Mississippi UCC3 Financing Statement Mississippi Form

What is the Mississippi UCC3 Financing Statement Mississippi

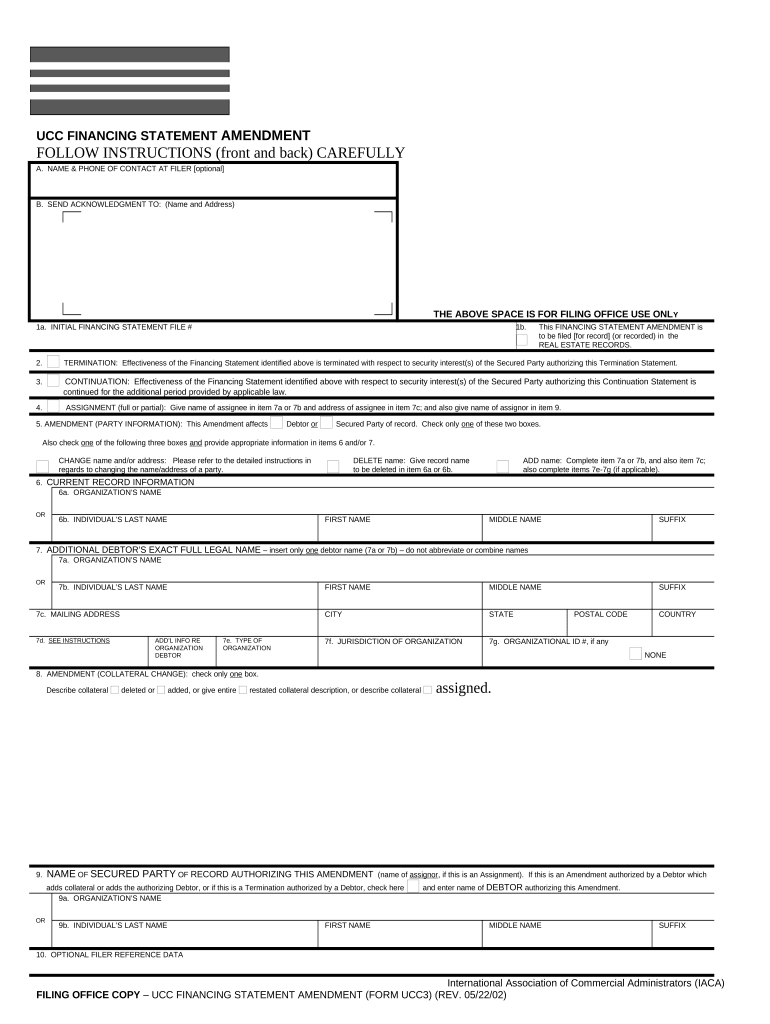

The Mississippi UCC3 Financing Statement is a legal document used to amend or terminate a previously filed UCC1 Financing Statement. This form is essential for businesses and individuals who want to update their secured transactions or remove a lien on collateral. By filing a UCC3, parties can ensure that their financial interests are accurately reflected in the public record, which is crucial for maintaining transparency and legal compliance in secured transactions.

How to use the Mississippi UCC3 Financing Statement Mississippi

To use the Mississippi UCC3 Financing Statement, you must first identify the original UCC1 Financing Statement that you wish to amend or terminate. The UCC3 form requires specific information, including the file number of the original statement, the names of the parties involved, and the details of the amendment or termination. Once completed, the form must be filed with the appropriate state office, typically the Secretary of State, to ensure that the changes are legally recognized.

Steps to complete the Mississippi UCC3 Financing Statement Mississippi

Completing the Mississippi UCC3 Financing Statement involves several key steps:

- Gather relevant information, including the original UCC1 file number and the names of the parties.

- Clearly indicate whether you are amending or terminating the original statement.

- Fill out the UCC3 form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form to the Mississippi Secretary of State, either online or by mail, along with any required fees.

Legal use of the Mississippi UCC3 Financing Statement Mississippi

The legal use of the Mississippi UCC3 Financing Statement is governed by the Uniform Commercial Code (UCC), which provides a framework for secured transactions across the United States. Filing a UCC3 is legally binding and serves to notify interested parties of changes to the status of a secured transaction. It is important to ensure compliance with all relevant laws and regulations to maintain the validity of the document and protect your legal rights.

Key elements of the Mississippi UCC3 Financing Statement Mississippi

Key elements of the Mississippi UCC3 Financing Statement include:

- The original UCC1 file number, which links the amendment or termination to the correct document.

- The names and addresses of the debtor and secured party.

- A clear indication of whether the form is being used to amend or terminate the original statement.

- Signature of the secured party or an authorized representative.

- Filing date and method of submission, which may affect the priority of the lien.

State-specific rules for the Mississippi UCC3 Financing Statement Mississippi

Mississippi has specific rules regarding the filing and processing of the UCC3 Financing Statement. These rules include deadlines for filing amendments or terminations, as well as fees associated with the submission. It is essential to be aware of these regulations to ensure that the UCC3 is filed correctly and timely, preserving the legal rights associated with the secured transaction.

Quick guide on how to complete mississippi ucc3 financing statement mississippi

Easily prepare Mississippi UCC3 Financing Statement Mississippi on any device

Web-based document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Mississippi UCC3 Financing Statement Mississippi on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

Easily edit and eSign Mississippi UCC3 Financing Statement Mississippi without hassle

- Obtain Mississippi UCC3 Financing Statement Mississippi and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, either by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Adjust and eSign Mississippi UCC3 Financing Statement Mississippi and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mississippi UCC3 Financing Statement Mississippi?

A Mississippi UCC3 Financing Statement Mississippi is a legal form used to amend or continue a previously filed UCC1 Financing Statement. It provides information about changes to a secured party's interests, ensuring that the financing statement remains effective. This document is essential for protecting secured transactions in Mississippi.

-

How can airSlate SignNow help with filing a Mississippi UCC3 Financing Statement Mississippi?

airSlate SignNow streamlines the process of creating and filing a Mississippi UCC3 Financing Statement Mississippi. With our intuitive platform, users can easily fill out, eSign, and submit documents electronically, saving time and avoiding paperwork hassles. This ensures compliance and allows for secure storage of important documents.

-

What are the benefits of using airSlate SignNow for a Mississippi UCC3 Financing Statement Mississippi?

Using airSlate SignNow for a Mississippi UCC3 Financing Statement Mississippi provides several benefits, including ease of use, efficiency, and secure electronic signatures. Businesses can quickly amend or continue their financing statements without extensive legal knowledge, ensuring that they stay compliant. Additionally, our platform offers real-time tracking of document status.

-

Is airSlate SignNow cost-effective for filing a Mississippi UCC3 Financing Statement Mississippi?

Yes, airSlate SignNow is a cost-effective solution for filing a Mississippi UCC3 Financing Statement Mississippi. Our pricing plans are designed to meet the budgets of businesses of all sizes, eliminating expensive lawyer fees for simple filings. This allows users to manage their documents affordably while maintaining compliance.

-

What features does airSlate SignNow offer for managing financing statements?

airSlate SignNow offers a range of features for managing Mississippi UCC3 Financing Statements Mississippi, including customizable templates, cloud storage, and automated reminders. Users can easily modify their documents and access them anytime, anywhere. Additionally, the platform supports multiple integrations to streamline workflows.

-

Can I integrate airSlate SignNow with other software for managing my Mississippi UCC3 Financing Statement Mississippi?

Yes, airSlate SignNow supports various integrations, allowing you to connect with popular applications for managing your Mississippi UCC3 Financing Statement Mississippi. This includes linking with accounting software, CRM systems, and cloud storage services. These integrations enhance productivity and organization.

-

Is electronic filing supported for Mississippi UCC3 Financing Statement Mississippi using airSlate SignNow?

Yes, electronic filing for the Mississippi UCC3 Financing Statement Mississippi is fully supported through airSlate SignNow. This feature allows users to submit their financing statements online, which is not only faster but also more secure. Electronic filing helps ensure that documents are received promptly by the appropriate parties.

Get more for Mississippi UCC3 Financing Statement Mississippi

- Bureau leerplicht plus users qlictonline form

- Waiver of rights sample 100265074 form

- Washington county circuit courts plea petition criminal defense form

- Petty cash request form word

- Port in form

- Institute of chartered shipbrokers books pdf form

- Ad computer jetpay form

- Pdb user access form 20080229 doc

Find out other Mississippi UCC3 Financing Statement Mississippi

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT