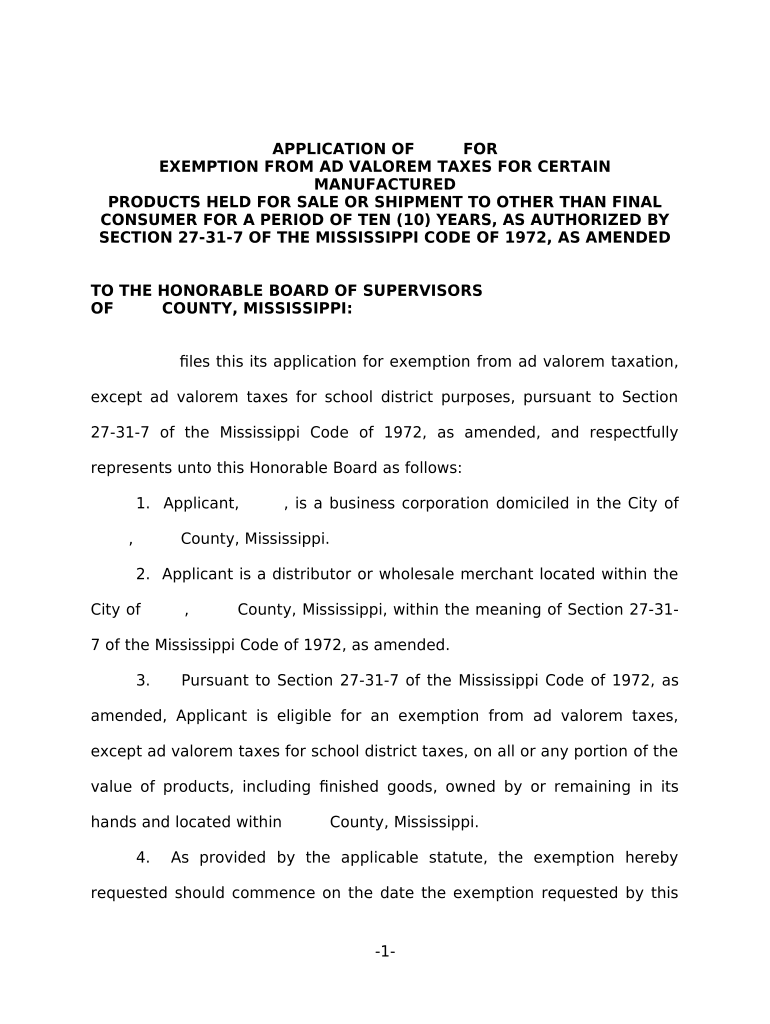

Mississippi Exemption Form

What is the Mississippi Exemption

The Mississippi exemption refers to a tax relief provision that allows eligible individuals or entities to reduce or eliminate certain ad valorem taxes on their property. This exemption is particularly relevant for agricultural property owners, as it aims to support farming operations by alleviating some financial burdens associated with property taxes. Understanding the specifics of the Mississippi exemption is crucial for anyone looking to benefit from this tax relief program.

Eligibility Criteria

To qualify for the Mississippi exemption, applicants must meet specific criteria set by the Mississippi Department of Revenue. Generally, eligibility is based on factors such as property use, ownership status, and compliance with state regulations. Commonly, agricultural land used for farming or related activities is eligible. It is essential for applicants to review the detailed requirements to ensure they meet all necessary conditions before applying.

Steps to Complete the Mississippi Exemption

Completing the Mississippi exemption application involves several key steps. First, gather all required documentation, including proof of property use and ownership. Next, fill out the Mississippi exemption form accurately, ensuring all information is complete and correct. After completing the form, submit it to the appropriate local authority, either online or by mail, depending on the submission methods available in your area. Finally, keep a copy of the submitted application for your records.

Required Documents

When applying for the Mississippi exemption, certain documents are typically required to support your application. These may include:

- Proof of property ownership, such as a deed or title.

- Evidence of property use, like agricultural production records.

- Any additional forms or documentation specified by the Mississippi Department of Revenue.

Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods

Applicants can submit the Mississippi exemption form through various methods. The most common options include:

- Online submission via the Mississippi Department of Revenue's website.

- Mailing the completed form to the designated local tax office.

- In-person submission at local government offices.

Choosing the right submission method can depend on personal preference and the urgency of the application.

Legal Use of the Mississippi Exemption

The legal use of the Mississippi exemption is governed by state laws and regulations. It is important for applicants to understand that misuse or fraudulent claims can lead to penalties and disqualification from future exemptions. Ensuring compliance with all legal requirements not only protects the applicant but also upholds the integrity of the tax relief program.

Quick guide on how to complete mississippi exemption

Effortlessly Prepare Mississippi Exemption on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without any delays. Handle Mississippi Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Alter and eSign Mississippi Exemption Effortlessly

- Obtain Mississippi Exemption and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically available from airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your delivery method for the form, whether it be email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Mississippi Exemption to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ms exemption in relation to airSlate SignNow?

The ms exemption refers to a specific provision that allows businesses to avoid certain regulatory requirements when using digital signatures with airSlate SignNow. This exemption can simplify the signing process, making it quicker and more efficient for users. By leveraging the ms exemption, companies can ensure compliance while enhancing their document workflows.

-

How does airSlate SignNow support businesses seeking ms exemption?

airSlate SignNow provides an intuitive platform that helps businesses understand and implement the ms exemption effectively. With its easy-to-use interface, users can streamline their document processes while remaining compliant with relevant regulations. This support is crucial for organizations looking to maximize their efficiency and minimize potential legal risks.

-

What pricing plans are available for airSlate SignNow users seeking ms exemption?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes features that support the ms exemption, allowing companies to choose one that best fits their budget and requirements. With transparent pricing, businesses can easily identify the most cost-effective solution for their document management needs.

-

What features of airSlate SignNow are beneficial for utilizing ms exemption?

Key features of airSlate SignNow that assist in leveraging the ms exemption include document templating, real-time tracking, and secure cloud storage. These functionalities ensure that companies can efficiently manage their eSignatures while adhering to compliance standards. Such capabilities not only enhance user experience but also contribute to a more efficient signing process.

-

Can I integrate airSlate SignNow with other software while applying for ms exemption?

Yes, airSlate SignNow offers integration capabilities with various software platforms which can help enhance the application of ms exemption. By integrating with tools like CRMs and project management software, businesses can automate workflows and improve efficiency. This seamless connectivity ensures that companies can easily manage their document workflows while complying with the ms exemption requirements.

-

What are the benefits of using airSlate SignNow for ms exemption compliance?

Using airSlate SignNow for ms exemption compliance offers numerous benefits, such as increased efficiency, reduced paper usage, and faster transaction times. Companies can streamline their signing processes, ensuring they meet compliance without unnecessary delays. This leads to improved customer satisfaction and a more sustainable approach to document management.

-

Is airSlate SignNow secure for handling documents relevant to ms exemption?

Absolutely, airSlate SignNow employs advanced security measures to protect documents, including those related to ms exemption. With features like bank-level encryption and secure cloud storage, businesses can trust that their sensitive information is safe from unauthorized access. This security is essential for maintaining compliance and fostering trust with clients.

Get more for Mississippi Exemption

Find out other Mississippi Exemption

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors