Indiana Income Tax Forms 2022

What are Indiana Income Tax Forms?

Indiana Income Tax Forms are official documents used by residents and businesses in Indiana to report their income and calculate the amount of state income tax owed. These forms are essential for ensuring compliance with Indiana tax laws and are used to gather necessary financial information for tax assessment. The primary form for individual income tax is the IT-40, while businesses may use various forms depending on their structure, such as IT-20 for corporations.

How to Use the Indiana Income Tax Forms

Using Indiana Income Tax Forms involves several steps. First, individuals or businesses must select the appropriate form based on their filing status and income type. After obtaining the correct form, taxpayers should carefully fill it out, ensuring all required information is accurate and complete. This includes reporting income, deductions, and credits. Once completed, the forms must be submitted to the Indiana Department of Revenue either electronically or by mail, along with any required payments.

Steps to Complete the Indiana Income Tax Forms

Completing Indiana Income Tax Forms requires attention to detail. Here are the steps to follow:

- Gather all necessary documents, such as W-2s, 1099s, and records of deductions.

- Select the correct form based on your filing status (e.g., IT-40 for residents).

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim any deductions and credits you qualify for to reduce your taxable income.

- Calculate the total tax owed or refund due.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Indiana Income Tax Forms to avoid penalties. Typically, the deadline for individual income tax filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses should also be aware of their specific deadlines, which can vary based on their tax structure. Keeping track of these dates ensures timely compliance with state tax regulations.

Required Documents

To accurately complete Indiana Income Tax Forms, several documents are necessary. Taxpayers should have:

- W-2 forms from employers showing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investments.

- Documentation for deductions, including receipts for medical expenses, education costs, and charitable contributions.

Form Submission Methods

Indiana Income Tax Forms can be submitted through various methods. Taxpayers have the option to file electronically via the Indiana Department of Revenue's online portal, which is often faster and more efficient. Alternatively, forms can be mailed to the appropriate state address, or in some cases, filed in person at local tax offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete indiana income tax forms

Easily Prepare Indiana Income Tax Forms on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without any holdups. Handle Indiana Income Tax Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Indiana Income Tax Forms Effortlessly

- Locate Indiana Income Tax Forms and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Indiana Income Tax Forms and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana income tax forms

Create this form in 5 minutes!

How to create an eSignature for the indiana income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

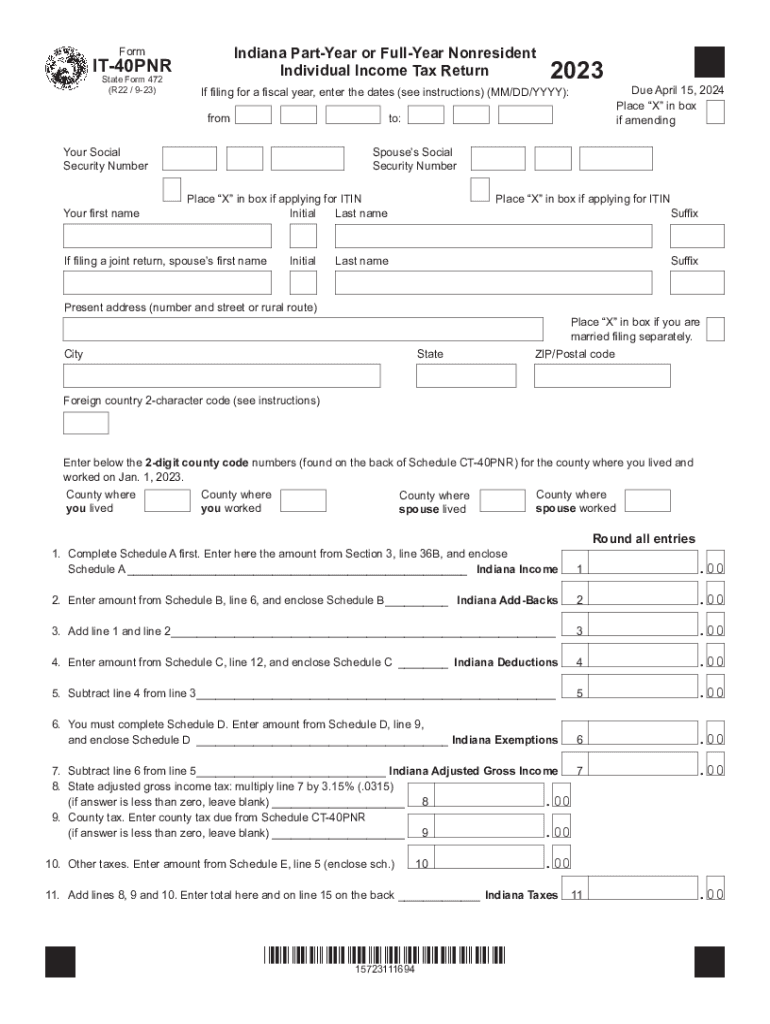

What are Indiana Income Tax Forms?

Indiana Income Tax Forms are official documents used to report your income and calculate your taxes within the state of Indiana. These forms include various types, such as the IT-40 and IT-40PNR, for different tax situations. Properly completing these forms is essential for compliance with Indiana tax regulations.

-

How can airSlate SignNow assist with Indiana Income Tax Forms?

airSlate SignNow provides an efficient solution for electronically signing and managing your Indiana Income Tax Forms. Users can easily upload their completed forms, request signatures, and send them securely. This streamlines the filing process, ensuring that your documents are submitted on time.

-

What are the pricing options for using airSlate SignNow with Indiana Income Tax Forms?

airSlate SignNow offers several pricing plans tailored to meet different needs, including individual and business options. These plans provide access to tools for managing Indiana Income Tax Forms as well as other document management features. A free trial is also available, allowing users to explore the platform without any initial commitment.

-

What features does airSlate SignNow offer for managing Indiana Income Tax Forms?

airSlate SignNow includes features like electronic signatures, document storage, and real-time tracking, making it an ideal choice for handling Indiana Income Tax Forms. Additionally, users can create templates for frequently used forms, ensuring a quicker turnaround when filing taxes. This enhances the overall efficiency of your tax process.

-

Can I integrate airSlate SignNow with other software while preparing Indiana Income Tax Forms?

Yes, airSlate SignNow offers integration capabilities with various software platforms such as Google Drive, Salesforce, and more. This allows for seamless document import and export, enabling a smoother workflow when preparing your Indiana Income Tax Forms. Enhancing connectivity helps improve data accuracy and reduces the need for manual data entry.

-

Are there any benefits to using airSlate SignNow for Indiana Income Tax Forms?

Using airSlate SignNow for Indiana Income Tax Forms provides signNow benefits such as improved efficiency, reduced paper usage, and enhanced security. Users can enjoy fast processing times through electronic signatures, while also ensuring sensitive information remains protected. Overall, this leads to a more organized approach to tax preparation.

-

Is it easy to navigate airSlate SignNow when working with Indiana Income Tax Forms?

Absolutely! airSlate SignNow has an intuitive interface designed for ease of use. Whether you’re a seasoned tax professional or a first-time filer, you can quickly navigate the platform to access and manage your Indiana Income Tax Forms with confidence and ease.

Get more for Indiana Income Tax Forms

- Nfpa 1582 form

- Premier steel doors and frames form

- Chocolate covered strawberries order form

- Phi theta kappa fillable membership application form

- Monster classification with a dichotomous key answer key form

- Convention registration form national association for ca naacp

- Initial sample inspection report template 421328036 form

- Autosweep corporate account form

Find out other Indiana Income Tax Forms

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity