Business Credit Application North Dakota Form

What is the Business Credit Application North Dakota

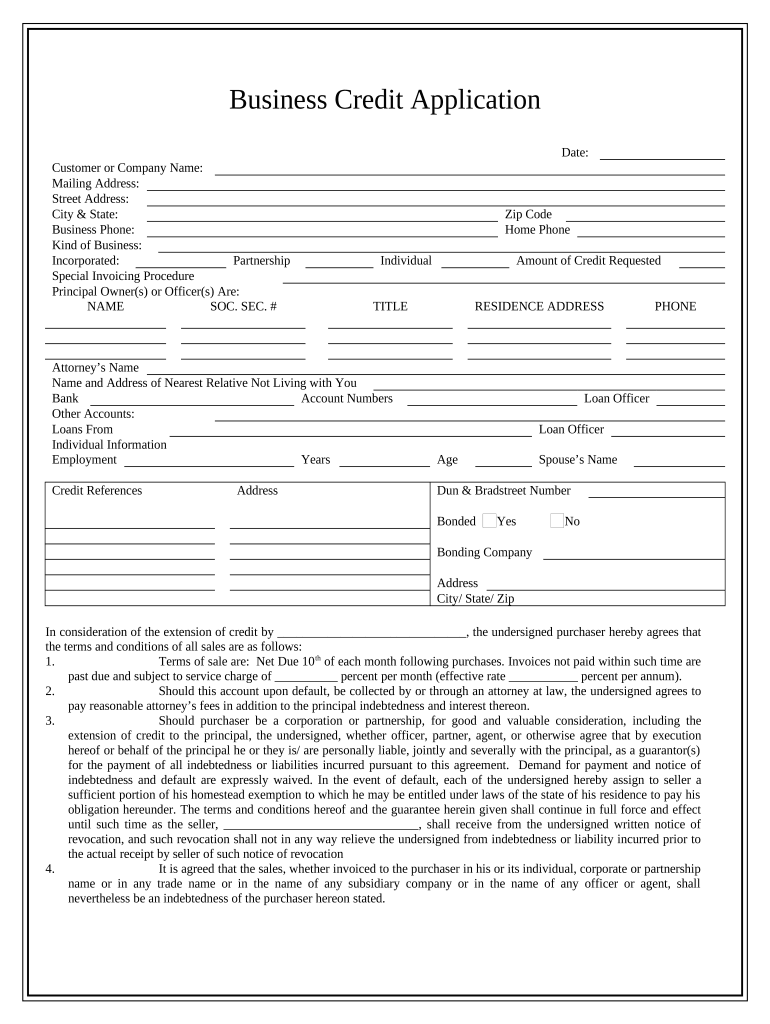

The Business Credit Application North Dakota is a formal document that businesses use to apply for credit from financial institutions or suppliers. This application collects essential information about the business, including its legal structure, financial status, and credit history. It serves as a critical tool for lenders to assess the creditworthiness of a business before extending credit or loans. Properly completing this application can significantly impact the approval process and the terms offered by creditors.

Key elements of the Business Credit Application North Dakota

Understanding the key elements of the Business Credit Application North Dakota is vital for successful completion. Typically, the application will require:

- Business Information: Name, address, and contact details.

- Legal Structure: Type of business entity, such as LLC, corporation, or partnership.

- Financial Information: Annual revenue, existing debts, and assets.

- Owner Information: Personal details of the business owner(s), including Social Security numbers and credit history.

- Purpose of Credit: Explanation of how the credit will be used, which helps lenders understand the risk involved.

Steps to complete the Business Credit Application North Dakota

Completing the Business Credit Application North Dakota involves several important steps to ensure accuracy and completeness:

- Gather Required Documents: Collect financial statements, tax returns, and any other relevant information.

- Fill Out the Application: Provide accurate and detailed information in each section of the application form.

- Review the Application: Double-check all entries for accuracy and completeness to avoid delays.

- Submit the Application: Follow the specified submission method, whether online, by mail, or in person.

- Follow Up: Contact the lender to confirm receipt and inquire about the timeline for a decision.

Legal use of the Business Credit Application North Dakota

The legal use of the Business Credit Application North Dakota is governed by various regulations that ensure the protection of both the lender and the borrower. It is essential that the application is filled out truthfully, as providing false information can lead to legal repercussions, including denial of credit or potential fraud charges. Additionally, the application must comply with federal and state laws regarding privacy and data protection, ensuring that sensitive information is handled securely.

Eligibility Criteria

Eligibility for the Business Credit Application North Dakota typically depends on several factors, including:

- Business Structure: The business must be a legally recognized entity in North Dakota.

- Credit History: A positive credit history increases the likelihood of approval.

- Financial Stability: Lenders often require proof of stable revenue and manageable debt levels.

- Purpose of Credit: The intended use of the credit must align with the lender's criteria.

Form Submission Methods

The Business Credit Application North Dakota can typically be submitted through various methods, including:

- Online Submission: Many lenders offer a digital platform for submitting applications, allowing for quicker processing.

- Mail: Traditional submission via postal service is still an option for those who prefer paper forms.

- In-Person: Some businesses may choose to deliver their application directly to the lender's office for immediate feedback.

Quick guide on how to complete business credit application north dakota

Easily Prepare Business Credit Application North Dakota on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Business Credit Application North Dakota on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign Business Credit Application North Dakota Effortlessly

- Find Business Credit Application North Dakota and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Business Credit Application North Dakota and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application in North Dakota?

A Business Credit Application in North Dakota is a formal document that businesses use to apply for credit from lenders. This application typically includes information about the business’s financial history, ownership, and creditworthiness. Completing a Business Credit Application in North Dakota is crucial for securing funding to grow your business.

-

How can airSlate SignNow help with Business Credit Applications in North Dakota?

airSlate SignNow simplifies the process of creating and signing Business Credit Applications in North Dakota. With its user-friendly platform, businesses can customize their applications, ensure compliance, and collect e-signatures securely and efficiently. This streamlined process saves time and enhances the accuracy of your Business Credit Application.

-

What are the pricing options for using airSlate SignNow for Business Credit Applications in North Dakota?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes looking to utilize the platform for Business Credit Applications in North Dakota. The pricing is competitive and transparent, with options ranging from basic to premium features, ensuring you find a plan that fits your budget and operational needs.

-

What features does airSlate SignNow offer for Business Credit Applications in North Dakota?

airSlate SignNow provides various features to enhance your Business Credit Application process in North Dakota, including customizable templates, e-signature capabilities, and document tracking. Additionally, features like real-time collaboration and cloud storage ensure that your applications are accessible and editable from anywhere.

-

Are there any integrations available for airSlate SignNow when handling Business Credit Applications in North Dakota?

Yes, airSlate SignNow offers integrations with various business applications, making it easier to manage Business Credit Applications in North Dakota. This includes connecting with systems like CRM software, project management tools, and accounting platforms, ensuring a cohesive workflow for your credit application process.

-

What benefits does using airSlate SignNow for Business Credit Applications in North Dakota provide?

Using airSlate SignNow for Business Credit Applications in North Dakota offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced compliance. By utilizing e-signatures and automated workflows, businesses can expedite their application processes and improve their chances of securing necessary credit.

-

Can airSlate SignNow help ensure compliance for Business Credit Applications in North Dakota?

Yes, airSlate SignNow is equipped with features that help ensure compliance when completing Business Credit Applications in North Dakota. The platform adheres to legal standards for e-signatures and provides audit trails to validate the authenticity and integrity of the applications submitted.

Get more for Business Credit Application North Dakota

Find out other Business Credit Application North Dakota

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter