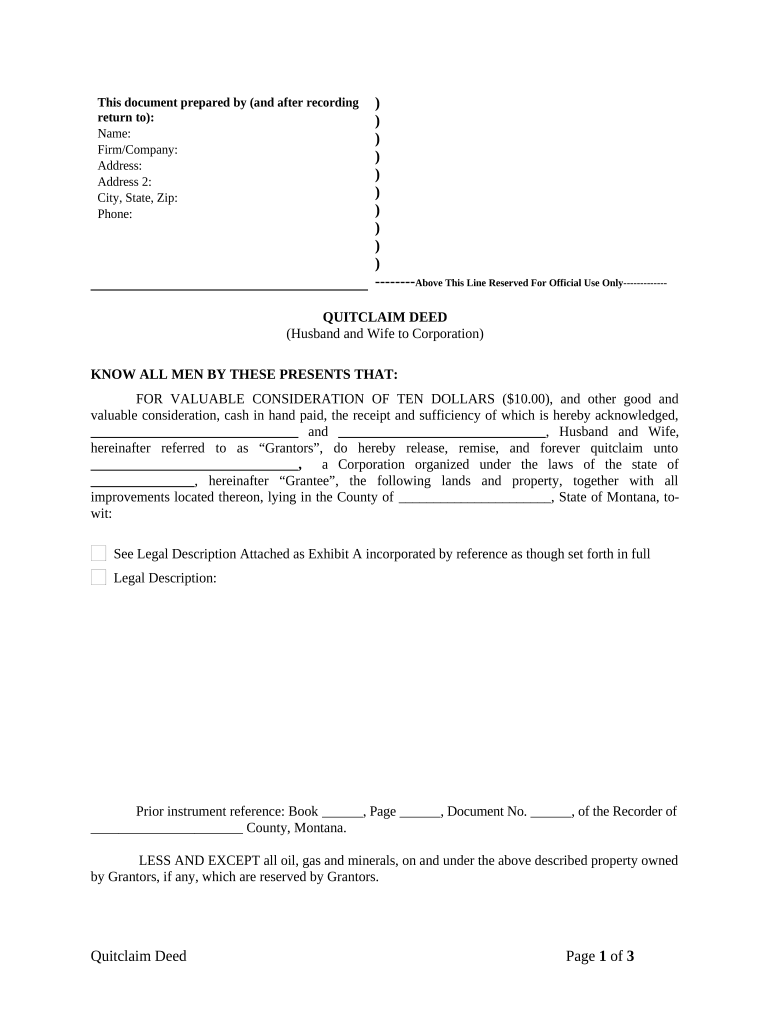

Husband Wife Corporation Form

What is the Husband Wife Corporation

A husband wife corporation is a specific type of business entity primarily formed by a married couple. This structure allows both spouses to operate a business together while enjoying certain tax benefits and legal protections. In the United States, husband wife corporations can be classified as S Corporations or C Corporations, depending on the couple's tax preferences. This designation is particularly beneficial for couples looking to streamline their business operations while maintaining a clear separation between personal and business finances.

How to use the Husband Wife Corporation

Utilizing a husband wife corporation involves several key steps. First, couples must decide on the appropriate business structure, either an S Corporation or a C Corporation, based on their financial goals. Next, they should register their business with the state, which may require filing specific documents and paying associated fees. Once established, the couple can operate the business, manage finances, and file taxes jointly, which can simplify the process and potentially reduce their overall tax liability. It's essential to maintain accurate records and adhere to state regulations to ensure compliance.

Steps to complete the Husband Wife Corporation

Completing the formation of a husband wife corporation involves a series of steps:

- Choose a business name that complies with state regulations.

- File the Articles of Incorporation with the state government.

- Obtain an Employer Identification Number (EIN) from the IRS.

- Draft corporate bylaws that outline the management structure and operational procedures.

- Hold an initial meeting to adopt bylaws and appoint officers.

- Open a business bank account to keep personal and business finances separate.

Legal use of the Husband Wife Corporation

The legal use of a husband wife corporation is grounded in the regulations governing business entities in the United States. Couples must adhere to specific laws regarding the operation of their corporation, including maintaining separate business accounts, keeping accurate records, and filing required tax documents. This structure can provide liability protection, meaning personal assets are generally shielded from business debts. Additionally, the couple can take advantage of certain tax benefits, such as income splitting and deductions for business expenses.

IRS Guidelines

The IRS has specific guidelines for husband wife corporations, particularly regarding taxation and filing requirements. Couples must decide whether to elect S Corporation status, which allows income to pass through to their personal tax returns, avoiding double taxation. It is crucial to file Form 2553 to make this election. Additionally, the IRS requires husband wife corporations to comply with all standard corporate tax regulations, including filing annual tax returns and maintaining proper documentation of income and expenses. Understanding these guidelines ensures compliance and maximizes potential tax benefits.

Eligibility Criteria

To establish a husband wife corporation, couples must meet certain eligibility criteria. Both spouses must be actively involved in the business operations, and they should be legally married. Additionally, the corporation must comply with state-specific regulations regarding business formation. It's essential to ensure that the business structure aligns with the couple's financial goals and that they understand the implications of their chosen entity type. Consulting with a legal or financial advisor can help clarify these criteria and guide the formation process.

Quick guide on how to complete husband wife corporation 497316156

Complete Husband Wife Corporation effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Husband Wife Corporation on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Husband Wife Corporation with ease

- Obtain Husband Wife Corporation and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools offered specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Choose your preferred delivery method for your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Husband Wife Corporation to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a husband wife corporation, and how does it work?

A husband wife corporation is a business entity jointly owned by a married couple. This structure allows for shared management and decision-making while potentially providing tax advantages. Couples can easily navigate ownership and profits through such a corporation, ensuring both partners have a stake in the business.

-

How can airSlate SignNow benefit our husband wife corporation?

airSlate SignNow provides an efficient solution for your husband wife corporation to manage and eSign documents seamlessly. With its user-friendly interface, both partners can easily collaborate on contracts, agreements, and legal documents without the hassle of printing or scanning. This streamlines your workflow and saves valuable time for you and your spouse.

-

Are there any pricing plans suitable for a husband wife corporation?

Yes, airSlate SignNow offers flexible pricing plans that cater to the needs of small businesses, including husband wife corporations. You can choose a plan that fits your budget and scale as your business grows. The cost-effective nature of airSlate SignNow makes it an ideal choice for couples starting or running a joint venture.

-

What features does airSlate SignNow offer for husband wife corporations?

airSlate SignNow includes features such as document templates, customizable workflows, and real-time collaboration tools tailored for husband wife corporations. You can efficiently manage your documents, set reminders for signatures, and track submissions, all while ensuring compliance with legal standards. This enhances productivity for both partners in the corporation.

-

Can airSlate SignNow integrate with other tools used by our husband wife corporation?

Absolutely! airSlate SignNow offers integrations with numerous popular applications that your husband wife corporation might already be using. Whether it’s a CRM, project management tool, or an accounting software, these integrations streamline your processes and enhance the overall efficiency of your business operations.

-

How secure is airSlate SignNow for a husband wife corporation?

Security is a priority at airSlate SignNow, making it a safe choice for husband wife corporations. Your documents are protected with advanced encryption protocols and secure cloud storage. This ensures that sensitive information remains confidential while giving you peace of mind as you manage your business documents.

-

Is it easy to get started with airSlate SignNow for our husband wife corporation?

Yes, getting started with airSlate SignNow is quick and easy for your husband wife corporation. With an intuitive setup process and comprehensive support resources, you and your spouse can begin eSigning documents almost immediately. Moreover, the platform provides tutorials and customer support to assist you along the way.

Get more for Husband Wife Corporation

- Bend it like beckham worksheet form

- Clz lit 013r2 form

- Registro civil de nacimiento para llenar form

- Megatugs form

- Nj 1040 instructions form

- Substance abuse individualized recovery treatment plan heartland hhstoday heartlandhs form

- Solicitud de beneficios del permiso familiar pagado pfl para proveer cuidado de 2501fcs rev 4 11 18 form

- Form ct 3 s new york s corporation franchise tax return tax year

Find out other Husband Wife Corporation

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy