Assignment of Mortgage by Corporate Mortgage Holder North Dakota Form

What is the Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

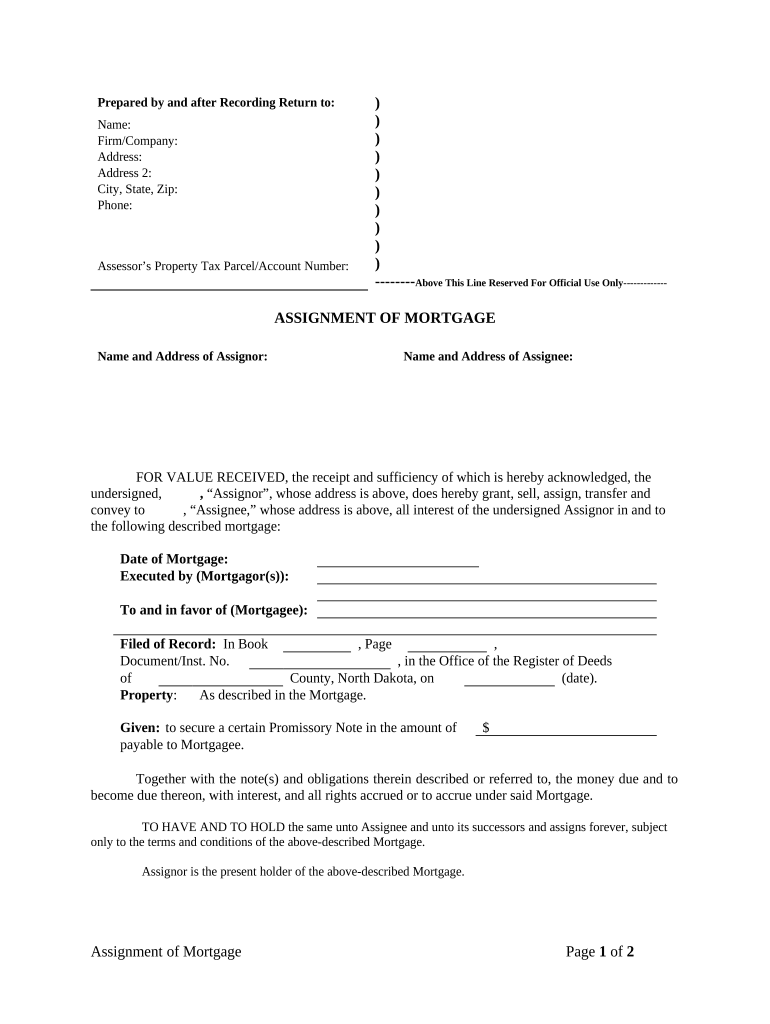

The Assignment of Mortgage by Corporate Mortgage Holder in North Dakota is a legal document that transfers the rights and obligations of a mortgage from one party to another. This document is essential for maintaining clear ownership records of the mortgage and ensuring that all parties involved are aware of the current holder of the mortgage. The corporate mortgage holder, typically a financial institution or corporation, uses this form to officially assign the mortgage to another entity, which may include another lender or an investor. This process is crucial in the real estate and financial sectors, as it helps facilitate the transfer of mortgage rights while adhering to state laws and regulations.

Steps to Complete the Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

Completing the Assignment of Mortgage by Corporate Mortgage Holder in North Dakota involves several important steps to ensure the document is legally binding and compliant with state regulations. The following steps outline the process:

- Identify the parties involved: Clearly state the names and addresses of the current mortgage holder and the new assignee.

- Prepare the document: Include all necessary details such as the original mortgage date, the property address, and the loan amount.

- Obtain signatures: Ensure that the authorized representatives of the corporate mortgage holder sign the document. Their signatures must be notarized to validate the assignment.

- Record the assignment: Submit the completed assignment to the appropriate county recorder’s office to make it part of the public record.

- Notify relevant parties: Inform the borrower and any other stakeholders about the assignment to maintain transparency.

Legal Use of the Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

The legal use of the Assignment of Mortgage by Corporate Mortgage Holder in North Dakota is governed by state laws that dictate how mortgages can be assigned and recorded. This form must comply with the North Dakota Century Code, which outlines the requirements for mortgage assignments, including necessary signatures and notarization. Failure to adhere to these legal standards may result in the assignment being deemed invalid, which can lead to complications in the enforcement of mortgage rights. It is essential for corporate mortgage holders to understand these legal requirements to ensure that the assignment is recognized in court and by other financial institutions.

Key Elements of the Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

Several key elements must be included in the Assignment of Mortgage by Corporate Mortgage Holder to ensure its validity and effectiveness. These elements include:

- Identifying Information: Full names and addresses of the assignor (current mortgage holder) and assignee (new mortgage holder).

- Mortgage Details: Information about the original mortgage, including the date it was executed, the property address, and the loan amount.

- Signatures: Signatures of authorized representatives from the corporate mortgage holder, along with notarization to confirm authenticity.

- Recording Information: A statement indicating that the assignment will be recorded with the county recorder’s office.

State-Specific Rules for the Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

North Dakota has specific rules governing the assignment of mortgages that must be followed to ensure compliance. These rules include:

- All assignments must be in writing and signed by the mortgage holder.

- Notarization is required to validate the signatures on the assignment.

- The assignment must be recorded with the county recorder’s office where the property is located to provide public notice of the change in mortgage ownership.

- Failure to comply with these rules may result in legal challenges or the inability to enforce the mortgage rights effectively.

How to Obtain the Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

To obtain the Assignment of Mortgage by Corporate Mortgage Holder in North Dakota, you can follow these steps:

- Contact the current mortgage holder: Reach out to the corporate mortgage holder to request the assignment form.

- Access online resources: Many legal forms, including the assignment of mortgage, can be found on legal document websites or through state government resources.

- Consult with a legal professional: If you are unsure about the process or need assistance, consider consulting with a real estate attorney who can provide guidance tailored to your situation.

Quick guide on how to complete assignment of mortgage by corporate mortgage holder north dakota

Effortlessly Prepare Assignment Of Mortgage By Corporate Mortgage Holder North Dakota on Any Device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Assignment Of Mortgage By Corporate Mortgage Holder North Dakota on any device with the airSlate SignNow apps for Android or iOS, streamlining any document-related process today.

How to Edit and eSign Assignment Of Mortgage By Corporate Mortgage Holder North Dakota with Ease

- Obtain Assignment Of Mortgage By Corporate Mortgage Holder North Dakota and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent portions of your documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), an invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Assignment Of Mortgage By Corporate Mortgage Holder North Dakota and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota?

An Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota is a legal process where the ownership of a mortgage is transferred from one lender to another. This ensures that the new lender has the proper documentation to enforce the mortgage terms. Understanding this process is crucial for both borrowers and lenders in North Dakota.

-

How does airSlate SignNow facilitate the Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota?

airSlate SignNow simplifies the Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota by providing an intuitive platform for eSigning documents. Our solution allows users to create, send, and sign mortgage assignment documents efficiently, reducing paperwork and saving time. This means you can manage your mortgage assignments seamlessly.

-

What are the costs associated with using airSlate SignNow for mortgage assignments?

The pricing for airSlate SignNow's services is designed to be cost-effective, especially for handling things like the Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota. We offer various pricing plans that cater to different business needs, ensuring you only pay for what you use. This transparency in pricing helps businesses stay budget-conscious.

-

What features does airSlate SignNow offer for financial transactions like mortgage assignments?

airSlate SignNow includes features such as real-time document tracking, customizable templates, and robust security measures to protect sensitive information. These tools are particularly beneficial for efficiently processing the Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota. All features are designed to streamline the eSigning experience.

-

Can airSlate SignNow integrate with existing financial software for ease of use?

Yes, airSlate SignNow offers seamless integrations with various financial software platforms. This allows businesses to efficiently manage the Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota without disrupting their existing workflows. Our integrations ensure smooth data exchange and enhance efficiency.

-

What are the benefits of using airSlate SignNow for mortgage assignments?

Using airSlate SignNow for the Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform makes it easy to manage eSignatures and track documents in real-time. This ensures that mortgage holders can focus on their business rather than administrative tasks.

-

Is it easy to get started with airSlate SignNow for mortgage documentation?

Absolutely! Getting started with airSlate SignNow for the Assignment Of Mortgage By Corporate Mortgage Holder in North Dakota is quick and straightforward. Our user-friendly interface and step-by-step guides allow you to set up your account and begin processing mortgage documents in no time. Support is also available to assist you with any questions.

Get more for Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

- Cold war superpowers face off cause and effect form

- How to get a vin for a trailer form

- Ihss recipient request for provider waiver cdss ca form

- Tenant income certification form

- 2220 form

- Preschool progress report planet kids form

- Dzu r poz 925 konsulat generalny rzeczypospolitej bb dziennikustaw gov form

- Cont oh manual catalan keselamatan ais program kes form

Find out other Assignment Of Mortgage By Corporate Mortgage Holder North Dakota

- Sign Nebraska Work Order Now

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement