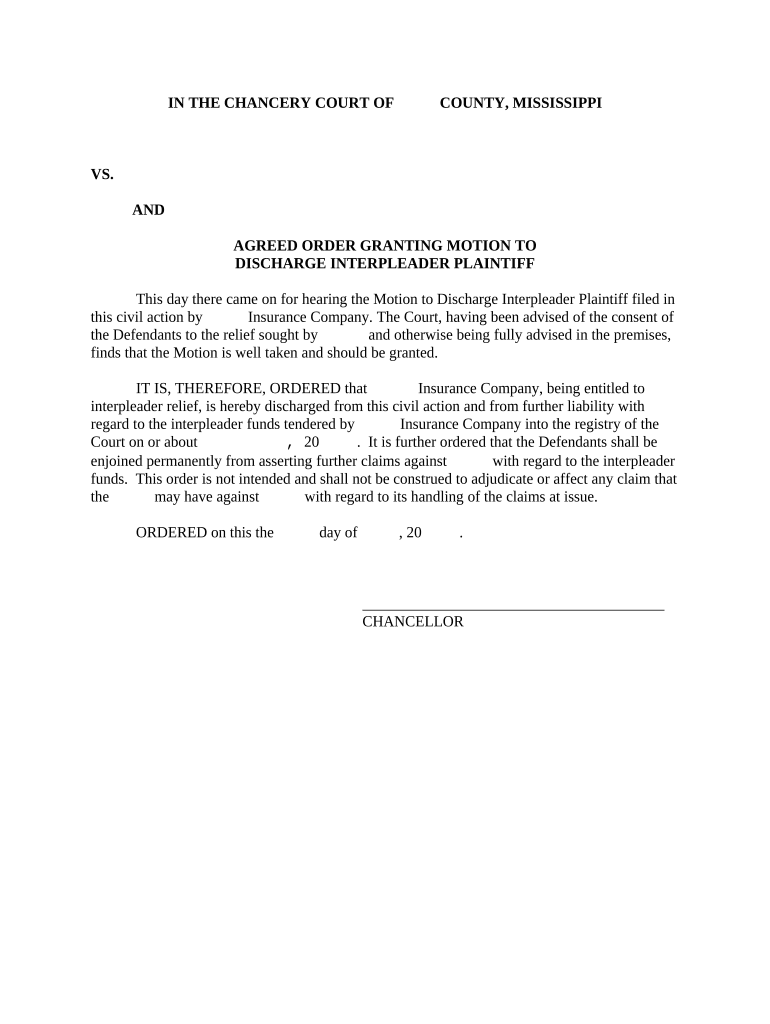

Granting Discharge Form

What is the granting discharge?

The granting discharge is a legal document commonly used in bankruptcy proceedings to formally release a debtor from personal liability for certain debts. Once a granting discharge is issued, creditors can no longer pursue collections on the discharged debts, providing a fresh start for the debtor. This document is crucial in the bankruptcy process, as it signifies the conclusion of the debtor's obligations under the bankruptcy plan.

How to use the granting discharge

Using the granting discharge involves understanding its implications and ensuring proper filing. Once a debtor receives the granting discharge, they should keep a copy for their records. This document may be required in future financial transactions, such as applying for loans or credit. It is essential to present this form when requested to demonstrate that certain debts have been legally discharged.

Steps to complete the granting discharge

Completing the granting discharge involves several key steps:

- Gather necessary documentation, including financial statements and bankruptcy filings.

- Fill out the granting discharge form accurately, ensuring all required information is provided.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate court or bankruptcy trustee as directed.

- Retain copies of all submitted documents for personal records.

Legal use of the granting discharge

The legal use of the granting discharge is governed by federal bankruptcy law, which outlines the conditions under which debts can be discharged. It is important for debtors to understand that not all debts are eligible for discharge, such as certain tax obligations and student loans. The granting discharge serves as a legal protection for the debtor, preventing creditors from taking further action on discharged debts.

Required documents

To obtain a granting discharge, several documents are typically required:

- Bankruptcy petition and schedules detailing assets and liabilities.

- Proof of income and expenses.

- Credit counseling certificate, demonstrating compliance with pre-filing requirements.

- Any additional documentation requested by the bankruptcy court or trustee.

Eligibility criteria

Eligibility for a granting discharge depends on various factors, including the type of bankruptcy filed (Chapter 7 or Chapter 13) and the debtor's financial situation. Generally, individuals must complete the bankruptcy process, including any required repayment plans or financial education courses. Additionally, the debtor must not have previously received a discharge in a certain timeframe, typically eight years for Chapter 7 filings.

Quick guide on how to complete granting discharge

Complete Granting Discharge effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It presents an ideal eco-friendly substitute to traditional printed and signed papers, enabling you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents promptly without any delays. Manage Granting Discharge on any device using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to adjust and eSign Granting Discharge effortlessly

- Find Granting Discharge and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Granting Discharge to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for granting discharge with airSlate SignNow?

Granting discharge with airSlate SignNow is streamlined and efficient. Users can easily create and send discharge documents for electronic signatures. The intuitive interface ensures that all parties can quickly understand the process, reducing delays and improving efficiency.

-

How does airSlate SignNow ensure the security of documents when granting discharge?

Security is a top priority when granting discharge with airSlate SignNow. The platform employs advanced encryption and secure cloud storage to protect your documents. Additionally, it complies with industry standards, providing peace of mind that your sensitive information is safe.

-

What features assist in granting discharge effectively?

airSlate SignNow offers features such as customizable templates, automated workflows, and notifications that enhance the granting discharge process. These tools help streamline document preparation and ensure timely responses. Users can also track the status of each document to stay informed.

-

Are there any costs associated with granting discharge via airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for granting discharge. Users can choose from features and limits that align with their requirements. A free trial is also available to explore the service before committing.

-

Can I integrate airSlate SignNow with other applications when granting discharge?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications to streamline the granting discharge process. Users can connect with popular tools like Google Drive, Salesforce, and more to enhance productivity and document management efficiency.

-

What are the benefits of using airSlate SignNow for granting discharge?

Using airSlate SignNow for granting discharge offers numerous benefits, including reduced turnaround time, improved professionalism, and increased convenience for all parties involved. The eSigning feature allows users to sign documents from anywhere, making the process quicker and more accessible.

-

Is airSlate SignNow user-friendly for granting discharge?

Yes, airSlate SignNow is designed with user experience in mind, making it highly user-friendly for granting discharge. Even users with minimal technical skills can navigate the platform effortlessly, ensuring a smooth experience during document creation and signing.

Get more for Granting Discharge

- Northampton community college withdrawal form

- Restriction removal notification form

- Dhsr form

- Presentation of documents under export letter of credit form

- Franciscan alliance financial assistance application form

- Coverdell esa contribution information do not cut or

- Founder equity agreement template form

- Founder exit agreement template form

Find out other Granting Discharge

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation