Living Trust for Husband and Wife with One Child Montana Form

What is the Living Trust For Husband And Wife With One Child Montana

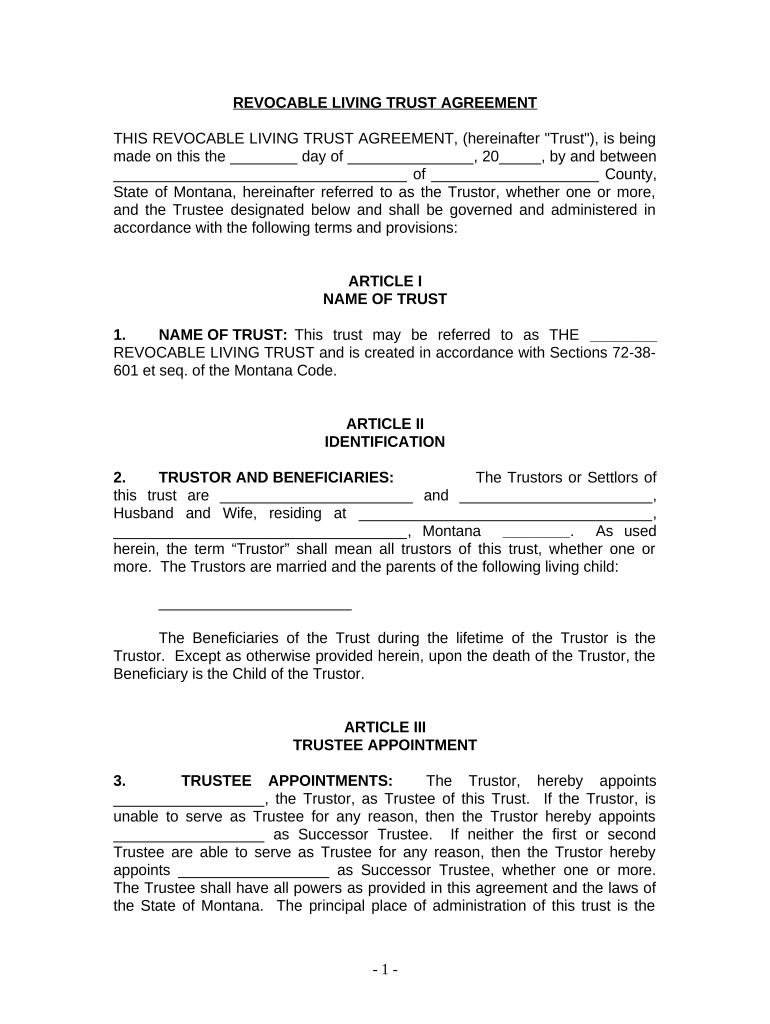

A living trust for husband and wife with one child in Montana is a legal document that allows a couple to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust is designed to simplify the estate planning process, ensuring that the couple’s wishes are honored while minimizing probate costs and delays. The trust can include various assets such as real estate, bank accounts, and investments, and it provides flexibility in managing these assets as circumstances change.

How to Use the Living Trust For Husband And Wife With One Child Montana

Using a living trust involves several steps. First, the couple must identify their assets and decide how they want to distribute them. Next, they will draft the trust document, which outlines the terms of the trust, including the beneficiaries and the trustee. Once the document is created, the couple must transfer ownership of their assets into the trust. This process is known as funding the trust and is crucial for the trust to be effective. After funding, the couple can manage their assets as usual, with the trust providing a framework for distribution upon their passing.

Steps to Complete the Living Trust For Husband And Wife With One Child Montana

Completing a living trust involves a series of important steps:

- Identify Assets: List all assets that will be included in the trust.

- Choose a Trustee: Select a trusted individual or institution to manage the trust.

- Draft the Trust Document: Create a legal document that outlines the terms of the trust.

- Fund the Trust: Transfer ownership of assets to the trust to ensure they are managed according to the trust’s terms.

- Review and Update: Regularly review the trust to ensure it reflects current wishes and circumstances.

Key Elements of the Living Trust For Husband And Wife With One Child Montana

Several key elements define a living trust for husband and wife with one child in Montana:

- Revocability: The trust can be altered or revoked by the couple at any time during their lifetime.

