Ms Executor Form

What is the ms executor?

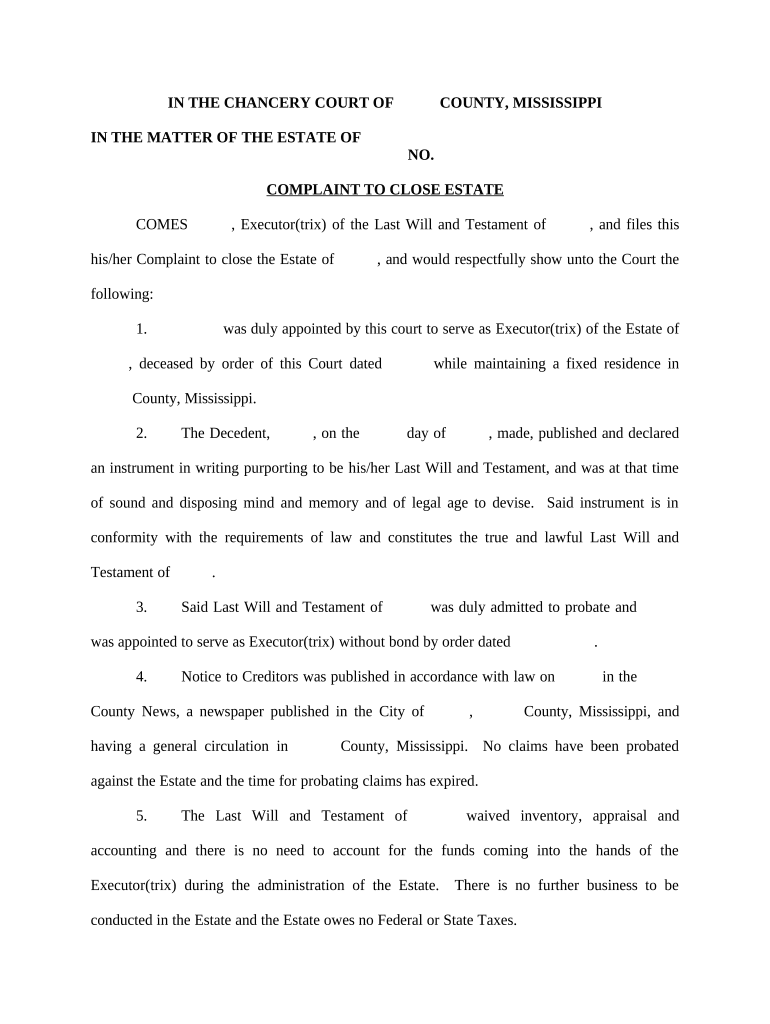

The ms executor form is a legal document used in Mississippi to appoint an executor for an estate. This form is essential for individuals who wish to designate someone to manage the distribution of their assets after passing. The appointed executor is responsible for settling debts, distributing property, and ensuring that the decedent's wishes are honored according to their will. Understanding the role of the executor is crucial, as it involves navigating legal obligations and responsibilities in the estate administration process.

Steps to complete the ms executor

Completing the ms executor form involves several important steps to ensure its validity and compliance with state laws. Here is a structured approach:

- Gather necessary information, including the decedent's details, the executor's information, and any relevant estate documents.

- Fill out the ms executor form accurately, ensuring all required fields are completed. This includes the names and addresses of the executor and beneficiaries.

- Sign the form in the presence of a notary public to validate the document. Notarization is a critical step to ensure the form is legally binding.

- Submit the completed form to the appropriate probate court in Mississippi, along with any required filing fees.

Legal use of the ms executor

The ms executor form has specific legal implications in the state of Mississippi. It serves as an official declaration of the executor's authority to manage the estate. For the form to be legally recognized, it must comply with Mississippi probate laws, which outline the responsibilities and powers granted to the executor. Proper execution of this form ensures that the estate is administered according to the decedent's wishes and in accordance with state regulations.

Key elements of the ms executor

Several key elements are essential for the ms executor form to be considered complete and legally binding. These include:

- Executor Information: Full name, address, and contact details of the appointed executor.

- Decedent Information: Full name, date of birth, and date of death of the individual whose estate is being managed.

- Witness Signatures: Signatures from witnesses, if required, to validate the form.

- Notarization: A notary public must witness the signing of the form to ensure its authenticity.

State-specific rules for the ms executor

Mississippi has specific rules governing the use of the ms executor form. These rules dictate how the form should be filled out, the requirements for notarization, and the process for submitting the form to the probate court. It is essential for individuals to familiarize themselves with these regulations to avoid delays or complications in the estate administration process. Compliance with state laws ensures that the executor can effectively carry out their duties without legal challenges.

How to obtain the ms executor

Obtaining the ms executor form is a straightforward process. Individuals can typically access the form through the Mississippi probate court's website or by visiting the local courthouse. It is advisable to ensure that the most current version of the form is used, as legal requirements may change. Additionally, consulting with a legal professional can provide guidance on completing the form accurately and in accordance with Mississippi law.

Quick guide on how to complete ms executor

Complete Ms Executor seamlessly on any gadget

Web-based document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Ms Executor on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Ms Executor effortlessly

- Find Ms Executor and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Choose how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ms Executor and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MS executor and how does it work with airSlate SignNow?

An MS executor refers to a person or entity appointed to execute the mandates of a will. With airSlate SignNow, MS executors can easily manage and sign important documents electronically, streamlining the execution process while ensuring compliance and legal validity.

-

How much does airSlate SignNow cost for MS executors?

airSlate SignNow offers several pricing plans that cater to various needs, including features specifically beneficial for MS executors. The pricing structure is transparent, allowing users to choose a plan that fits their budget while accessing powerful eSigning and document management features.

-

What features does airSlate SignNow offer for MS executors?

For MS executors, airSlate SignNow provides dynamic document templates, audit trails, and convenient reminders to ensure all essential tasks are completed on time. These features make it easier to handle paperwork efficiently, even amid the complexities of estate management.

-

Can MS executors integrate airSlate SignNow with other tools?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Microsoft Office. This allows MS executors to streamline their workflow by combining eSignature capabilities with their existing tools for improved efficiency.

-

How secure is airSlate SignNow for MS executors?

Security is paramount for MS executors, and airSlate SignNow utilizes bank-level encryption to protect sensitive documents. Additionally, features like two-factor authentication and detailed audit logs enhance security, ensuring that all signed documents are safe and compliant.

-

What benefits can MS executors gain from using airSlate SignNow?

MS executors benefit from increased efficiency, reduced turnaround time, and enhanced organization when using airSlate SignNow. The ability to sign documents from anywhere saves valuable time, allowing executors to focus on more pressing matters related to estate administration.

-

Is there a mobile app available for MS executors using airSlate SignNow?

Yes, airSlate SignNow offers a user-friendly mobile app that allows MS executors to manage and sign documents on the go. This flexibility ensures that important tasks can be completed promptly, regardless of the executor's location.

Get more for Ms Executor

- Application for salon employment when completed nail bar form

- Accession agreement template form

- How to fill out employment application form

- Eng form 4914 r

- E 1r form

- E z pass ny application online 40765668 form

- Matura prime time pre intermediate quick test 3 1b 3a 3d egis form

- Passport renewal with name changecall sign renewals or changes american radio relay leagueconcealed handgun licensesdouglas form

Find out other Ms Executor

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT