentages.

- Financial Information: Current financial statements, including income, expenses, and assets.

- Credit History: Information regarding previous credit accounts and payment history.

- Purpose of Credit: A description of how the requested credit will be used.

Steps to complete the Business Credit Application Mississippi

Completing the Business Credit Application Mississippi involves several important steps:

- Gather Documentation: Collect all necessary documents, such as financial statements and ownership details.

- Fill Out the Application: Accurately enter all required information in the application form.

- Review for Accuracy: Double-check all entries to ensure correctness and completeness.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Business Credit Application Mississippi

The legal use of the Business Credit Application Mississippi is governed by various laws and regulations. To ensure the application is legally binding, it must be completed in compliance with state and federal requirements. This includes providing accurate information and obtaining necessary signatures. Additionally, electronic submissions must adhere to eSignature laws, which recognize electronically signed documents as legally valid when specific criteria are met.

How to obtain the Business Credit Application Mississippi

The Business Credit Application Mississippi can typically be obtained through various channels. Many lenders and financial institutions provide the application directly on their websites. Additionally, businesses may access templates or forms through state business resources or financial service providers. It is important to ensure that the version of the application used is up-to-date and compliant with current regulations.

Eligibility Criteria

Eligibility criteria for submitting the Business Credit Application Mississippi may vary depending on the lender or supplier. Generally, businesses must meet certain requirements, such as:

- Being a legally registered entity in Mississippi.

- Having a valid Employer Identification Number (EIN).

- Demonstrating a stable financial history and creditworthiness.

- Providing necessary documentation to support the application.

Application Process & Approval Time

The application process for the Business Credit Application Mississippi involves submitting the completed form along with any required documentation. Approval times can vary significantly based on the lender's policies, the completeness of the application, and the complexity of the business's financial situation. Typically, businesses can expect a response within a few days to several weeks, depending on these factors.

Quick guide on how to complete business credit application mississippi

Effortlessly complete Business Credit Application Mississippi on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Business Credit Application Mississippi on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to modify and electronically sign Business Credit Application Mississippi without stress

- Locate Business Credit Application Mississippi and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from your chosen device. Edit and electronically sign Business Credit Application Mississippi and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application in Mississippi?

A Business Credit Application in Mississippi is a formal document that businesses use to apply for credit or financing from lenders. It typically requires information about the business, its finances, and its owners to assess creditworthiness. Completing this application accurately is essential for securing funding.

-

How can airSlate SignNow streamline the Business Credit Application process in Mississippi?

airSlate SignNow streamlines the Business Credit Application process in Mississippi by providing a user-friendly platform for creating, sending, and eSigning documents electronically. This eliminates the need for paper and manual workflows, reducing errors and saving time. Businesses can track the status of their applications easily through the platform.

-

What are the costs associated with using airSlate SignNow for a Business Credit Application in Mississippi?

The costs associated with using airSlate SignNow for a Business Credit Application in Mississippi vary based on the plan you choose. Typically, airSlate SignNow offers flexible pricing options to suit different business sizes and needs. The investment is often justified by the time saved and increased efficiency in managing credit applications.

-

What features does airSlate SignNow offer for Business Credit Applications in Mississippi?

airSlate SignNow offers a range of features designed for Business Credit Applications in Mississippi, including customizable templates, automated workflows, and secure electronic signatures. These features help businesses to maintain compliance while speeding up the application process. Additionally, the platform allows for easy data collection and sharing.

-

Why should businesses use airSlate SignNow for their Business Credit Applications in Mississippi?

Using airSlate SignNow for Business Credit Applications in Mississippi enhances the efficiency and security of document workflows. The platform is designed to simplify the eSigning process, making it accessible for both business owners and lenders. This not only expedites approvals but also improves the overall experience for all parties involved.

-

Can airSlate SignNow integrate with other software for Business Credit Applications in Mississippi?

Yes, airSlate SignNow can integrate with various software solutions that businesses in Mississippi commonly use for managing their finances and operations. This includes CRM systems, accounting software, and other productivity tools, allowing for a seamless workflow. Integrations help businesses keep all necessary data synchronized and up-to-date.

-

Is airSlate SignNow compliant with regulations concerning Business Credit Applications in Mississippi?

Absolutely, airSlate SignNow prioritizes compliance with industry regulations, ensuring that Business Credit Applications in Mississippi meet the required standards for electronic signatures and document handling. The platform adheres to various compliance frameworks and provides features to maintain legal and regulatory integrity throughout the application process.

Get more for Business Credit Application Mississippi

Find out other Business Credit Application Mississippi

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free