Claim of Lien by Corporation or LLC North Carolina Form

What is the Claim Of Lien By Corporation Or LLC North Carolina

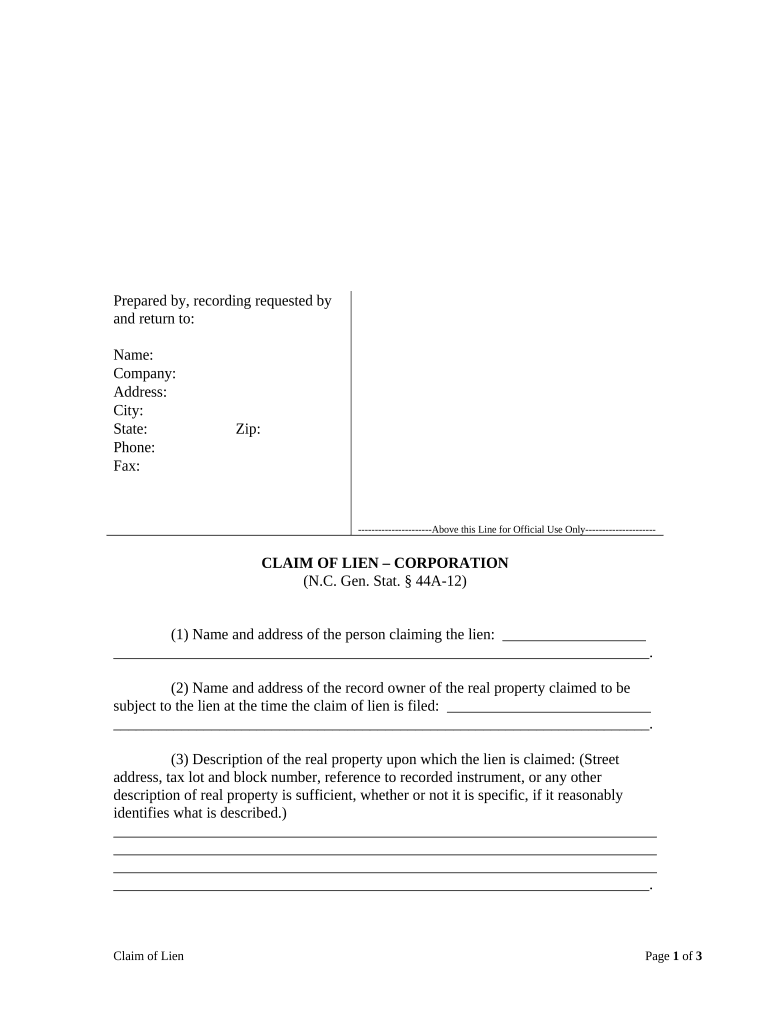

The Claim of Lien by Corporation or LLC in North Carolina is a legal document that allows a corporation or limited liability company to assert a lien against a property for unpaid debts related to services or materials provided. This form serves as a formal notice to property owners and potential buyers that a claim exists, which can affect the property's title. It is essential for businesses in the construction and service industries to understand this process to protect their financial interests.

Key elements of the Claim Of Lien By Corporation Or LLC North Carolina

Understanding the key elements of the Claim of Lien is crucial for its validity. The form typically includes:

- Identification of the parties: Names and addresses of the lien claimant and property owner.

- Description of the property: A clear description of the property subject to the lien.

- Details of the debt: The amount owed and the nature of the services or materials provided.

- Date of service: When the services were rendered or materials supplied.

- Signature: A signature from an authorized representative of the corporation or LLC.

Steps to complete the Claim Of Lien By Corporation Or LLC North Carolina

Completing the Claim of Lien involves several important steps:

- Gather necessary information about the debt, including amounts and descriptions.

- Fill out the form accurately, ensuring all required details are included.

- Review the document for completeness and accuracy.

- Obtain the necessary signatures from authorized individuals.

- File the completed form with the appropriate county office to ensure it is officially recorded.

Legal use of the Claim Of Lien By Corporation Or LLC North Carolina

The legal use of the Claim of Lien is governed by North Carolina law, which outlines the rights and responsibilities of lien claimants. This form must be filed within a specific timeframe after the services are rendered or materials are supplied, typically within 120 days. Failure to adhere to these legal requirements may result in the loss of the right to enforce the lien. Understanding these regulations helps protect the interests of corporations and LLCs.

Filing Deadlines / Important Dates

Filing deadlines are crucial for maintaining the validity of a Claim of Lien. In North Carolina, the lien must be filed within 120 days from the last date of service or delivery of materials. It is advisable to keep track of these dates to ensure compliance and protect the claim. Missing the filing deadline may result in the inability to collect the owed amount through lien enforcement.

Form Submission Methods (Online / Mail / In-Person)

The Claim of Lien can be submitted through various methods, depending on the county's regulations. Typically, it can be filed in person at the county register of deeds office or submitted by mail. Some counties may offer online submission options, making it easier for corporations and LLCs to file their claims efficiently. It is important to check with the local office for specific submission guidelines.

Quick guide on how to complete claim of lien by corporation or llc north carolina

Finish Claim Of Lien By Corporation Or LLC North Carolina effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and electronically sign your documents quickly without delays. Manage Claim Of Lien By Corporation Or LLC North Carolina on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and electronically sign Claim Of Lien By Corporation Or LLC North Carolina with ease

- Obtain Claim Of Lien By Corporation Or LLC North Carolina and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional hand-signed signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you'd like to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies of your documents. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Claim Of Lien By Corporation Or LLC North Carolina to guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Claim Of Lien By Corporation Or LLC in North Carolina?

A Claim Of Lien By Corporation Or LLC in North Carolina is a legal notice filed by a corporation or limited liability company to secure payment for services rendered or materials supplied. This lien can establish a right to payment that attaches to the property in question. Understanding this process is crucial for businesses seeking to protect their financial interests.

-

How do I file a Claim Of Lien By Corporation Or LLC in North Carolina?

To file a Claim Of Lien By Corporation Or LLC in North Carolina, you must prepare the necessary documentation outlining your claim and submit it to the appropriate county office. It’s important to comply with state laws regarding timelines and specifications for this process. Utilizing airSlate SignNow can streamline document preparation and e-filing for maximum efficiency.

-

What are the benefits of using airSlate SignNow for a Claim Of Lien By Corporation Or LLC in North Carolina?

Using airSlate SignNow for a Claim Of Lien By Corporation Or LLC in North Carolina offers several benefits, including secure document e-signing and the ability to track document status in real time. The platform is user-friendly, making it accessible for all businesses. Additionally, it supports compliance with legal requirements, giving you confidence in your filing process.

-

Are there costs associated with filing a Claim Of Lien By Corporation Or LLC in North Carolina?

Yes, there are costs associated with filing a Claim Of Lien By Corporation Or LLC in North Carolina, including filing fees that vary by county. Additionally, using services like airSlate SignNow may incur subscription fees based on your plan. However, the investment can save you time and ensure your documents are handled correctly.

-

What features does airSlate SignNow offer for managing claims and liens?

airSlate SignNow offers features like customizable templates, secure e-signatures, and advanced document management for handling claims and liens effectively. You can easily prepare, send, and track your Claim Of Lien By Corporation Or LLC in North Carolina. These tools help streamline your workflow and maintain compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow can be integrated with various platforms such as CRM systems, cloud storage solutions, and project management tools. This integration allows for a seamless workflow, ensuring that your Claim Of Lien By Corporation Or LLC in North Carolina is managed efficiently. The flexibility of integrations helps tailor the solution to fit your business needs.

-

Is airSlate SignNow suitable for small business needs when filing liens?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an excellent choice for small businesses needing to file a Claim Of Lien By Corporation Or LLC in North Carolina. Its affordable pricing plans and user-friendly interface allow small businesses to manage their documentation effectively without incurring high costs.

Get more for Claim Of Lien By Corporation Or LLC North Carolina

- Defence records management policy manual polman3 defence gov form

- Navedtra 43901 form

- New jersey certificate to discharge lien claim of record mechanic liens for corporation form

- Credit application rj schinner form

- Eli amp his wicked sons form

- Help to buy property information form south east

- Form n 323 rev carryover of tax credits forms

- Form il 4562 instructions illinois department of revenue

Find out other Claim Of Lien By Corporation Or LLC North Carolina

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer