Tax Return Use Form SA100 to File a Tax Return, Report Your Income and to Claim Tax Reliefs and Any Repayment Due You'll Need so 2021

Understanding the SA100 Tax Return

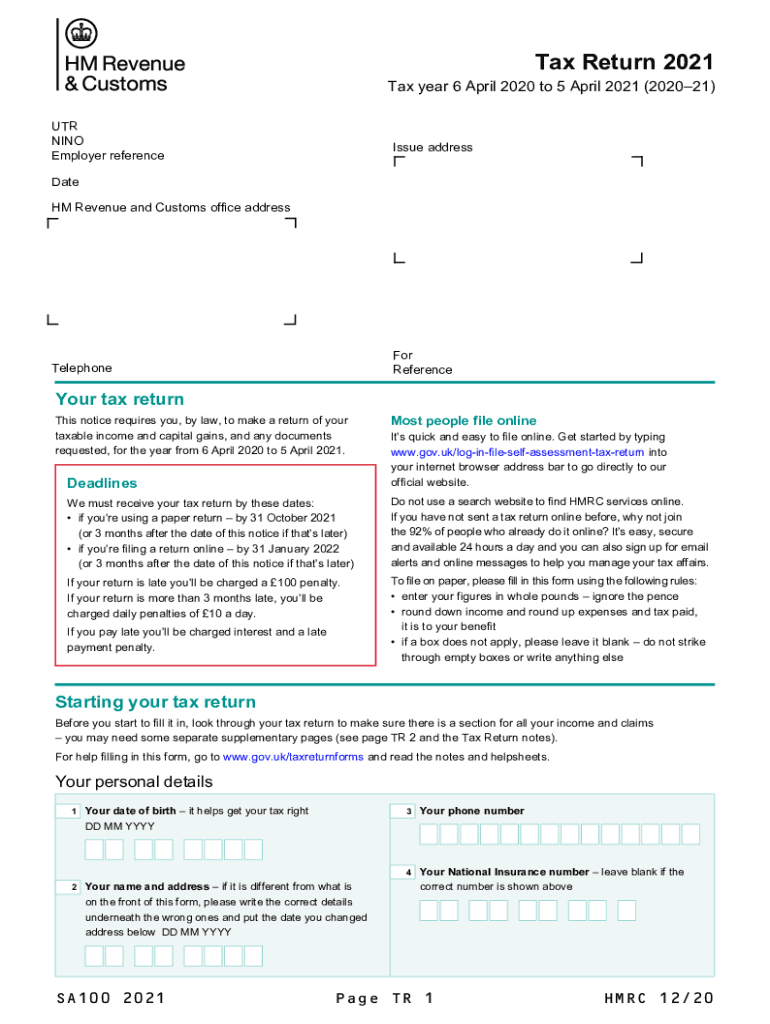

The SA100 form is a self-assessment tax return used by individuals in the United Kingdom to report their income, claim tax reliefs, and request any repayments due. This form is essential for ensuring that taxpayers fulfill their legal obligations to HM Revenue and Customs (HMRC). It is particularly important for those who are self-employed, have additional income sources, or wish to claim certain allowances.

When completing the SA100, it is crucial to include all relevant income details, such as employment earnings, rental income, and dividends. Additionally, supplementary pages may be required for specific types of income, such as capital gains. Understanding the requirements for these supplementary pages can help streamline the filing process.

Steps to Complete the SA100 Form

Completing the SA100 form involves several key steps to ensure accurate reporting. Start by gathering all necessary documents, including P60s, P45s, and any other income statements. Follow these steps:

- Fill in personal information, including your name, address, and National Insurance number.

- Report your income from all sources, ensuring to include any additional earnings.

- Claim any eligible tax reliefs, such as those for pension contributions or charitable donations.

- Complete any required supplementary pages for specific income types.

- Review your entries for accuracy and completeness before submission.

Once completed, the form can be submitted online or via mail, depending on your preference and circumstances.

Legal Use of the SA100 Form

The SA100 form is legally binding when filled out correctly and submitted to HMRC. It is essential to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal issues. The form must be submitted by the deadline established by HMRC to avoid late filing penalties.

Utilizing electronic tools, such as e-signature solutions, can enhance the security and validity of the submission process. Ensuring compliance with eSignature laws, such as ESIGN and UETA, can further protect the integrity of your submission.

Required Documents for Filing the SA100

To complete the SA100 form accurately, several documents are typically required. These may include:

- P60 or P45 forms from employers

- Bank statements and interest statements

- Rental income records

- Details of any capital gains

- Receipts for deductible expenses

Having these documents ready will help ensure a smooth and efficient filing process.

Filing Deadlines for the SA100

It is important to be aware of the filing deadlines associated with the SA100 form. For most taxpayers, the deadline for online submissions is usually January 31 of the year following the end of the tax year. Paper submissions typically have an earlier deadline of October 31. Missing these deadlines can result in penalties, so planning ahead is essential.

Examples of Taxpayer Scenarios Using the SA100

The SA100 form is applicable to various taxpayer scenarios, including:

- Self-employed individuals reporting business income.

- Employees with additional income from freelance work.

- Individuals receiving rental income from property.

- Taxpayers claiming reliefs for charitable donations.

Understanding these scenarios can help individuals determine their eligibility and the specific requirements for completing the SA100 form.

Quick guide on how to complete tax return 2021 use form sa1002021 to file a tax return report your income and to claim tax reliefs and any repayment due youll

Effortlessly Prepare Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Need So on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hold-ups. Handle Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Need So across any platform with the airSlate SignNow apps for Android or iOS, and enhance your document-related processes today.

The Simplest Way to Alter and Electronically Sign Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Need So with Ease

- Locate Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Need So and click Get Form to start.

- Utilize the available tools to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Need So and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return 2021 use form sa1002021 to file a tax return report your income and to claim tax reliefs and any repayment due youll

Create this form in 5 minutes!

How to create an eSignature for the tax return 2021 use form sa1002021 to file a tax return report your income and to claim tax reliefs and any repayment due youll

How to make an e-signature for a PDF online

How to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

How to create an e-signature for a PDF document on Android

People also ask

-

What is the sa100 and how does it work?

The sa100 is a feature of airSlate SignNow that allows users to send and electronically sign documents seamlessly. It simplifies the signing process while ensuring security and compliance. Businesses can leverage sa100 for faster transactions and improved workflow efficiency.

-

How much does airSlate SignNow cost for using the sa100 feature?

Pricing for airSlate SignNow featuring the sa100 varies based on the subscription plan selected. We offer flexible packages that cater to various business sizes and needs. For detailed pricing information, please visit our pricing page or contact sales for a tailored quote.

-

What benefits does the sa100 provide for businesses?

The sa100 offers numerous benefits including enhanced efficiency, reduced operational costs, and improved document tracking. By streamlining the signing process, businesses can accelerate their workflow and enhance customer satisfaction. Additionally, it supports compliance with legal standards for document signing.

-

Can I integrate the sa100 with other software applications?

Yes, airSlate SignNow supports integration of the sa100 with various software applications including CRM systems and project management tools. This enhances productivity by allowing seamless data flow between platforms. You can find a list of our integrations on our website.

-

Is the sa100 feature secure and compliant with legal standards?

Absolutely! The sa100 feature adheres to industry security standards and legal requirements for electronic signatures. airSlate SignNow ensures that all documents signed via sa100 are legally binding and secure, providing peace of mind to businesses and their clients.

-

What types of documents can I sign using the sa100?

The sa100 allows you to sign a wide variety of documents, including contracts, agreements, and consent forms. Whether you're signing a single document or a bulk batch, the sa100 feature handles it with ease. This flexibility makes it ideal for various industries and use cases.

-

How do I get started with the sa100 feature on airSlate SignNow?

Getting started with the sa100 feature is simple! First, sign up for an account on airSlate SignNow and choose the plan that suits your needs. Once you're set up, you can easily access the sa100 functionality and start sending documents for electronic signatures.

Get more for Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Need So

Find out other Tax Return Use Form SA100 To File A Tax Return, Report Your Income And To Claim Tax Reliefs And Any Repayment Due You'll Need So

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word