- Beneficiaries: Typically includes the couple’s child, but can also include other family members or charities.

- Trustee: The couple can serve as trustees during their lifetime, managing the trust's assets.

- Distribution Instructions: Clear guidelines on how assets should be distributed upon the death of the surviving spouse.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Montana

Montana has specific laws governing living trusts that couples should be aware of. These include requirements for the trust document to be in writing and signed by the creators. Additionally, Montana law allows for the creation of a pour-over will, which can work in conjunction with the living trust to ensure that any assets not included in the trust are transferred to it upon death. Understanding these state-specific rules is essential for ensuring that the trust is valid and enforceable.

Legal Use of the Living Trust For Husband And Wife With One Child Montana

The legal use of a living trust in Montana includes asset management during the couple's lifetime and the distribution of assets after death without the need for probate. This legal tool provides a clear framework for asset distribution, which can help avoid family disputes and ensure that the couple’s wishes are followed. It is important to ensure that the trust is properly funded and that all legal requirements are met to maintain its validity.

Quick guide on how to complete living trust for husband and wife with one child montana

Complete Living Trust For Husband And Wife With One Child Montana effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without holdups. Manage Living Trust For Husband And Wife With One Child Montana on any operating system using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and electronically sign Living Trust For Husband And Wife With One Child Montana without hassle

- Find Living Trust For Husband And Wife With One Child Montana and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Living Trust For Husband And Wife With One Child Montana and ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in Montana?

A Living Trust for Husband and Wife with One Child in Montana is a legal document that allows couples to manage their assets during their lifetime and designate how these assets will be distributed after their passing. This type of trust simplifies the probate process and offers flexibility in asset management while ensuring that your child inherits without complications.

-

Why should I create a Living Trust for Husband and Wife with One Child in Montana?

Creating a Living Trust for Husband and Wife with One Child in Montana can help avoid probate, provide privacy, and ensure your child is safeguarded in the distribution of your assets. It also allows you to control how and when your child receives their inheritance, which can be crucial in protecting their financial future.

-

How much does it cost to set up a Living Trust for Husband and Wife with One Child in Montana?

The cost of setting up a Living Trust for Husband and Wife with One Child in Montana can vary based on legal fees and any additional service costs. Typically, you can expect expenses ranging from a few hundred to several thousand dollars, depending on complexity and whether you utilize online platforms or hire an attorney.

-

What are the key features of a Living Trust for Husband and Wife with One Child in Montana?

Key features of a Living Trust for Husband and Wife with One Child in Montana include asset management during your lifetime, seamless transfer of assets upon death, and provisions for disability. Additionally, it offers flexibility to alter terms as life circumstances change, ensuring it remains relevant to your family's needs.

-

Can I modify my Living Trust for Husband and Wife with One Child in Montana after it's created?

Yes, a Living Trust for Husband and Wife with One Child in Montana can typically be modified or revoked during the granters' lifetime. This flexibility allows you to adjust to changes in your family's circumstances or financial situation, ensuring that the trust continues to meet your needs.

-

How does a Living Trust for Husband and Wife with One Child in Montana interact with wills?

A Living Trust for Husband and Wife with One Child in Montana can work in conjunction with a will, often referred to as a pour-over will. This ensures that any assets directed to the trust upon your death are appropriately handled, providing a comprehensive estate plan that complements your existing will.

-

What integration options are available for managing a Living Trust for Husband and Wife with One Child in Montana?

Many online platforms, including airSlate SignNow, offer integration with legal and financial tools to manage your Living Trust for Husband and Wife with One Child in Montana. These integrations streamline document preparation, secure e-signatures, and simplify ongoing management of your trust and related assets.

Get more for Living Trust For Husband And Wife With One Child Montana

- Damage assessment form building contents

- World religions worksheet pdf answers form

- Customer service charter template word form

- Sop pharmacy example form

- Toyota hiace workshop manual pdf download form

- Lesson 7 homework practice theoretical and experimental probability answer key form

- Building permitcertificate application form

- Third party agreement template form

Find out other Living Trust For Husband And Wife With One Child Montana

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding