NFC 20 07 Bar Renewal Fees Tax Deduction PDF 2023-2026

Overview of the 480 6C Form

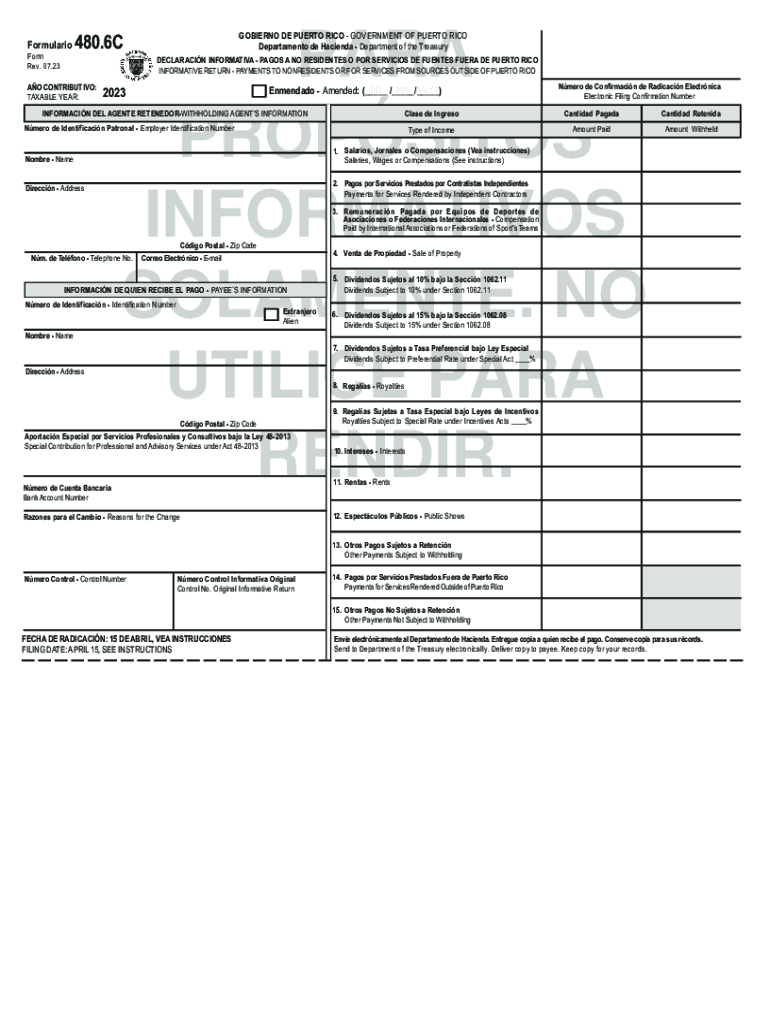

The 480 6C form is a tax document used in Puerto Rico for reporting certain types of income. This form is essential for individuals and businesses that need to disclose income received from sources outside of Puerto Rico. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with local regulations.

Instructions for Completing the 480 6C Form

Filling out the 480 6C form requires careful attention to detail. The form typically includes sections for personal information, income details, and deductions. It is important to accurately report all income sources and ensure that all calculations are correct. Users should refer to the specific instructions provided with the form to guide them through the completion process.

Key Elements of the 480 6C Form

The 480 6C form includes several key elements that are critical for proper filing. These elements often consist of:

- Taxpayer Identification: This section requires the taxpayer's name, address, and identification number.

- Income Reporting: Taxpayers must report all applicable income, including wages, dividends, and interest.

- Deductions: The form allows for specific deductions that can reduce taxable income.

Filing Deadlines for the 480 6C Form

Timely submission of the 480 6C form is essential to avoid penalties. The filing deadline typically aligns with the annual tax filing period in Puerto Rico. Taxpayers should confirm the exact dates each year, as they may vary, and ensure that all forms are submitted by the due date to maintain compliance.

Form Submission Methods

The 480 6C form can be submitted through various methods, including:

- Online Submission: Many taxpayers prefer to file electronically for convenience.

- Mail: The form can also be printed and mailed to the appropriate tax authority.

- In-Person: Some individuals may choose to submit their forms directly at tax offices.

Penalties for Non-Compliance

Failure to file the 480 6C form on time or inaccuracies in reporting can lead to significant penalties. These may include fines and interest on unpaid taxes. It is crucial for taxpayers to understand the importance of compliance to avoid these repercussions.

Quick guide on how to complete nfc 20 07 bar renewal fees tax deduction pdf

Complete NFC 20 07 Bar Renewal Fees Tax Deduction pdf effortlessly on any device

Digital document administration has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage NFC 20 07 Bar Renewal Fees Tax Deduction pdf on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to alter and eSign NFC 20 07 Bar Renewal Fees Tax Deduction pdf without hassle

- Obtain NFC 20 07 Bar Renewal Fees Tax Deduction pdf and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign option, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign NFC 20 07 Bar Renewal Fees Tax Deduction pdf and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nfc 20 07 bar renewal fees tax deduction pdf

Create this form in 5 minutes!

How to create an eSignature for the nfc 20 07 bar renewal fees tax deduction pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 480 6c form, and how can airSlate SignNow help?

The 480 6c form is a document used for reporting certain types of income. airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the 480 6c form, ensuring that your documents are processed quickly and securely.

-

How much does it cost to use airSlate SignNow for the 480 6c form?

airSlate SignNow offers competitive pricing plans to fit various business needs. With our affordable packages, you can easily manage your 480 6c form and other documents without breaking the bank.

-

What features does airSlate SignNow include for managing the 480 6c form?

airSlate SignNow includes essential features such as customizable templates, automated workflows, and real-time tracking for your 480 6c form. These tools streamline the document management process and enhance efficiency.

-

Can I integrate airSlate SignNow with other applications for the 480 6c form?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems and cloud storage services. This allows you to automate the workflow related to the 480 6c form and access your documents easily.

-

How does airSlate SignNow ensure the security of my 480 6c forms?

We prioritize the security of your documents at airSlate SignNow by employing bank-grade encryption and GDPR compliance. Your 480 6c forms are protected against unauthorized access and data bsignNowes, giving you peace of mind.

-

Is it easy to collaborate with others using airSlate SignNow for the 480 6c form?

Absolutely! airSlate SignNow allows for easy collaboration on the 480 6c form by enabling multiple users to access and edit documents simultaneously. This feature enhances teamwork and speeds up the signing process.

-

What are the benefits of using airSlate SignNow for my 480 6c form?

Using airSlate SignNow for your 480 6c form offers numerous benefits, including rapid document turnaround time, reduced paperwork, and increased convenience. Our platform minimizes the traditional hassles associated with paper forms.

Get more for NFC 20 07 Bar Renewal Fees Tax Deduction pdf

- Guidelines and forms for louisianas interdiction law

- What is a disbursementtax adviser form

- Collection of court costs and fines by louisiana judicial form

- Motion and order to dismiss for failure form

- State of louisiana parish of ouachitamorehouse 4 th form

- Petition for eviction case number in the justice court precinct form

- Exception louisiana department form

- Expungement information sheet forms bossier parish clerk

Find out other NFC 20 07 Bar Renewal Fees Tax Deduction pdf

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template