Schedule K 1 Form 1120 S Shareholder's Share of 2022

What is the Schedule K-1 Form 1120 S?

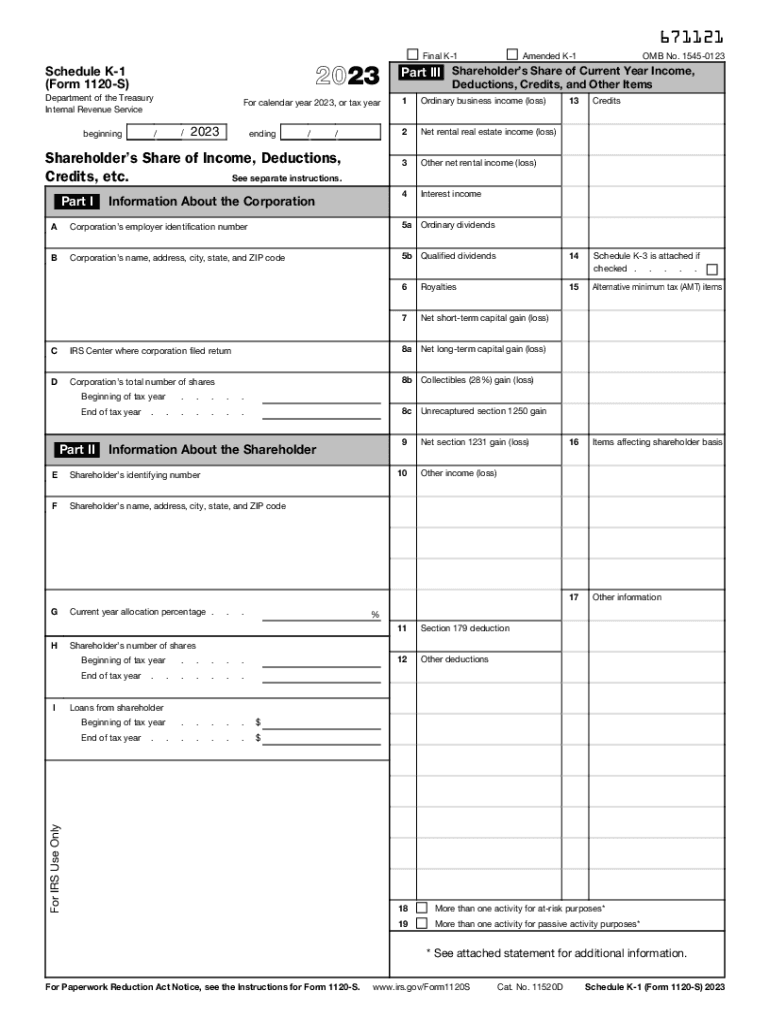

The Schedule K-1 Form 1120 S is a tax document used by S corporations to report income, deductions, and credits allocated to shareholders. This form provides shareholders with detailed information about their share of the corporation's income, which they must report on their individual tax returns. The K-1 form is essential for ensuring that shareholders accurately report their income and comply with IRS regulations. It includes various sections that outline the shareholder's specific share of the corporation's profits, losses, and other tax-related items.

Key Elements of the Schedule K-1 Form 1120 S

The Schedule K-1 Form 1120 S contains several key elements that are crucial for both the S corporation and its shareholders. These elements include:

- Shareholder Information: This section includes the shareholder's name, address, and taxpayer identification number.

- Income and Losses: The form details the shareholder's share of the corporation's income, losses, and deductions, which are reported on their personal tax return.

- Credits: Any tax credits that the shareholder can claim based on their share of the corporation's activities are also included.

- Other Information: This section may include additional details relevant to the shareholder's tax situation, such as distributions or adjustments.

How to Use the Schedule K-1 Form 1120 S

Using the Schedule K-1 Form 1120 S involves several steps. Shareholders should first receive the completed form from the S corporation, typically by the tax filing deadline. Once received, shareholders should:

- Review the information for accuracy, ensuring that all details align with their records.

- Report the income, losses, and credits on their individual tax return, typically using Form 1040.

- Consult a tax professional if there are any discrepancies or questions regarding the information provided.

