Form W-4 - Employee’s Withholding Certificate

What is the Form W-4 - Employee’s Withholding Certificate

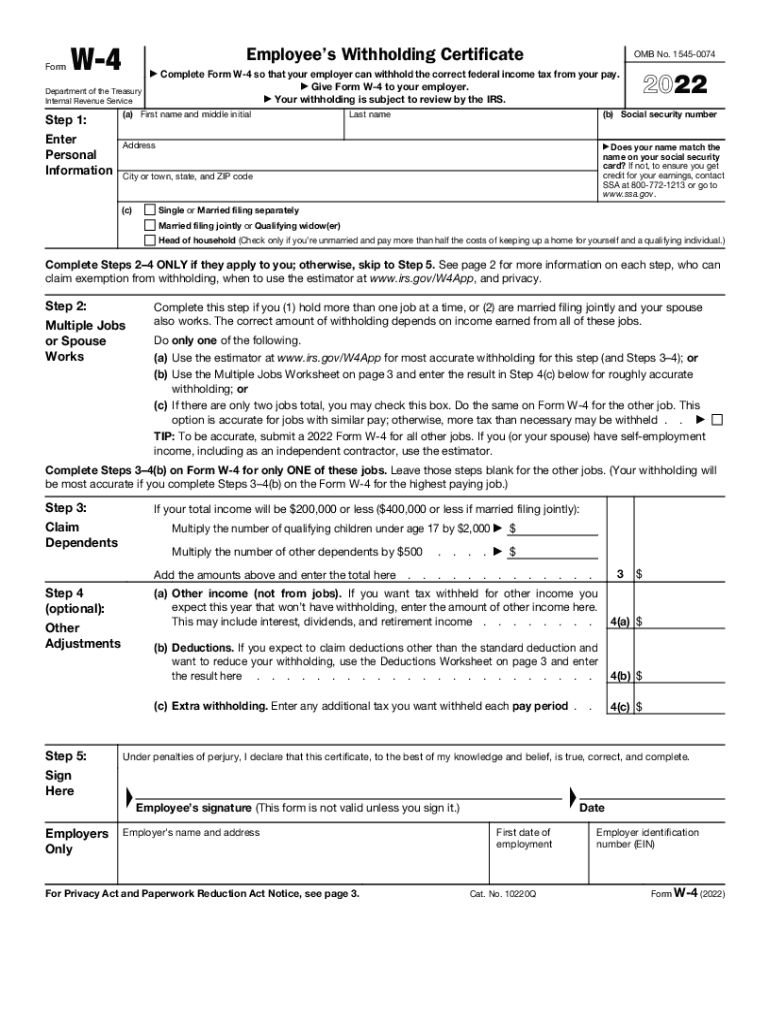

The Form W-4, officially known as the Employee’s Withholding Certificate, is a critical document used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is deducted based on the employee's personal financial situation, including marital status and number of dependents. Proper completion of the W-4 can help employees avoid owing taxes at the end of the year or receiving a large refund.

Steps to complete the Form W-4 - Employee’s Withholding Certificate

Completing the Form W-4 involves several key steps that help accurately communicate your tax withholding preferences to your employer. Here’s a straightforward guide:

- Personal Information: Enter your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: If applicable, complete the section to account for multiple jobs or if your spouse works.

- Claim Dependents: Indicate the number of dependents you can claim for tax credits.

- Other Adjustments: Specify any additional income, deductions, or extra withholding amounts, if necessary.

- Signature: Sign and date the form to validate your information.

Legal use of the Form W-4 - Employee’s Withholding Certificate

The legal validity of the Form W-4 is grounded in its compliance with IRS regulations. Employees must provide accurate and truthful information to ensure proper tax withholding. Misrepresenting information on the W-4 can lead to penalties, including fines or increased tax liability. It is essential to keep the form updated, especially after significant life changes such as marriage, divorce, or the birth of a child.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form W-4. It is recommended to review these guidelines annually or whenever there are changes in your financial situation. The IRS also offers a withholding calculator on its website, which can assist in determining the appropriate withholding amount based on your unique circumstances. Following these guidelines helps ensure compliance and minimizes the risk of under-withholding or over-withholding taxes.

Form Submission Methods (Online / Mail / In-Person)

Employees can submit the completed Form W-4 to their employers through various methods. Common submission methods include:

- Online: Many employers offer online portals where employees can upload or enter their W-4 information directly.

- Mail: Employees can print the form and mail it to their employer's human resources or payroll department.

- In-Person: Submitting the form in person is also an option, allowing for immediate confirmation of receipt.

Key elements of the Form W-4 - Employee’s Withholding Certificate

The Form W-4 contains several key elements that are crucial for accurate tax withholding:

- Filing Status: Determines the tax rate applied to your income.

- Number of Allowances: Affects the amount withheld; more allowances generally mean less tax is withheld.

- Additional Withholding: Allows employees to request extra amounts to be withheld from each paycheck.

Examples of using the Form W-4 - Employee’s Withholding Certificate

Understanding how to use the Form W-4 can be illustrated through various scenarios:

- New Job: A new employee fills out the W-4 to ensure proper withholding from their first paycheck.

- Life Changes: An employee who gets married updates their W-4 to reflect a new filing status.

- Tax Planning: An employee expecting a significant tax refund may choose to adjust their withholding to receive more in their paycheck throughout the year.

Quick guide on how to complete federal w 4 employees withholding allowance certificatefederal w 4 employees withholding allowance certificatefederal w 4

Complete Form W-4 - Employee’s Withholding Certificate seamlessly on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form W-4 - Employee’s Withholding Certificate on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Form W-4 - Employee’s Withholding Certificate effortlessly

- Obtain Form W-4 - Employee’s Withholding Certificate and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you'd like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Form W-4 - Employee’s Withholding Certificate and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2022 form W-4 and why is it important?

The 2022 form W-4 is the Employee's Withholding Certificate used to determine the amount of federal income tax withheld from employee paychecks. Its importance lies in ensuring accurate tax withholding, which helps avoid underpayment or overpayment of taxes. Utilizing the 2022 form W-4 ensures compliance with IRS regulations and allows employees to adjust their withholding as needed.

-

How can airSlate SignNow help me with the 2022 form W-4?

airSlate SignNow simplifies the process of completing and submitting your 2022 form W-4 by providing a user-friendly platform for eSigning documents. With features like document templates and automated reminders, you won't miss important deadlines associated with tax withholding. Our solution makes it easy to manage all your tax forms digitally and securely.

-

Is there a cost associated with using airSlate SignNow for the 2022 form W-4?

airSlate SignNow offers various pricing plans, starting at an affordable rate that is designed to fit businesses of all sizes. While some features may come at a premium, signing and managing the 2022 form W-4 can be done with the basic plan, making it a cost-effective solution. Explore our pricing to find a plan that best suits your needs.

-

Can I integrate airSlate SignNow with other tools for the 2022 form W-4?

Yes, airSlate SignNow provides seamless integrations with various business applications such as Google Drive, Salesforce, and Microsoft Office. This allows you to manage your 2022 form W-4 alongside other essential workflows and documents. Our integration capabilities enhance productivity by streamlining your document management process.

-

What are the key features of airSlate SignNow related to the 2022 form W-4?

Key features include a customizable template for the 2022 form W-4, secure eSigning, and automated workflows that ensure timely processing. Additionally, users can track document statuses in real-time, set reminders, and protect sensitive information with advanced security protocols. These features make handling tax forms efficient and reliable.

-

How secure is my information when using airSlate SignNow for the 2022 form W-4?

airSlate SignNow employs robust security measures to protect your information, including data encryption and authentication protocols. Your 2022 form W-4 and other documents are stored securely to prevent unauthorized access. We prioritize your privacy and adhere to compliance standards to ensure your data remains safe.

-

Can I access the 2022 form W-4 on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing you to access, complete, and sign your 2022 form W-4 on the go. This mobile functionality ensures flexibility and convenience for users who prefer managing their documents from anywhere at any time. Experience seamless document handling with our mobile app.

Get more for Form W-4 - Employee’s Withholding Certificate

- Transcript request formpdf west chester university

- Cross curricular reading comprehension worksheets pdf form

- Makeup registration form

- O holy night flute sheet form

- Instructions for form 1099 k rev march instructions for form 1099 k payment card and third party network transactions

- About form 8804 w installment payments of section 1446

- I 050 form 1npr nonresident amp part year resident wisconsin income tax wisconsin form 1npr

- Etrade customer agreement form

Find out other Form W-4 - Employee’s Withholding Certificate

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple