Business Credit Application North Carolina Form

What is the Business Credit Application North Carolina

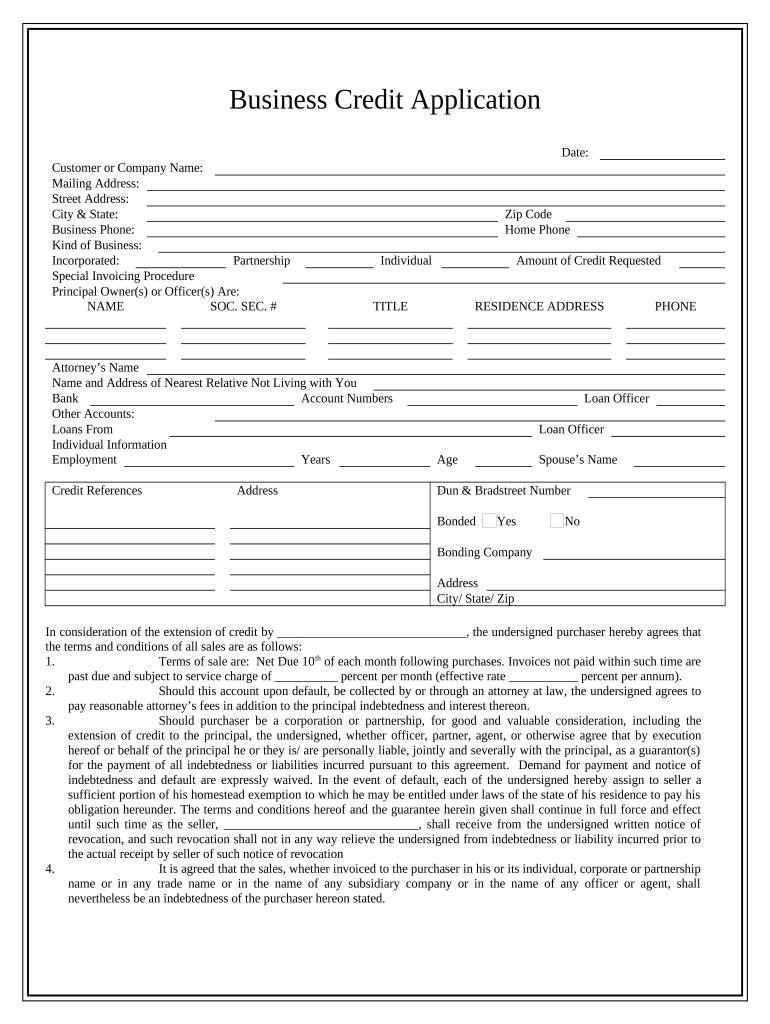

The Business Credit Application North Carolina is a formal document used by businesses to apply for credit from lenders or financial institutions within the state. This application typically requires detailed information about the business, including its legal structure, financial history, and creditworthiness. By completing this form, businesses can access necessary funding to support their operations, purchase inventory, or invest in growth opportunities.

Key elements of the Business Credit Application North Carolina

Several critical components are essential for a complete Business Credit Application North Carolina. These include:

- Business Information: Name, address, and contact details of the business.

- Ownership Structure: Details about the owners or partners, including their personal information and ownership percentages.

- Financial Statements: Recent financial statements, including balance sheets and income statements, to demonstrate the business's financial health.

- Credit History: Information regarding the business's credit history, including any existing debts and payment records.

- Loan Purpose: A clear statement of how the funds will be used, which helps lenders assess the risk.

Steps to complete the Business Credit Application North Carolina

Completing the Business Credit Application North Carolina involves several straightforward steps:

- Gather Required Information: Collect all necessary documents and details about the business and its finances.

- Fill Out the Application: Carefully complete the application form, ensuring all information is accurate and complete.

- Review the Application: Double-check all entries to avoid errors that could delay processing.

- Submit the Application: Send the completed form to the lender, either online or via traditional mail, depending on their requirements.

- Follow Up: Contact the lender to confirm receipt of the application and inquire about the timeline for approval.

Legal use of the Business Credit Application North Carolina

The Business Credit Application North Carolina is legally binding once completed and signed. It is essential for businesses to understand the legal implications of the information provided. Misrepresentation or providing false information can lead to legal consequences, including denial of credit or potential fraud charges. Therefore, businesses should ensure that all information is truthful and accurate before submission.

Eligibility Criteria

To qualify for credit through the Business Credit Application North Carolina, businesses typically need to meet specific eligibility criteria. Common requirements include:

- Established business entity, such as an LLC, corporation, or partnership.

- Minimum operational history, often at least one to two years.

- Demonstrated financial stability, including positive cash flow and credit history.

- Compliance with state and federal regulations.

Application Process & Approval Time

The application process for the Business Credit Application North Carolina can vary by lender but generally follows a standard timeline:

- Application Submission: Once the application is submitted, the lender will acknowledge receipt.

- Review Period: Lenders typically take anywhere from a few days to a couple of weeks to review the application and assess risk.

- Approval Notification: If approved, the lender will notify the business and provide terms for the credit offered.

Quick guide on how to complete business credit application north carolina

Set up Business Credit Application North Carolina effortlessly on any gadget

Web-based document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Business Credit Application North Carolina on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign Business Credit Application North Carolina without hassle

- Obtain Business Credit Application North Carolina and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Business Credit Application North Carolina and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Business Credit Application North Carolina?

The Business Credit Application North Carolina is a streamlined process for businesses in North Carolina to apply for credit. With airSlate SignNow, you can easily complete and eSign the application online, ensuring your business gets the financial support it needs quickly.

-

How does airSlate SignNow improve the Business Credit Application process in North Carolina?

airSlate SignNow simplifies the Business Credit Application process in North Carolina by providing an intuitive platform for document management. Businesses can fill out, send, and eSign applications securely and efficiently, reducing the time and paperwork involved.

-

What are the costs associated with submitting a Business Credit Application in North Carolina using airSlate SignNow?

Using airSlate SignNow to submit your Business Credit Application North Carolina is cost-effective. Our pricing plans are designed to accommodate businesses of all sizes, offering various features to improve your document management without breaking the bank.

-

Can I customize the Business Credit Application North Carolina template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Business Credit Application North Carolina template to suit your specific business needs. You can add, remove, or modify fields to ensure that all required information is included accurately.

-

What features does airSlate SignNow offer for the Business Credit Application North Carolina?

airSlate SignNow provides several features for the Business Credit Application North Carolina, including electronic signatures, document tracking, and templates. These features help streamline the application process and ensure that your documents are processed smoothly.

-

Is airSlate SignNow compliant with North Carolina regulations for Business Credit Applications?

Yes, airSlate SignNow is fully compliant with North Carolina regulations regarding Business Credit Applications. Our platform adheres to legal standards to ensure that your electronic signatures and documents are valid and enforceable.

-

What benefits will my business gain from using airSlate SignNow for Business Credit Applications in North Carolina?

Using airSlate SignNow for your Business Credit Applications in North Carolina can signNowly enhance efficiency and speed. The ability to eSign and manage documents online helps reduce delays and accelerates your access to funding.

Get more for Business Credit Application North Carolina

- Lmh patient portal form

- Asam supplement forms south florida behavioral health network cdsgvl

- Printable msp questionnaire form

- Sag aftra industrial contract talent partners form

- Advanced mask modeling accuracy and stability study university of form

- B project partnerships and networks reporting form and nordplus nj

- Seperation agreement template form

- Separation for unmarried couples agreement template form

Find out other Business Credit Application North Carolina

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free