Steps to Complete the Schedule K-1 Form 1120 S

Completing the Schedule K-1 Form 1120 S requires careful attention to detail. The steps include:

- Gathering necessary financial documents, including previous tax returns and records of income and expenses.

- Filling out the form accurately, ensuring that all income, deductions, and credits are reported correctly.

- Submitting the completed form to the IRS along with the corporation's tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form 1120 S are crucial for compliance. The S corporation must provide the K-1 to shareholders by March 15 each year, which aligns with the deadline for filing the S corporation's tax return. Shareholders must then report the information on their individual tax returns, typically due on April 15. It is important for both parties to adhere to these deadlines to avoid penalties.

Who Issues the Form?

The Schedule K-1 Form 1120 S is issued by S corporations to their shareholders. The corporation is responsible for preparing and distributing the form, ensuring that it accurately reflects each shareholder's share of the corporation's income, deductions, and credits. Shareholders should expect to receive their K-1 by the tax filing deadline to allow for proper reporting on their individual tax returns.

Quick guide on how to complete schedule k 1 form 1120 s shareholders share of

Complete Schedule K 1 Form 1120 S Shareholder's Share Of effortlessly on any device

Managing documents online has gained signNow traction among organizations and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can locate the relevant form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your papers swiftly without delays. Handle Schedule K 1 Form 1120 S Shareholder's Share Of on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Schedule K 1 Form 1120 S Shareholder's Share Of effortlessly

- Obtain Schedule K 1 Form 1120 S Shareholder's Share Of and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Schedule K 1 Form 1120 S Shareholder's Share Of to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 1120 s shareholders share of

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1120 s shareholders share of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a K-1 form?

A K-1 form is a tax document used to report income, deductions, and credits from partnerships, estates, or trusts. It provides detailed information on each partner's share of income, and it's important for accurate tax filing. Understanding what a K-1 form is can signNowly impact how you report your earnings to the IRS.

-

Why do I need a K-1 form for my business?

If your business is structured as a partnership or involves any trust distributions, a K-1 form is essential for tax purposes. It helps to clarify each participant's share of the income, which is necessary for filing individual tax returns. This ensures transparency and compliance with IRS regulations regarding income reporting.

-

How do I obtain a K-1 form?

You can obtain a K-1 form from the partnership or trust that generated the income. Typically, partnerships and LLCs will provide K-1 forms to their partners after the end of the tax year. If you’re unsure how to get your K-1, consult with your accountant or the entity managing the partnership.

-

What information is included in a K-1 form?

A K-1 form includes information such as the partner's share of income, deductions, credits, and other signNow tax-related data. It details how much money each partner will report on their tax returns and is a critical element for accurate reporting. Understanding what is included in a K-1 form can help prevent errors in your tax filings.

-

What are the deadlines for filing a K-1 form?

The deadlines for filing a K-1 form generally align with the partnership's tax return filing date, typically March 15 for partnerships and LLCs. It’s crucial to receive your K-1 form in time to file your personal tax return by April 15. Failing to meet these deadlines can lead to penalties, so stay organized and proactive.

-

How does the K-1 form affect my personal taxes?

The income reported on your K-1 form will be included in your personal income tax return, affecting your overall tax liability. It's essential to report accurately because K-1s can sometimes include income that's not subject to self-employment tax. Understanding how a K-1 form affects your personal taxes can help you plan your financial strategy.

-

Can I eSign a K-1 form using airSlate SignNow?

Yes, airSlate SignNow allows you to electronically sign and send K-1 forms securely. This functionality enhances your document management process, making it easier to share essential tax documents with partners or accountants. With airSlate SignNow, handling K-1 forms is efficient and compliant with legal standards.

Get more for Schedule K 1 Form 1120 S Shareholder's Share Of

- 28th annual clinical update in form

- Northwestern university commercial card form

- Site visit form

- Graduate language verification form

- Police department police city of redlands form

- Pregnancy or pregnancy related condition accommodation request form

- Social skills checklist form

- Private ampamp semi private swim lessons department of form

Find out other Schedule K 1 Form 1120 S Shareholder's Share Of

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF