Ms Withholding Form

What is the Mississippi Withholding Form

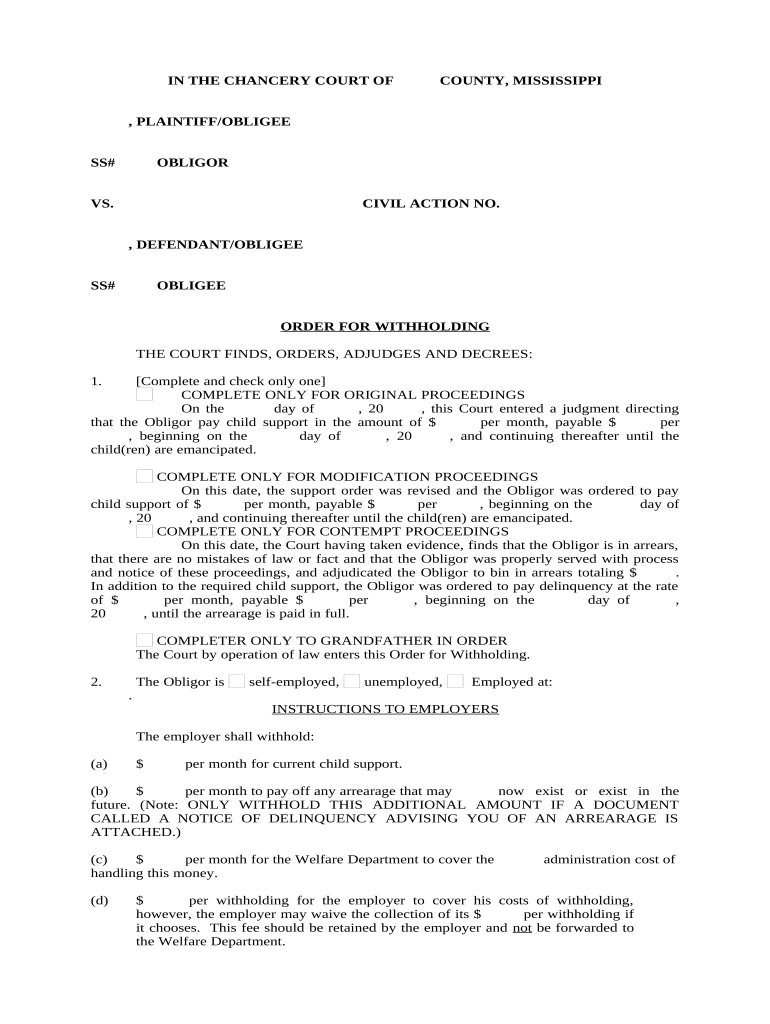

The Mississippi withholding form is a crucial document used by employers to report and remit state income tax withheld from employees' wages. This form ensures compliance with Mississippi tax laws and helps employees meet their tax obligations. Employers must accurately complete this form to determine the correct amount of withholding based on the employee's earnings and exemptions claimed.

How to Use the Mississippi Withholding Form

To effectively use the Mississippi withholding form, employers must first gather necessary information about their employees, including Social Security numbers, filing status, and the number of allowances claimed. Once this information is collected, employers can fill out the form, ensuring all fields are accurately completed. After submission, employers must keep a copy for their records and provide employees with their withholding information for tax filing purposes.

Steps to Complete the Mississippi Withholding Form

Completing the Mississippi withholding form involves several key steps:

- Gather employee information, including names, Social Security numbers, and filing statuses.

- Determine the number of allowances each employee is claiming.

- Fill out the form by entering the required information in the designated fields.

- Calculate the amount of state tax to withhold based on the provided information.

- Review the form for accuracy before submission.

Key Elements of the Mississippi Withholding Form

Several key elements are essential for the Mississippi withholding form:

- Employee Information: This includes the employee's name, address, and Social Security number.

- Filing Status: The employee's filing status, such as single or married, affects the withholding calculations.

- Allowances: The number of allowances claimed by the employee, which influences the amount withheld.

- Withholding Amount: The calculated amount of state tax to be withheld from the employee's paycheck.

Legal Use of the Mississippi Withholding Form

The Mississippi withholding form is legally binding when completed and submitted according to state regulations. Employers must ensure that the form is filled out accurately and submitted on time to avoid penalties. Additionally, it is important for employers to maintain records of all submitted forms to demonstrate compliance with state tax laws.

Form Submission Methods

The Mississippi withholding form can be submitted through various methods, ensuring flexibility for employers. These methods include:

- Online Submission: Employers can submit the form electronically through the Mississippi Department of Revenue's website.

- Mail: The completed form can be mailed to the appropriate state tax office.

- In-Person: Employers may also choose to deliver the form in person at designated tax offices.

Quick guide on how to complete ms withholding form

Easily prepare Ms Withholding Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Handle Ms Withholding Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Ms Withholding Form effortlessly

- Locate Ms Withholding Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ms Withholding Form and guarantee exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Mississippi withholding and how does it affect my business?

Mississippi withholding refers to the state tax deducted from employee wages to cover their income tax obligations. It's important for businesses to understand Mississippi withholding as it ensures compliance with state tax regulations, avoiding potential penalties. Implementing accurate Mississippi withholding practices can also streamline payroll processes within your organization.

-

How does airSlate SignNow facilitate Mississippi withholding documentation?

With airSlate SignNow, businesses can easily create, send, and eSign documents related to Mississippi withholding, such as tax forms and employee contracts. The platform provides a user-friendly interface that simplifies the management of these documents, ensuring that all forms are up-to-date and compliant with state regulations. This can signNowly reduce administrative burdens for HR and payroll departments.

-

Are there any costs associated with using airSlate SignNow for Mississippi withholding?

airSlate SignNow offers a cost-effective solution for managing documentation related to Mississippi withholding. Pricing plans are designed to fit various business sizes and needs, ensuring you only pay for what you use. By reducing paperwork and streamlining workflows, many businesses find that the savings often outweigh the costs.

-

Can I integrate airSlate SignNow with other payroll systems for Mississippi withholding?

Yes, airSlate SignNow seamlessly integrates with various payroll systems, making it easy to manage Mississippi withholding and other tax-related documents. This integration allows for automatic updates to employee records and ensures accurate withholding calculations. By connecting your payroll system with airSlate SignNow, you can improve accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for managing Mississippi withholding?

Using airSlate SignNow for Mississippi withholding allows businesses to save time and reduce errors associated with manual paperwork. The platform's electronic signature feature speeds up approvals and increases accuracy in documentation. Moreover, it enhances security and accessibility, ensuring that all sensitive information is protected.

-

Is airSlate SignNow compliant with Mississippi tax regulations regarding withholding?

Absolutely! airSlate SignNow is designed with compliance in mind, including adherence to Mississippi tax regulations regarding withholding. The platform is regularly updated to reflect any changes in tax laws, ensuring your business remains compliant. This commitment to compliance helps protect you from any potential legal issues related to Mississippi withholding.

-

How can airSlate SignNow improve my team's efficiency in handling Mississippi withholding?

By utilizing airSlate SignNow, your team can automate document workflows related to Mississippi withholding, signNowly improving efficiency. The ability to eSign documents quickly reduces the time spent on manual signatures and approvals. This allows your staff to focus on more strategic tasks rather than getting bogged down in paperwork.

Get more for Ms Withholding Form

Find out other Ms Withholding Form

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple